BoJ meeting preview: Status quo and its impact on USD/JPY

2025-09-18 18:48:11

The USD/JPY exchange rate will be primarily influenced by the Federal Reserve's interest rate cuts. While the Bank of Japan's meeting will also have an impact, its significance is likely to be relatively low. However, any unexpected remarks from Governor Kazuo Ueda could trigger a significant appreciation of the yen, pushing it above the current trading range of 147 to 149.

Expected Bank of Japan policy decision: Maintain status quo

The Bank of Japan (BoJ) is expected to maintain its interest rate at 0.5% this week, unchanged since January. This cautious “wait-and-see” approach is based on several key reasons.

First, there is political uncertainty in Japan, and the Bank of Japan wants to avoid any sudden policy changes that could exacerbate economic instability. Second, the Bank of Japan is still assessing the full impact of the new US-Japan trade agreement and US tariffs, which are taking a toll on Japanese exports.

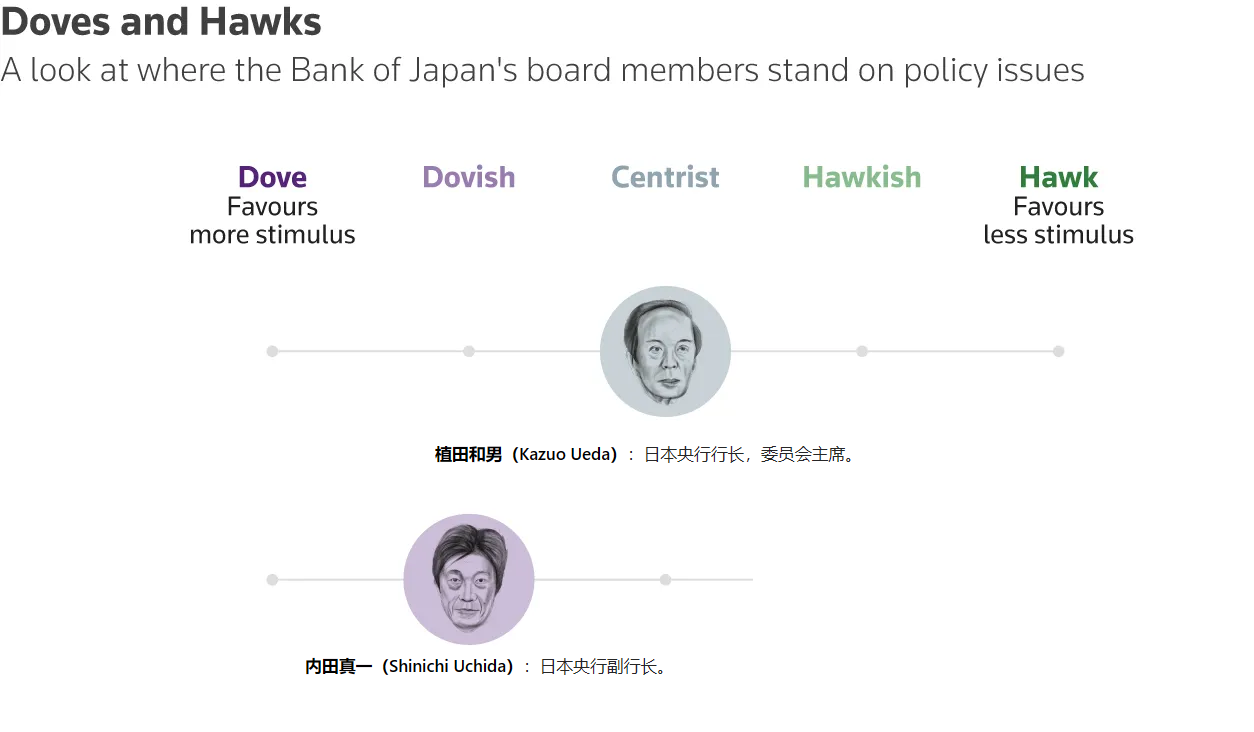

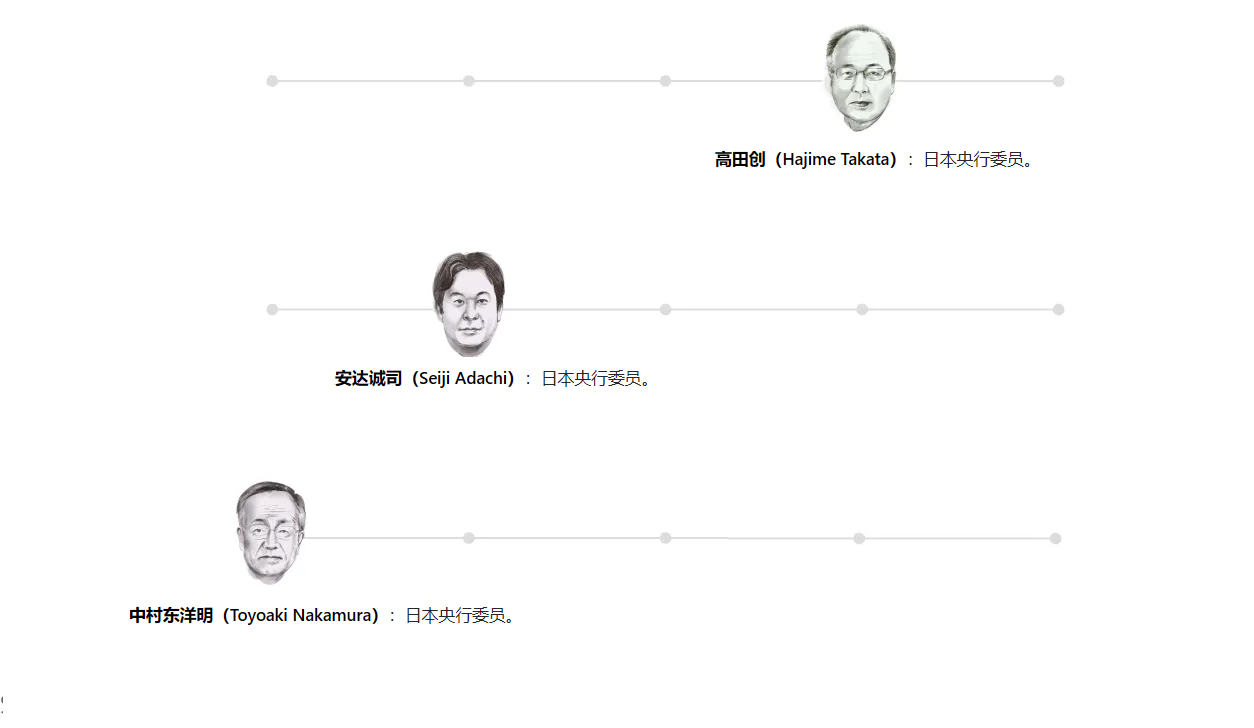

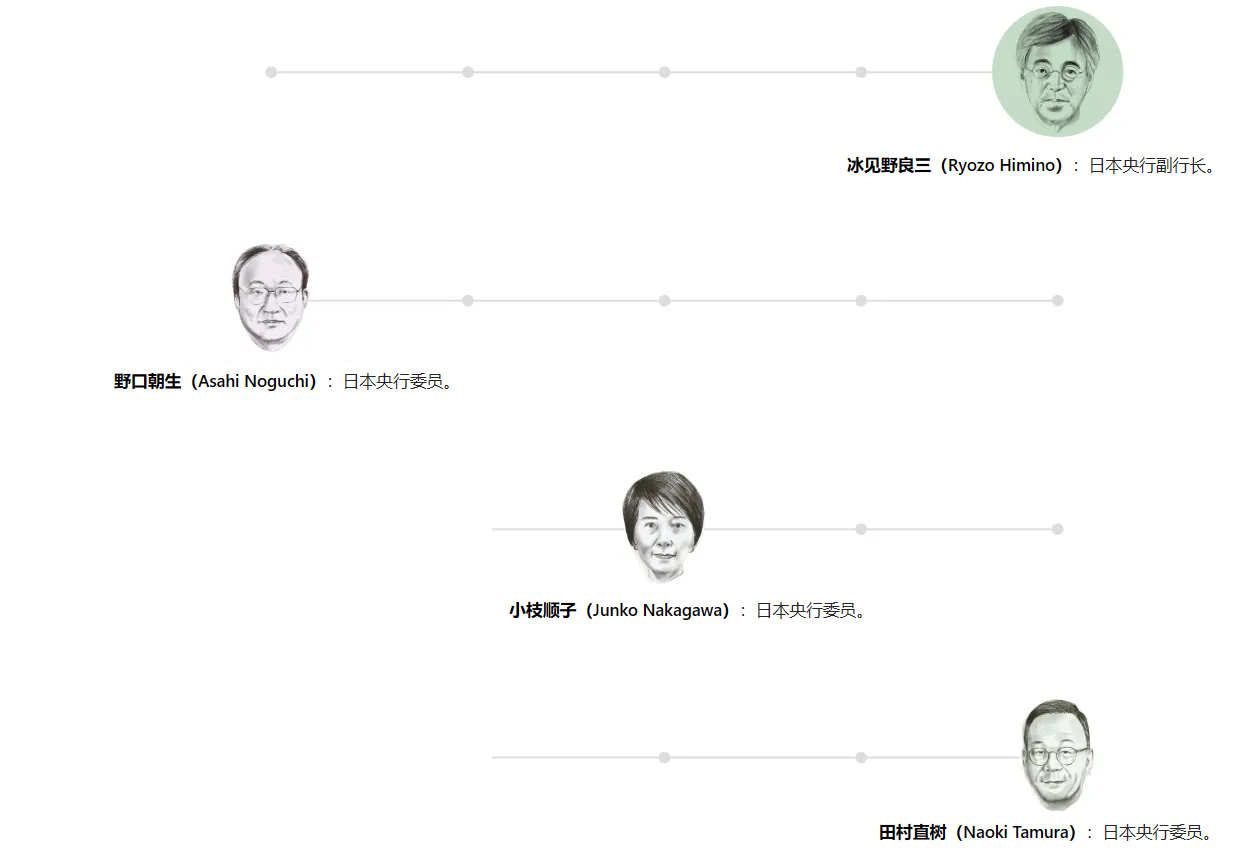

The chart below shows the distribution of Bank of Japan board members by policy stance. From left to right: Dove, Dovish, Centrist, Hawkish, and Hawkish.

(Data sources: Bank of Japan, Refinitiv)

It is noteworthy that despite Japan's high inflation, which is outpacing wage growth, the central bank still prioritizes economic stability over inflation control. This divergence between central bank policy and domestic inflationary realities could cause market problems in the future.

Forward-looking monetary policy: Outlook beyond September

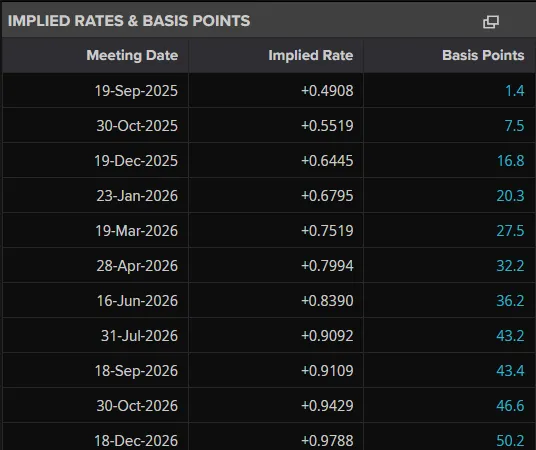

The market expects the Bank of Japan to keep interest rates unchanged in September but believes it will start raising rates soon. Many traders believe a rate hike before the end of 2025 is likely, with more hikes possible by the middle of next year.

Source: London Stock Exchange Group (LSEG)

Looking at implied interest rates from London Stock Exchange Group data, the market expects the Bank of Japan to have cut rates by around 50 basis points by December 2026. This may not seem like much, but remember, this is the Bank of Japan we are talking about.

Since no new economic forecasts will be released at this meeting, market reaction will depend entirely on what Governor Kazuo Ueda says at the press conference.

The Bank of Japan is known for its ambiguous communications. If Governor Ueda continues to be vague, the market reaction is likely to be muted. However, if he delivers an unexpectedly clear signal about future rate hikes, it would confirm aggressive market expectations. Consequently, his comments could trigger large and sudden market fluctuations.

Dual Central Bank Catalysts: Impact on USD/JPY

The USD/JPY exchange rate is primarily driven by Federal Reserve policy. When investors anticipate a rate cut from the Fed, the dollar typically depreciates against the yen. This was particularly crucial this week, as the Fed implemented its expected rate cut.

The consensus expectation of a rate cut in the US and an eventual rate hike in Japan could weaken the USD/JPY. While the Bank of Japan's decision is also important, its impact will be largely limited by the actions of the Federal Reserve, which has a much stronger influence on the pair.

Given market expectations that the Federal Reserve will cut interest rates by another 50 basis points before the end of the year, in addition to the 25 basis point rate cut implemented this week, the yen is expected to rise in the medium term.

USD/JPY technical analysis

(Source of USD/JPY daily chart: Yihuitong)

From a technical perspective, USD/JPY has shown signs of a bullish rebound, but the potential impact of interest rate differentials may come into play.

On the weekly chart, the long-term downtrend line has been broken, and since then, USD/JPY has been trapped in a range of 145.00 to 150.00, with brief rallies followed by rapid selling pressure.

Furthermore, there is an ascending trend line extending from the April low, with the low just below the 140.00 mark.

On the daily chart, the K-line closed in a hammer pattern on Wednesday, and rebounded with support from the rising trend line and the 100-day moving average of 146.20.

The immediate resistance level is the 50-day moving average (located at 147.67), and after breaking through it, the 200-day moving average (148.61) will become the next focus.

A break of the ascending trendline could push the pair towards the 145.00 mark, after which the 143.33 swing low would come into view.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.