The Fed shifts gears! The bond market releases key signals, and investors collectively bet on a "jobs recession."

2025-10-23 16:35:30

Despite record highs for US stocks, narrowing credit spreads, and high inflation, US Treasury yields have fallen instead of rising. This seemingly contradictory market behavior reflects an emerging consensus among investors: concerns about the labor market are driving monetary policy.

This consensus could trigger a self-reinforcing feedback loop—job market concerns drive down yields, which in turn exacerbate concerns about an economic slowdown, putting continued downward pressure on yields. In this loop, any negative news about the job market could be amplified, leading to increased market volatility.

Bond market reacts coolly to inflation data

The US government shutdown entered its 23rd day on Thursday (October 23rd). The Senate has rejected temporary funding resolutions 12 times, and the political impasse shows no signs of easing. The complete absence of official economic data during the shutdown has made Friday's release of the Consumer Price Index (CPI) a focal point for the market. However, this highly anticipated data may not provide the information investors truly need.

The market expects core inflation to remain at 3.1% in September, which is more than one percentage point higher than the Federal Reserve's 2% inflation target. It is worth noting that over the past five years, the year-on-year growth rate of core CPI has been at or above 3% almost every month.

However, the bond market may react sluggishly. The two-year Treasury yield fell to its lowest level since August 2022 last week, reflecting market expectations that the Fed will continue to cut interest rates at its meeting next week, in December and next year.

Hidden concerns in the job market

The 10-year U.S. Treasury yield has also fallen below 4%, reaching its lowest closing level in over a year on Tuesday. These signs suggest that even if inflation data exceeds expectations, it will be difficult to reverse the downward trend in yields. The technical performance of the bond market shows that investors have formed a relatively consistent pessimistic outlook for the future economic outlook.

(Figure: U.S. 10-year Treasury yield hits lowest closing level since October 3, 2024)

Amid the government shutdown and the absence of official data, investors are relying on their own assessments of the economic outlook to fill the information vacuum. The most concerning factor for the market is the sharp slowdown in job growth . While this sharp deceleration in job creation has so far been largely offset by a contraction in the labor supply, the trend remains troubling.

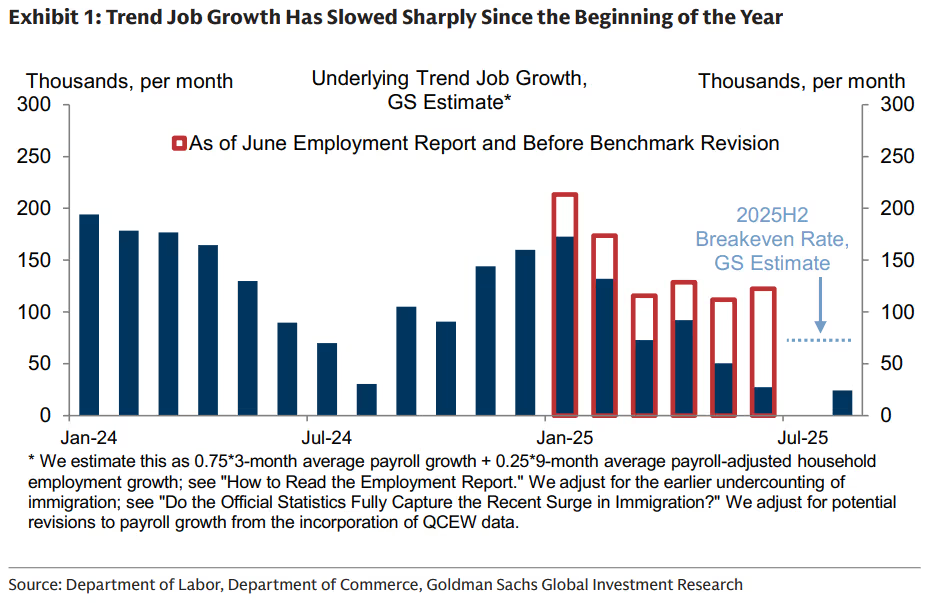

This week, Goldman Sachs economists systematically outlined five key factors contributing to the rapid decline in job growth: slowing immigration, reduced government hiring and funding, widespread adoption of artificial intelligence (AI), rising tariff costs and trade uncertainty, and heightened macroeconomic growth risks . They estimate that underlying trend job growth has fallen to just 25,000 per month, a significant decrease of approximately 125,000 from their January forecast.

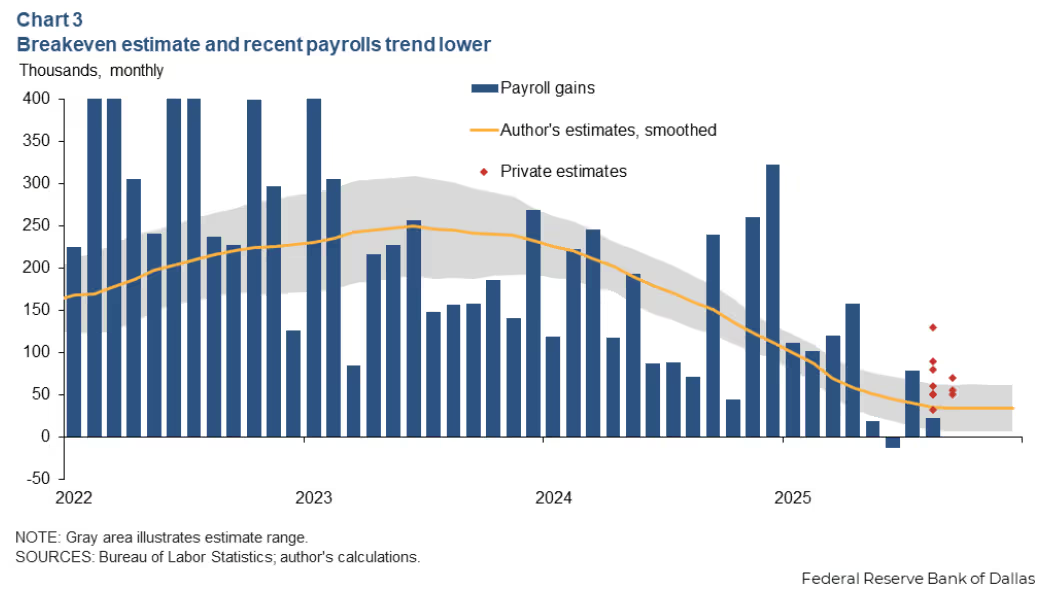

(Chart: Employment balance point and growth trend continue to be revised downward)

This figure is also well below the "break-even" level required to maintain a stable unemployment rate, which Goldman Sachs estimates to be around 75,000 per month. It's worth noting that this is only at the upper end of the break-even range. Dallas Fed economist Anton Cheremukhin's estimate is even more conservative, putting the break-even level at around 30,000, far lower than the estimate of around 250,000 two years ago.

Increased labor market vulnerabilities

The key issue is that while the low level of balanced employment growth helps to curb a rapid rise in unemployment, it also masks the inherent fragility of the labor market. Under this strained environment, any small negative shock could turn the already weak net employment growth negative. This fragility significantly reduces the labor market's resilience to external shocks.

(Graphic: Trend employment growth has slowed significantly since the beginning of the year)

The Federal Reserve is clearly aware of this risk. Last month, Chairman Powell explicitly stated that, despite inflation remaining above the 2% target, concerns about a rapidly deteriorating labor market prompted the Fed's decision to resume its rate cut cycle. This statement marks a significant shift in the Fed's policy framework, with labor market stability now taking precedence over inflation control .

Oil price trends provide additional evidence

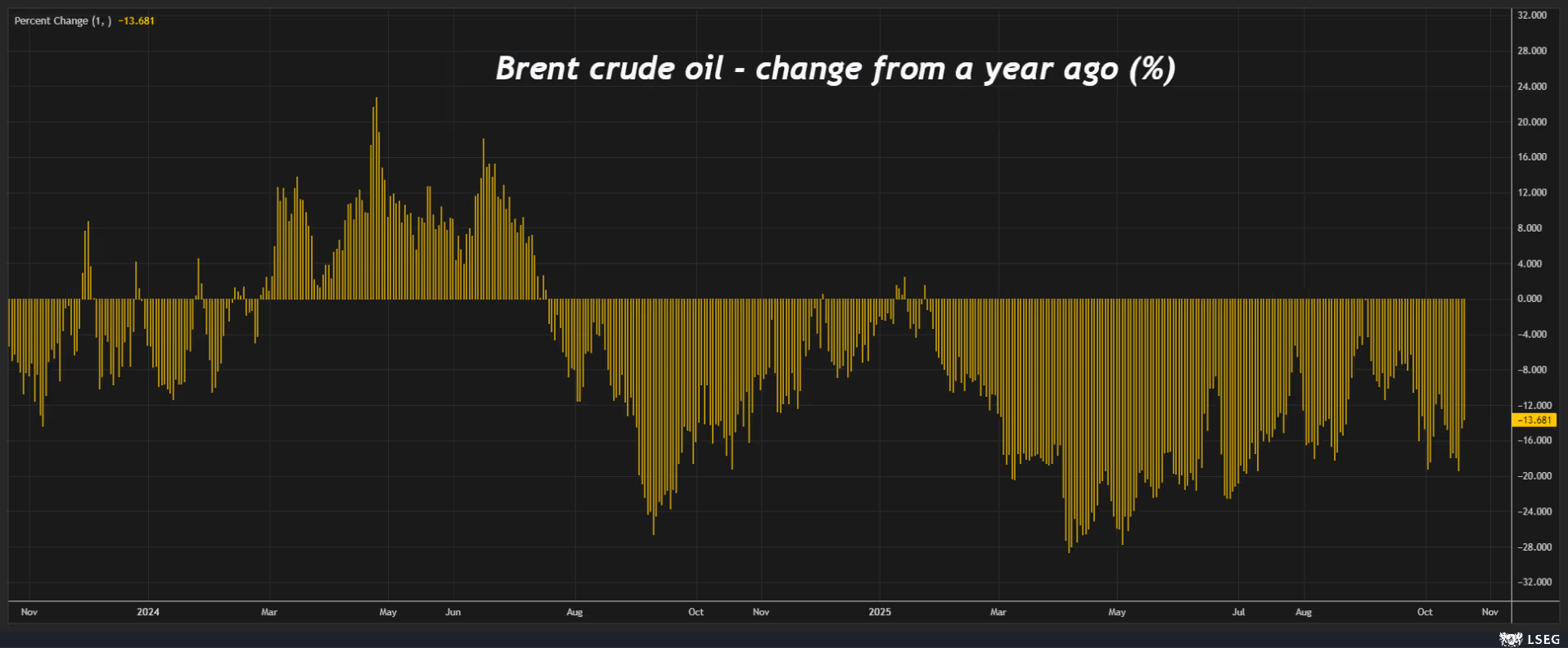

Furthermore, the Federal Reserve and investors may have other reasons to turn a blind eye to still-high inflation. Signals from the oil market are one such reason. While the correlation between crude oil prices and inflation is less pronounced than it once was, their role as an indicator remains significant. Currently, oil prices are hovering around a five-month low of $60.05 per barrel, with Brent crude trading around $65.10 per barrel, down approximately 15% from the same period last year.

(Figure: Year-on-year change in Brent crude oil prices (%))

Most energy analysts, including the International Energy Agency (IEA), predict that the crude oil market will remain in a state of supply and demand imbalance over the next year due to the dual pressures of increased supply and weak demand. Analysts at Eurasia Group even predict that this oversupply could push oil prices to $55 per barrel by the end of the year, a five-year low.

Moderate oil prices continued to exert downward pressure on inflation throughout the year. While cheaper crude oil alone is insufficient to return inflation to the 2% policy target, it is another key factor explaining why the Federal Reserve and investors are shifting their focus from inflation to the shaky labor market. The continued weakening of oil prices provides the Fed with more room for maneuver and a rationale for this policy shift.

At 16:32 Beijing time, Brent crude oil continued to trade at US$65.13 per barrel.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.