ADP released its first weekly jobs data, easing the Fed's "flying blind" dilemma but raising new questions...

2025-10-28 21:32:30

This shift coincides with the US federal government shutdown entering its fourth week, bringing official employment data releases to a complete standstill. The September non-farm payroll report has yet to be released, and the likelihood of a timely October release is slim . Against this backdrop, ADP announced that its weekly data will be "open to all," providing the market with a rare and timely window into the situation.

It is worth noting that ADP emphasized in its statement that its data is based on "anonymous, aggregated private sector payroll data" covering more than 26 million private sector employees across the United States. This coverage size accounts for approximately 20% of the US private sector workforce, and its representativeness cannot be ignored.

Behind the Data Dispute: The Fed’s “Flying Blind” Dilemma

On the same day that ADP released its weekly figures, news emerged from Washington: Massachusetts Senator Elizabeth Warren had formally sent a letter to ADP, demanding an explanation for its suspension of providing proprietary employment data to the Federal Reserve . Warren bluntly stated in the letter that, in the absence of official data, the loss of ADP data has left the Fed "flying blind in a time of unprecedented economic uncertainty."

The data blackout began in late August. Federal Reserve Governor Waller cited preliminary ADP data in a speech, noting continued labor market weakness, even before the release of ADP's public report. While the Fed's use of ADP data is well-documented, the early disclosure clearly touched a nerve with ADP.

In response, ADP stated that it is "actively working with the Federal Reserve to improve data sharing processes" and emphasized that historically, data has been provided to the central bank "as a free public service." However, during the extraordinary period of the government shutdown, this data power game has risen to a new level.

Policymakers' dilemma and market outlook

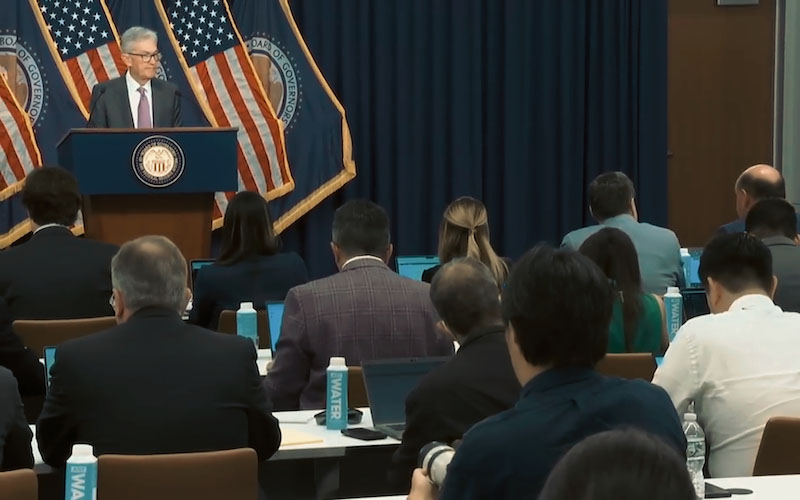

The Fed's dilemma goes far beyond this. Policymakers will meet on October 28-29, and the market generally expects another 25 basis point rate cut. However, this meeting will take place without any official employment data to guide it .

Vincent Reinhart, chief economist at BNY Investments, offered a unique perspective: During periods of data scarcity, the Federal Reserve may be more inclined to ease policy, as insufficient evidence will make policymakers cautious about maintaining excessively high interest rates . Citi economists predict the Fed will cut interest rates by 25 basis points each in October and December, and may cut further early next year if the job market continues to soften.

Even greater challenges lie ahead. If the government shutdown ends, delayed official reports could be released in quick succession — the September report could be released within days of the government reopening in early November, followed by the October report, and the November report, as per usual, in early December. This means three major employment reports could be squeezed into the market within about four weeks, any of which could potentially shift the Fed's policy outlook.

While the release of weekly ADP data provides the market with a new observation tool, it also raises new questions: In the absence of official statistics, do private data providers wield excessive influence? As the Federal Reserve faces both a data vacuum and policy pressure, the outcome of this data dispute could profoundly impact the direction of monetary policy.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.