Is gold caught in a vicious cycle of "the stronger it is, the weaker it becomes"? The probability of an interest rate cut surges to 71%, with the $4080 level set before the Russia-Ukraine agreement determines its fate.

2025-11-24 20:48:50

Last week, the University of Michigan Consumer Sentiment Index and SPGI Manufacturing PMI were released. The preliminary PMI reading of 51.9 was slightly lower than the expected 52 and also showed a decline compared to the previous month. Meanwhile, the University of Michigan Consumer Sentiment Index rose slightly from 50.3 to 51. Although it slightly exceeded expectations, it was still not far from the expansion/contraction threshold, depicting a scene of stagnation in both consumption and production, which also slightly boosted gold prices.

In addition, the continued increase in gold holdings by central banks around the world, coupled with the continuous inflow of funds into ETFs, has provided key support for gold prices. Conversely, the recent decline in US stocks and the contraction of risk appetite, coupled with the continued purchase of US Treasury bonds, have led to the diversion of safe-haven funds and thus have not brought much upward momentum to gold.

Investors are focusing on key U.S. economic data—including GDP and inflation indicators—as well as interest rate guidance signals from the Federal Reserve’s December policy meeting.

Pranav Meyer, Vice President of Commodities and Foreign Exchange Research at JM Financial Services, noted, "Ahead of the Fed's December policy meeting, the market focus remains on US economic data, and gold may continue its consolidation trend." He emphasized that initial jobless claims, GDP, and PCE inflation data are all key tracking variables.

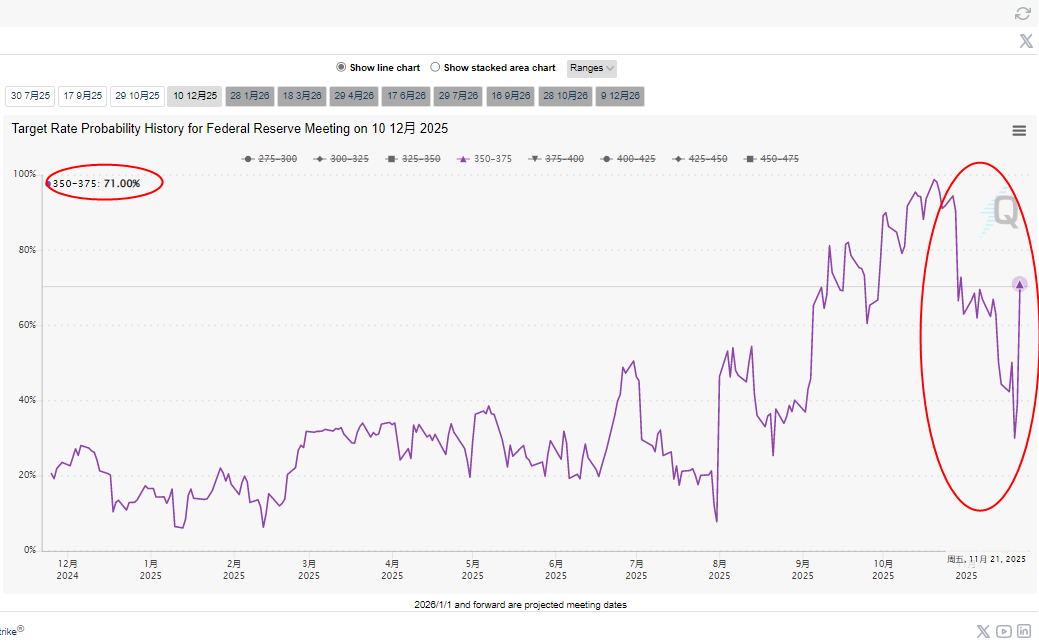

Last week's Federal Open Market Committee (FOMC) meeting minutes signaled that high interest rates might be maintained until 2025, leading to a downward revision of the probability of a rate cut in December to 36%. However, subsequent dovish remarks by New York Fed President Williams reversed the probability of a rate cut, which is now around 71%.

(US CME FedWatch interest rate futures trend)

Institutional installment payments are intensifying:

The divergence between bulls and bears in the gold market has intensified significantly. A recent survey by Bank of America (BofA), disclosed by the financial analysis account "TheKobeissiLetter," shows a clear divergence in professional investors' predictions for gold's performance in 2026.

Survey data shows that only 5% of global fund managers expect gold prices to break through $5,000 per ounce by the end of 2026; 34% of respondents believe that gold prices will stabilize in the $4,000-$4,500 range; 27% predict the range to be $4,500-$5,000; and another 34% are bearish on gold prices to below $4,000, of which 26% expect them to fall to the $3,500-$4,000 range.

It is worth noting that the survey also showed that 39% of professional investors did not allocate any gold assets in their portfolios, reflecting that some institutions are still cautious about allocating to precious metals.

Interesting logic: Is gold becoming stronger or weaker?

Recently, we have frequently seen both gold and the US dollar index strengthen simultaneously. The United States possesses the world's largest gold reserves, totaling approximately 8,133.46 metric tons (equivalent to 261.5 million troy ounces). These reserve assets are primarily stored in core security facilities such as Fort Knox in Kentucky, West Point Military Academy in New York, Denver, and the Federal Reserve Bank of New York.

By 2025, driven by the continued rise in gold prices, the market valuation of US gold reserves had exceeded $1 trillion. As a core symbol of global economic stability and geopolitical power, the massive gold reserves provide important support for the US's dominant position in the international financial system. This creates an interesting logic: the higher gold prices rise, the stronger the dollar becomes, and the stronger the dollar, the more it suppresses gold prices, ultimately leading to a situation where the stronger gold becomes, the weaker it becomes.

Institutional View: Interest Rate Concerns Limit Gains from Historical Highs

According to Ria Singh, a commodities and foreign exchange research analyst at Emkay Global Financial Services, gold experienced a technical pullback after hitting a record high in October, and historically, precious metals tend to be under pressure during periods of delayed interest rate cuts.

However, supported by previous interest rate cuts, continued purchases by central banks, and ETF inflows, gold's cumulative increase this year is still around 55%. The recent rise is essentially a reflection of investors exiting sovereign debt through "devaluation trading." She emphasized: "From a medium-term perspective, the upward structure of precious metals remains solid—expectations of policy easing in 2026, continued geopolitical uncertainty, and strong official demand for gold will jointly anchor the overall upward trend."

Technical Analysis:

As can be seen from the intraday chart of spot gold, the area around 4080 is a crucial dividing line between bullish and bearish sentiment in the near term, as well as a significant resistance level. Below this price level, gold prices are likely to continue to fluctuate and search for a bottom. In the near term, we need to pay attention to whether gold prices can break through this price level.

Although gold prices have been weak recently, the overall trend remains volatile. Due to the important milestone of the signing of the Russia-Ukraine agreement on November 27, the market may bet on the failure of the agreement before that date, causing gold prices to rebound ahead of time.

Going forward, we can pay attention to gold price movements and the release of important US data.

(Spot gold intraday chart, source: EasyForex)

At 20:40 Beijing time, spot gold was trading at $4074.21 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.