Interest rates are going to fall, the dollar is going to depreciate, and the world is going to be turbulent: Is the "perfect storm" for gold really coming?

2025-12-01 21:08:44

The dominant force in the recent macroeconomic environment remains the shift in monetary policy expectations. With multiple US economic indicators continuing to show slowing growth momentum, market expectations for the Federal Reserve to initiate a new round of interest rate cuts at its December meeting have significantly increased. The latest non-farm payroll data was weaker than the previous figure, and the consumer confidence index also showed a downward trend. Coupled with manufacturing activity remaining in contraction territory for several consecutive months, this reflects the fact that domestic demand expansion is weak. These indicators collectively reinforce the market's judgment of insufficient endogenous economic growth, thereby driving the interest rate futures market to repric future policy directions.

According to implied probability calculations in the derivatives market, the market has already priced in an approximately 87% probability that the Federal Reserve will implement a 25 basis point interest rate cut at the Federal Open Market Committee meeting on December 9-10. If this expectation materializes, it will be the second rate cut this year since September, marking a further shift in monetary policy towards easing. This shift directly weakens the relative attractiveness of dollar assets, particularly in terms of increased downward pressure on real interest rates, thereby reducing the opportunity cost of holding non-interest-bearing assets like gold. Meanwhile, the tone of recent statements from several Fed officials has become more dovish. Although San Francisco Fed President Mary Daly is not a voting member this year, she explicitly stated her support for a more prudent interest rate strategy in the current environment, a move interpreted by the market as a significant signal of increased dovish voices within the policymaking body. While individual officials, such as Dallas Fed President Lori Logan, still emphasize the need for policy patience, the overall communication direction is gradually converging with market expectations, creating systemic pressure on the dollar. From an exchange rate perspective, the dollar index has been weakening since last week, currently falling back to around 99.10, a near two-week low.

Geopolitical factors also provided temporary support for gold prices. While peace negotiations between Ukraine and Russia have not made a breakthrough, the US stance has subtly shifted, with the deadline for an agreement, originally set for this Thursday, being substantially postponed. According to sources, a new draft containing 19 articles is being prepared, covering energy infrastructure protection, food transport corridor security, and prisoner-of-war exchange mechanisms. Although German Chancellor Merz expressed reservations about the outcome of these talks, believing that a consensus was unlikely this week, the Kremlin's response was relatively restrained, demonstrating a certain degree of willingness to engage in dialogue. This atmosphere of "cautious optimism" prevented a large-scale withdrawal of risk premiums from the market; instead, the continued uncertainty maintained a certain level of safe-haven holdings. Furthermore, central bank demand for gold remains strong, with several emerging market countries continuing to increase their gold reserves to cope with potential external shocks, and ETF inflows showing no reversal, indicating that institutional allocation logic has not fundamentally changed.

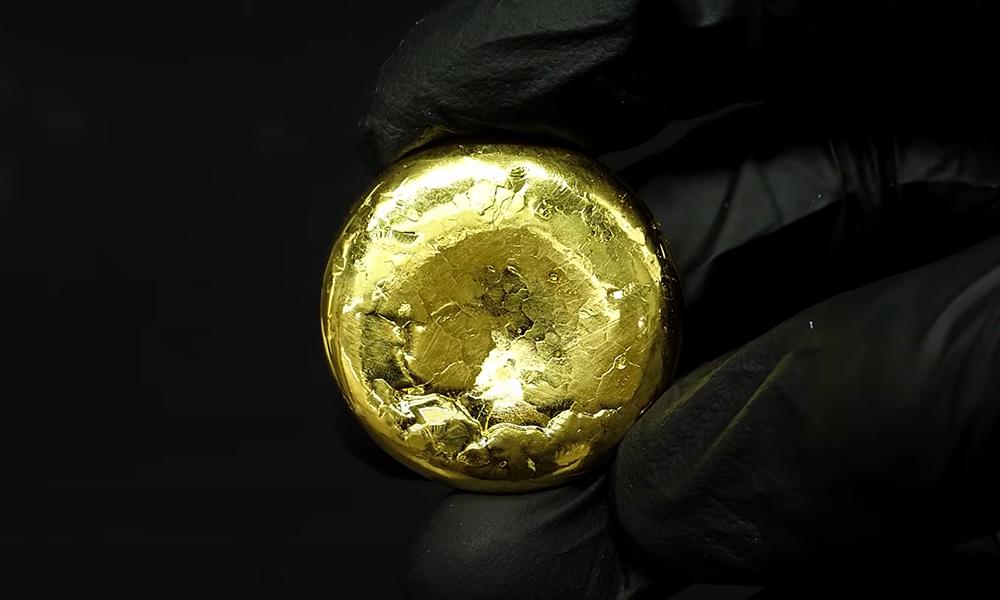

Spot gold prices were thus boosted by multiple positive factors, reaching $4,262 per ounce on Monday, the highest level since October 21. The current price represents a cumulative increase of nearly 60% since the beginning of the year, and is on track for its best annual performance since 1979.

In terms of technical form

According to the daily chart analysis of spot gold, gold prices have recently been in a fluctuating upward trend. The price is currently around $4250, approaching the resistance zone of the previous high of $4262.23. While the price has shown some upward momentum, it still faces the test of key resistance levels.

From a technical perspective, the MACD indicator's DIFF line (49.82) is higher than the DEA line (39.01), and the MACD histogram is positive, indicating strong short-term upward momentum for gold. Meanwhile, gold prices found support around $4120.00 and formed an upward trend line (from $3886.51 to $4120.00). This technical pattern suggests that gold prices are currently maintaining a certain upward trend, but close attention needs to be paid to whether the price can break through the previous resistance area and whether a pullback will occur.

Outlook

If the upcoming ISM Manufacturing PMI falls less than expected, or if the Personal Consumption Expenditures (PCE) price index shows strong inflation stickiness, it could temporarily dampen bets on interest rate cuts, triggering a pullback in gold prices. However, from a medium-term perspective, as long as the Federal Reserve maintains its current policy narrative and geopolitical tensions do not fundamentally ease, gold's valuation center still has room to move upward. Fund flow data shows that the proportion of long positions in gold futures has been rising recently, with net long positions in the CFTC's positioning report nearing historical highs, reflecting a generally optimistic market sentiment.

In summary, the current commodity market is still dominated by macroeconomic variables, with adjustments in monetary policy expectations being the core driver influencing precious metal pricing. The weakening of the US dollar's creditworthiness, the established downward trend in real interest rates, and persistent geopolitical uncertainties collectively constitute the fundamental conditions supporting higher gold prices. Meanwhile, although the pace of balance sheet expansion by major central banks globally has slowed, they have not yet initiated a substantial balance sheet reduction process.

Next, the focus will be on the PCE price index released on Friday. As the Federal Reserve's most closely watched measure of inflation, its performance will directly influence the final decision on interest rates in December. In addition, the progress of negotiations following the conflict in Ukraine and the final readings of manufacturing PMIs from major countries will also serve as important windows into the global economic climate.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.