One chart: The Baltic Dry Index hits a near two-year high, boosted by soaring Capesize freight rates.

2025-12-03 23:46:34

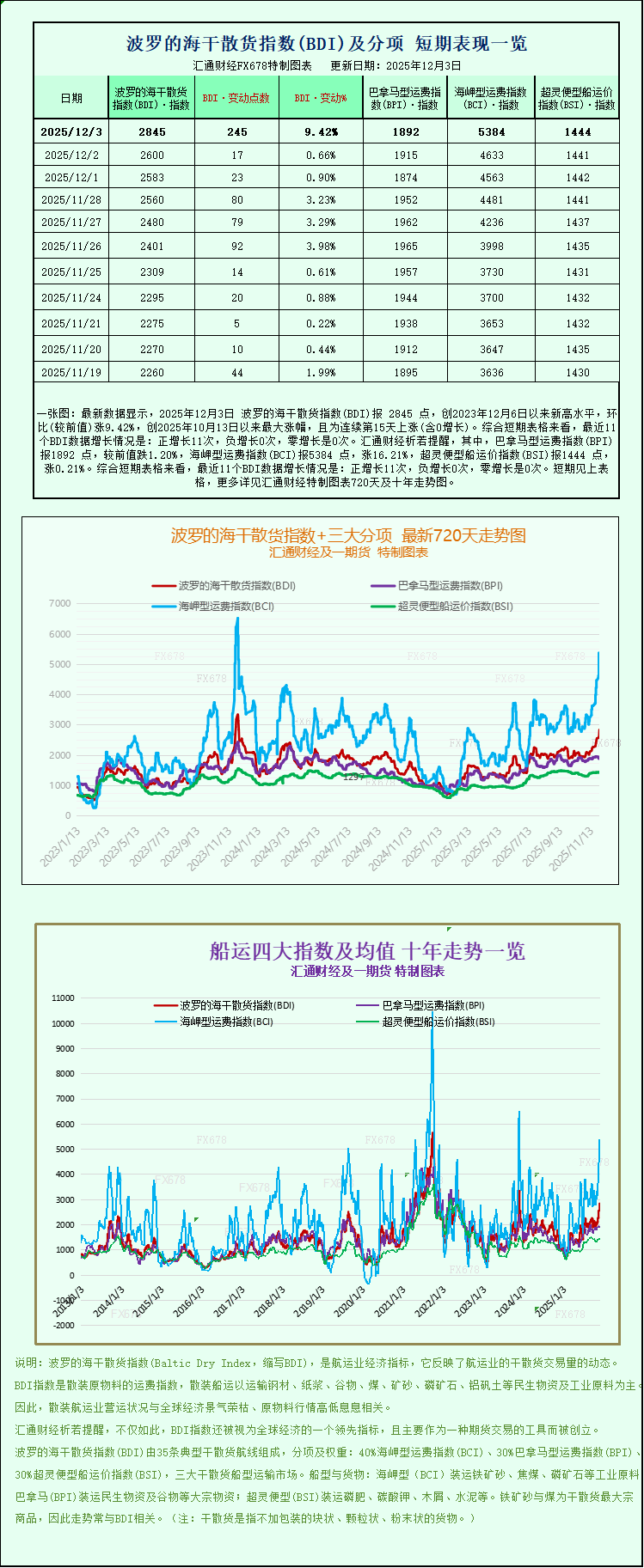

On Wednesday, the Baltic Dry Index (BDI), which tracks freight rates for dry bulk cargo vessels, climbed to its highest point in nearly two years, driven primarily by strong gains in the Capesize segment. As a barometer of global commodity trade, significant fluctuations in the BDI are often directly related to demand for transporting basic industrial raw materials such as iron ore and coal. This record high injects strong momentum into the global shipping market at the end of the year.

Overall Index Performance: Reached a near two-year peak, with a remarkable single-day increase.

The composite index, covering Capesize, Panamax, and Supramax vessel freight rates, rose 245 points, or 9.4%, to close at 2845 points, marking its highest level since December 2023. This daily increase also represents the best single-day performance since October 13th, indicating a concentrated release of market buying power and a strengthening upward trend in freight rates. From a market cycle perspective, the end of the fourth quarter typically sees a decline in dry bulk freight rates due to factors such as the global manufacturing off-season and the waning of shipping demand before the Christmas holidays. This counter-trend increase further highlights the unique nature of the current market supply and demand relationship.

Capesize vessels: the core driving force, with both freight rates and profits booming.

As the core engine of this index surge, the Capesize freight rate index jumped 754 points, a significant increase of 16.3%, closing at 5384 points, also setting a new high since December 2023. Capesize vessels are the "juggernauts" of dry bulk shipping, mainly undertaking the transportation of bulk commodities of 150,000 tons or more, with iron ore and coal accounting for more than 80% of their cargo volume. Their freight rate fluctuations are highly correlated with the global steel industry's prosperity and changes in energy demand.

Correspondingly, the average daily earnings of Capesize vessels also increased significantly, rising by $6,245 to $44,672. This earnings level is significantly higher than the average level for the year, indicating a substantial improvement in the profitability of shipowners. Industry analysts believe that the surge in Capesize freight rates is mainly due to two factors: first, as the world's largest iron ore importer, China's recent steel mill restocking demand has increased, leading to a month-on-month increase in iron ore imports; second, improved port operating efficiency in major iron ore exporting countries such as Australia and Brazil has accelerated vessel turnaround, coupled with some vessels choosing to detour around the Cape of Good Hope to avoid the situation in the Red Sea, resulting in regional capacity constraints and further pushing up freight rates.

Panamax vessels: Slight decline against the trend, market segmentation

In contrast to the strong performance of Capesize vessels, the Panamax freight index saw a slight decline, falling 23 points, or 1.2%, to close at 1892 points. Panamax vessels mainly transport bulk commodities such as coal and grain in the 60,000 to 70,000 tonne range, and their freight rate trends reflect changes in demand in global energy and food trade.

Panamax vessel freight rates declined by $205 to $17,038 per day, influenced by factors such as relatively high coal inventories in some parts of the world and reduced demand for coal substitution due to falling natural gas prices in Europe. However, in the long term, Panamax freight rates are expected to find support as the peak winter energy demand season in the Northern Hemisphere approaches and the South American grain export window opens, with the market maintaining a cautiously optimistic outlook for their future performance.

Supramax vessels: Steady growth with small shipyards performing well.

In the small vessel sector, the Supramax freight rate index remained stable, rising slightly by 3 points to 1444. Supramax vessels typically have a deadweight tonnage of 30,000 to 50,000 tons, offering advantages such as high flexibility and the ability to call at small and medium-sized ports. They primarily transport diversified goods such as grain, bauxite, and fertilizers, and their freight rates are less affected by fluctuations in a single commodity, resulting in a more stable trend. This slight increase also reflects the resilience of global small and medium-sized dry bulk trade, providing some support to the generally volatile market.

Institutional View: Year-End Rise Against the Trend Highlights Market Resilience

In a research report, Jefferies analysts noted, "Dry bulk freight rates continue to strengthen as 2025 draws to a close, whereas rates typically tend to decline at this time of year." The analysts believe that in addition to short-term supply and demand factors, the historically low global dry bulk vessel order book and limited new capacity deployment provide long-term support for freight rates. Meanwhile, the stable demand for basic industrial raw materials during China's economic recovery, as well as the temporary demand for coal transportation during the global energy structure transition, are also important drivers propelling freight rates against the trend.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.