A game of licking blood off a knife during a sovereign debt crisis

2025-12-12 16:53:09

According to the Committee on Responsible Federal Budget, the U.S. borrows approximately $7 billion per day to support the government's daily operations, and the fiscal deficit for this fiscal year is projected to approach $2 trillion.

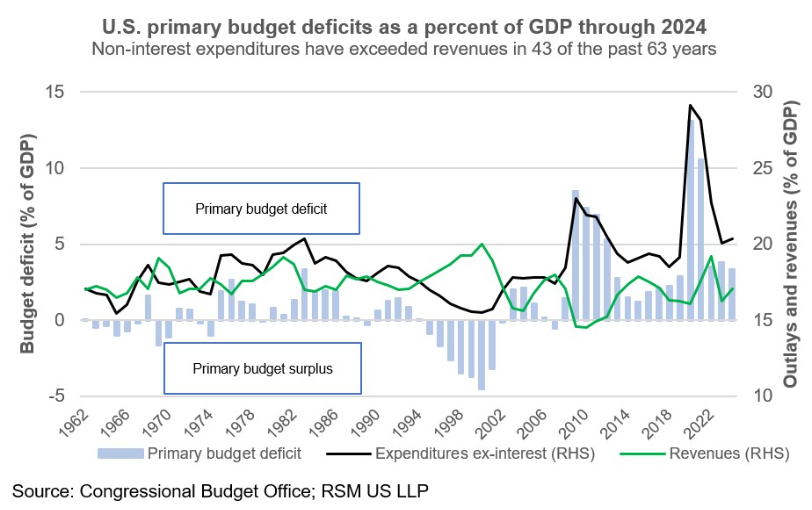

This situation will worsen further as the expansionary fiscal policy takes effect in the new year. The basic budget deficit, excluding interest on existing debt, has now climbed to 3.78% of GDP, a level that is completely unsustainable in the long run.

Under a fiscally prudent governance framework, the United States could have seized the window of opportunity when its economic growth rate was close to 2% to initiate a fiscal consolidation cycle and push its fiscal path back to a sustainable track. However, instead, neither party in the U.S. Congress showed any willingness to support this.

Global government debt expansion: an unsustainable fiscal situation

Admittedly, the US dollar's status as the global reserve currency, relying on the vast global currency and bond market centered on US finance, has endowed the US with a consumption capacity far exceeding its own financial resources.

However, global funding pricing will be directly driven by the trajectory of US borrowing, and as the scale of borrowing continues to expand, the financing costs for US households and businesses will inevitably rise in tandem.

Politicians and voters prefer to hear things that offer immediate benefits, while rational advice that requires restraint in the present for the sake of long-term good is ignored in electoral politics.

However, at the financial market level, the expansion of public debt is being taken into account as a core risk factor.

The term risk premium for US public debt continues to rise, and even as the Federal Reserve initiates a policy rate cut cycle, long-term interest rates continue to rise against the trend.

The surge in global government debt over the past 15 years, coupled with the passive response of successive governments that have only offered verbal explanations, should be a core concern for global market participants.

Following the structural disruptions to the global economy caused by the pandemic, high inflation and high interest rates have become the norm in the current financial markets.

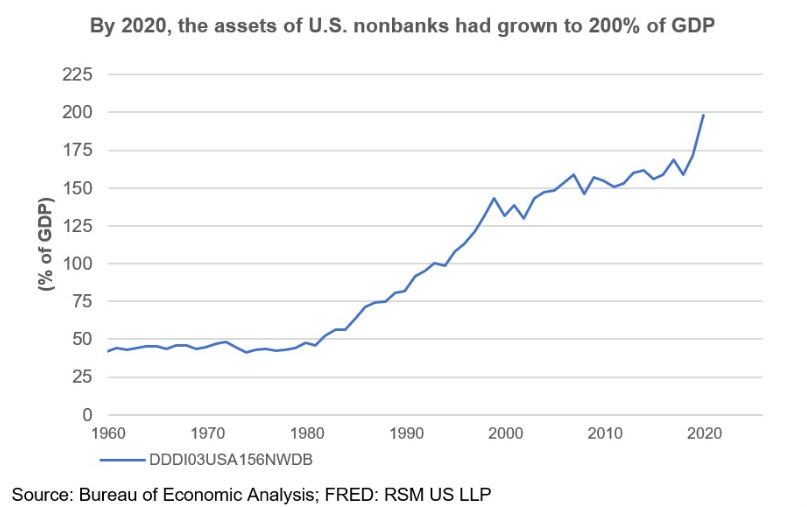

As the General Manager of the Bank for International Settlements (BIS) emphasized in a public speech, while government debt is expanding, non-bank financial intermediation activities continue to heat up, and the size of short-term, highly leveraged trading positions has increased significantly.

The relatively lax regulatory constraints on these institutions will undoubtedly further amplify systemic risks.

Historical experience shows that financial crises have fully exposed the risk transmission capabilities of non-bank financial institutions to the economic system.

The recession following the crisis forced countries to launch a dual stimulus of monetary and fiscal measures, which exacerbated distortions in the financing markets and further increased the size of public debt.

Ultimately, if the government borrows too much money, it will occupy market funds and investment opportunities, leaving businesses with neither the money nor the motivation to invest. As a result, the basic effect of government investment will gradually slow down.

The core definition of the debt problem: historical trajectory and key concepts

The core definition of the debt problem is that since the 1980s, the ratio of US government debt to GDP has been on a continuous upward trend.

During the Reagan administration, the percentage returned to over 40%, but after several rounds of negative impacts and spending policies without financial support, it soared to 132% in 2020.

Unfunded expenditures specifically refer to expenditures committed by the government that have not been matched by growth in fiscal revenue, requiring the issuance of treasury bonds, medium- and long-term government bonds, and other tools to make up for the funding gap.

Undeniably, under sudden economic shocks such as the pandemic, spending policies without financial support are necessary to effectively prevent the economy from falling into a deep recession.

However, during an economic growth cycle, expansionary fiscal policy should be phased out – the growth momentum of the private sector will naturally lead to an increase in tax revenue.

However, the US is about to implement a procyclical expansionary fiscal policy, which will directly exacerbate inflationary pressures and the risk of rising interest rates.

Despite the argument that economic growth alone can reduce the deficit, a review of the historical trajectory of spending without financial support since the 1980s reveals that this assertion lacks real-world support.

The real core question is: how long can this spending pattern without financial support continue?

It needs to be made clear that the U.S. bond market has fully demonstrated its ability to absorb debt—U.S. trading partners are happy to finance their domestic spending in exchange for geopolitical security guarantees and access to U.S. consumer and financial markets.

The dramatic increase in government debt, coupled with market participants taking advantage of easy access to funds for arbitrage, has fundamentally changed the way the global financial system originally operated.

(The chart shows that the number of bonds available for trading and speculation has been increasing, and has recently accelerated.)

Highly Debt-Industry Agencies Lifting Blood on a Knife's Edge: Hidden Risks of Non-Bank Institutions

The sustainability of high government debt should be questioned, but it is becoming an attractive short-term speculative target for market participants with lax regulations.

Unlike previous global financial crises that stemmed from private sector debt defaults and regulatory deficiencies, the current market speculation focus has shifted to short-term trading opportunities amid high levels of public debt.

In addition, non-bank financial institutions have been increasingly involved in the sovereign bond market and have faced weaker regulatory constraints, gradually replacing banks' traditional core position in public financing.

These non-bank institutions encompass various financial intermediaries such as investment funds, hedge funds, insurance companies, and pension funds, and are now able to profit through extremely short-term, highly leveraged trading positions.

According to World Bank statistics, more than half of the world's financial assets are currently held by non-bank institutions.

Today, the government has new providers of U.S. Treasury liquidity, medium-sized enterprises have expanded their financing channels, and consumers and small businesses have more borrowing options.

However, the potential risks cannot be ignored: First, the World Bank warns that the rapid development of non-bank institutions has increased the probability of "non-bank runs"—money market funds invest in long-term assets by purchasing long-term government bonds, but promise investors immediate redemption rights. This mismatch between the promised investment and the actual investment duration may create risks, meaning that when redemption is needed, the bonds may not have matured yet, requiring investors to buy them on the market, thus triggering a bank run.

If a non-bank institution experiences a liquidity crisis, it will have to rely on government bailouts, and the central bank will be forced to assume the risk exposure of such institutions.

To address this risk, the World Bank has called for improved data collection systems, enhanced risk quantification analysis, and an upgraded regulatory framework for non-bank institutions.

Secondly, a special analysis by the Bank for International Settlements shows an increasingly pronounced trend towards low margin ratios in sovereign bond trading. Margin ratios represent the borrowing costs between financial intermediaries, allowing borrowers to leverage funds to capitalize on market volatility.

The Bank for International Settlements further points out that the widespread adoption of zero-margin transactions in bilateral repurchase agreements raises two core questions: Who are the actual beneficiaries of these preferential terms? And what hidden risks will this pose to financial stability? The analysis also indicates that large hedge funds, compared to smaller institutions, are able to obtain higher leverage limits, a difference that essentially stems from their stronger market pricing power.

Unregulated non-bank participants in the sovereign debt market, coupled with the proliferation of costless, highly leveraged positions, have posed a substantial threat to financial stability.

The continued rise in this risk necessitates a prudent and coordinated response strategy from countries at both the domestic and international regulatory levels.

(Growth rate of asset portfolios held by non-bank financial institutions)

Primary budget deficit: a core indicator of the sustainability of government's daily revenue and expenditure.

The classic definition of the primary budget deficit is: government revenue minus non-interest-bearing basic expenditures within a specific period, expressed as a percentage of GDP. A deficit less than or equal to zero indicates that government operations are sustainable, while a deficit greater than zero indicates that historical debts are excluded and the government still needs to borrow to operate.

The primary budget deficit helps us "filter out the interference of historical debt" and directly judges "whether the government can make money now to cover current daily expenses," serving as a "core benchmark" for assessing the sustainability of fiscal policy.

The last time the United States experienced a budget surplus where annual fiscal revenue covered expenditures occurred between 1995 and 2001. This period coincided with the productivity boom at the end of the Clinton administration and continued into the early Bush administration.

Subsequently, under the long-term effects of the financial crisis and the impact of the pandemic, the primary budget deficit experienced explosive growth. Although the current primary budget deficit has declined somewhat, the level in 2022-2024 is still higher than any year since 1983—the double trough recession that plunged the global economy into severe distress.

When financial markets completely lose their willingness to invest in a country's debt, the primary budget deficit will transform into systemic risk. The direct consequence will be a sharp rise in interest rates, and the dramatic increase in debt financing costs will significantly inhibit investment and economic growth.

(The bar chart below the zero axis represents that the government can bear the current debt through operations.)

The institutional roots of deficit preference: political logic and global commonalities

The institutional roots of deficit preference lie in the fundamental shift in governments' perceptions of debt.

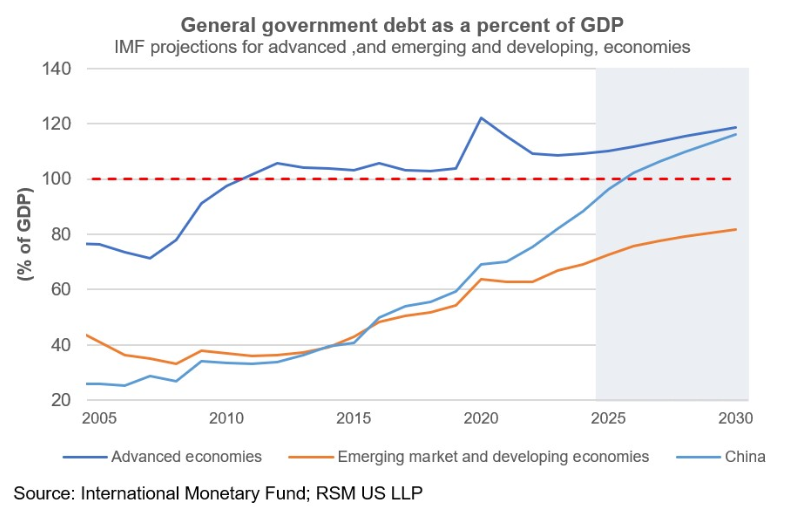

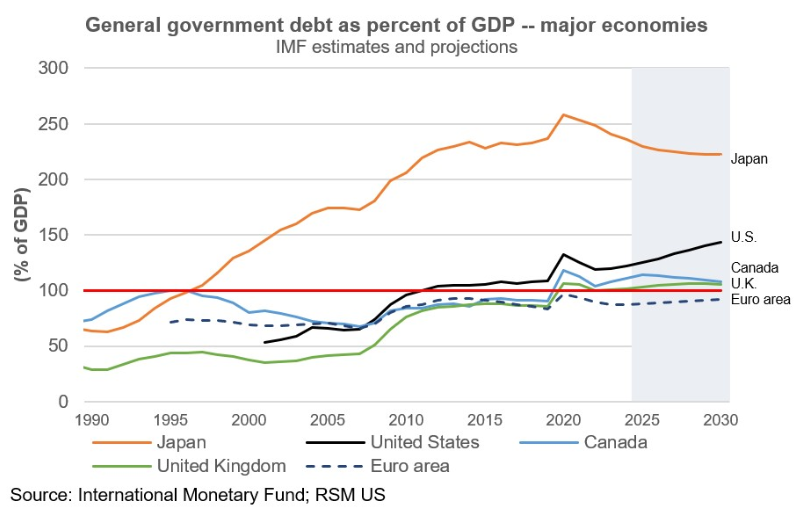

For example, Japan's government debt has exceeded 100% of its GDP for nearly 30 years.

Despite Japan's prolonged economic stagnation, the yen has not faced substantial sell-off risks, except for the period of dollar appreciation pressure during the pandemic, thanks to its key role in dollar debt financing.

However, debt expansion is not unique to Japan and the United States; other countries are also experiencing a surge in their debt levels.

As the Bank for International Settlements has pointed out, many countries’ political mechanisms have a natural “deficit preference”, which leads to persistent fiscal deficits, especially during periods of economic stress.

External shocks such as the pandemic are often accompanied by deep recessions, while the pressure on public service expenditures from an aging society continues to increase.

Furthermore, the US political establishment is unwilling to match the scale of spending with tax increases, and it refuses to acknowledge the tax cuts implemented by high-income economies, thus failing to achieve fiscal compensation through a leap in economic growth.

In reality, the potential GDP growth rate of developed economies has long hovered at a low level of below 2%.

(A summary of government debt as a percentage of GDP in various countries)

The debt transmission effect of high interest rates: the implicit pressure of interest payments.

The zero or low interest rate environment in many countries following the financial crisis created the illusion of free and readily available funds, providing policymakers with an excuse to expand fiscal spending.

However, attributing the size of the US debt solely to previously low interest rates ignores the core issue.

For example, long-term interest rates entered a downward trend after 1980, while deficit spending became the norm during this period.

Even with interest rates falling below 2%, debt interest payments continue to grow.

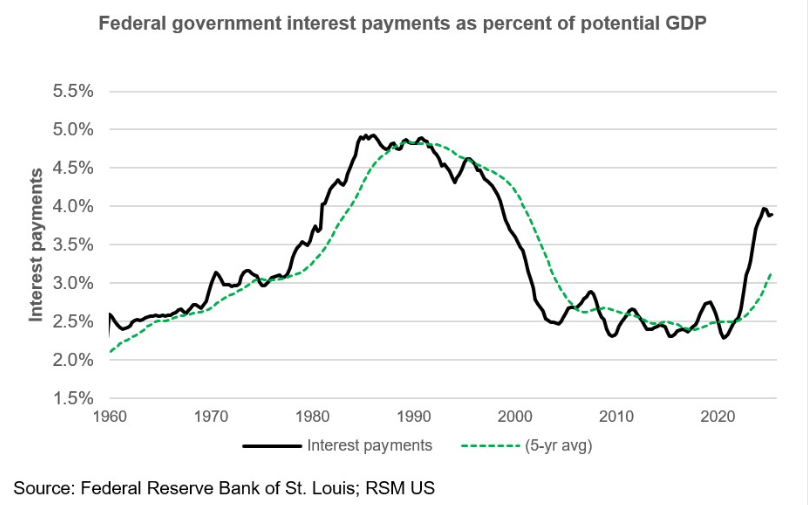

The recent surge in interest payments is directly related to the fact that the yield on 10-year U.S. Treasury bonds has remained stable in the 4%-5% range over the past two years.

(Chart showing the growth trend of US government debt interest)

Key Transaction Insights: The Long-Term Market Logic of Fiscal Imbalance

With many banks closing long-term deposit channels, stable investment products are becoming increasingly scarce in the market. When entrusting your assets, you must pay attention to identifying the core of the assets to avoid various financial risks such as defaults.

Key takeaways from the transaction: In summary, monetary policy and interest rate levels are indeed important factors affecting debt repayment capacity. This year, US debt interest payments have climbed to 4% of GDP.

However, to fundamentally correct fiscal imbalances, the core lies in controlling the scale of debt and resolving the mismatch between revenue and expenditure—this is the long-term logic that foreign exchange and financial market participants need to focus on.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.