A chart shows the Baltic Dry Index falling to a near one-month low, dragged down by weaker freight rates.

2025-12-12 22:45:50

The Baltic Dry Index (BDI), which tracks freight rates for dry bulk shipping vessels, plummeted to its lowest level in nearly a month, with a significant cumulative decline throughout the week. The core reason for this drop was a broad weakening of freight rates across all types of vessels, a lack of strong support from the demand side, and an overall sluggish shipping market.

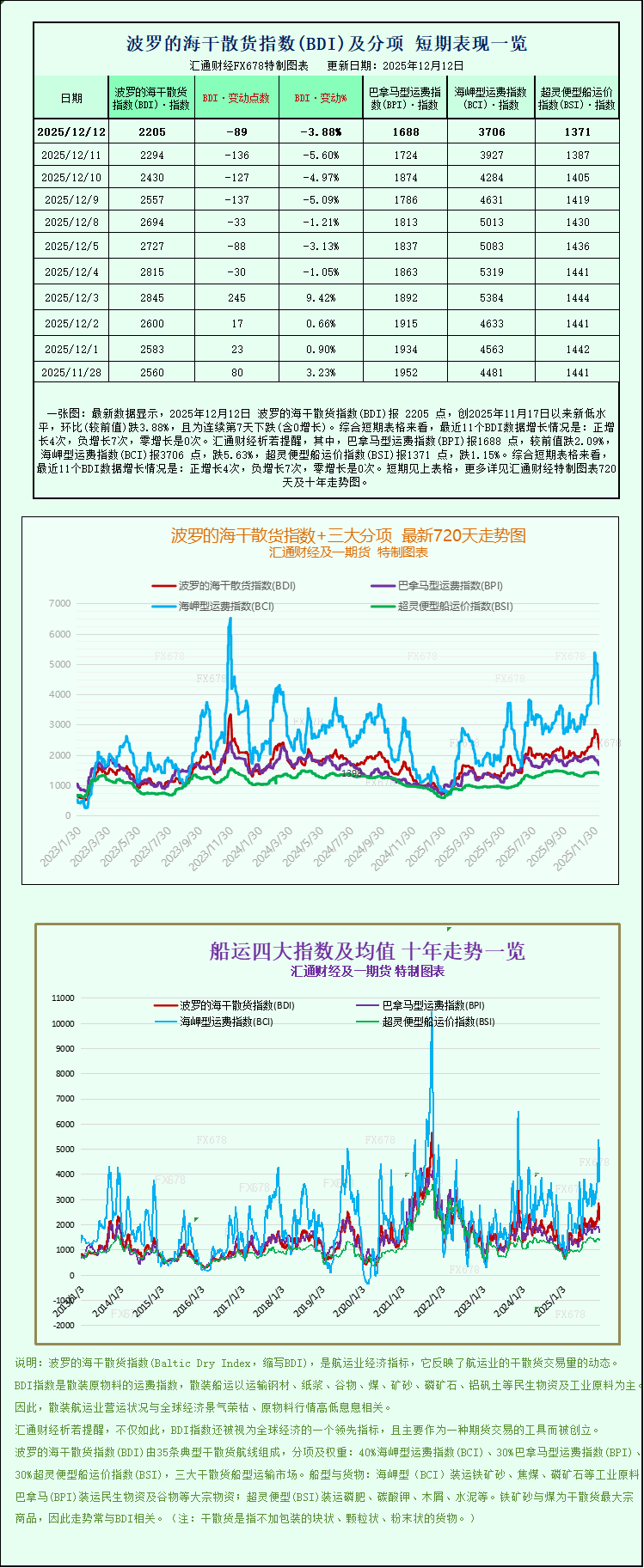

The Baltic Dry Index (BDI), a key indicator reflecting freight rates for Capesize, Panamax, and Supramax dry bulk carriers, fell 89 points, or 3.9%, to close at 2205 points, its lowest level since November 17. On a weekly basis, the index fell 15.9%, the steepest weekly decline since January 20, highlighting the recent downward pressure on the dry bulk shipping market.

Among the various vessel types, the Capesize Index (BCI) performed particularly poorly. The index plunged 221 points, a drop of approximately 5.6%, closing at 3706 points, its lowest level since November 24th. On a weekly basis, the index has fallen by a cumulative 22.7%, ranking among the worst performers. Capesize vessels, the "giants" of the dry bulk shipping market, primarily handle the transportation of bulk commodities such as iron ore and coal, with individual vessels typically boasting capacities of up to 150,000 tons. Affected by declining freight rates, the average daily earnings of these vessels decreased by $1838 to $30731, significantly squeezing shipowners' profit margins.

Meanwhile, iron ore futures prices on China's Dalian Commodity Exchange also saw a slight decline on Friday, and are poised for their second consecutive week of losses. As the world's largest iron ore consumer, China's slowing demand is the main factor dragging down iron ore prices, compounded by persistently high port inventories, further exacerbating downward pressure. However, the fiscal stimulus policies previously promised by the Chinese government and a series of measures aimed at stabilizing the real estate market have provided some support for iron ore prices, preventing further declines.

The Panamax Index (BPI) was also affected, falling 36 points, or 2.1%, to close at 1688, its lowest level in over two months, with a cumulative weekly decline of 6.2%. These vessels typically have a capacity of 60,000 to 70,000 tons and primarily transport commodities such as coal and grain. The lower freight rates directly resulted in a reduction of $325 in average daily earnings, ultimately dropping to $15,194.

In the small and medium-sized vessel sector, the Supramax Index (BSI) fell 16 points to close at 1371, with a cumulative weekly decline of 3.4%. Although these vessels have a certain degree of resilience in their niche market due to their flexible capacity configuration, they are still unable to remain unaffected by the overall weak shipping market environment, with freight rates and profitability declining to varying degrees.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.