The dollar's decline may be difficult to halt, with interest rate futures revealing details.

2025-12-15 17:56:46

Interest rate futures reveal Fed's dovish policy shift

The core driver that triggered the dollar sell-off was the market's dovish interpretation of the Federal Open Market Committee (FOMC) statement and Chairman Powell's press conference.

Although this rate cut was priced in, the degree of easing in the forward guidance far exceeded market expectations.

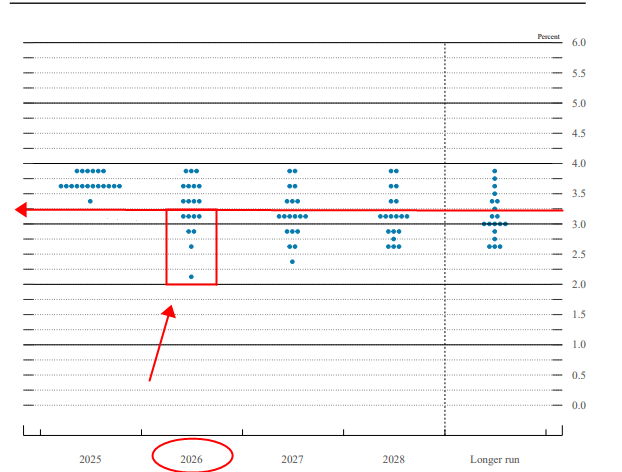

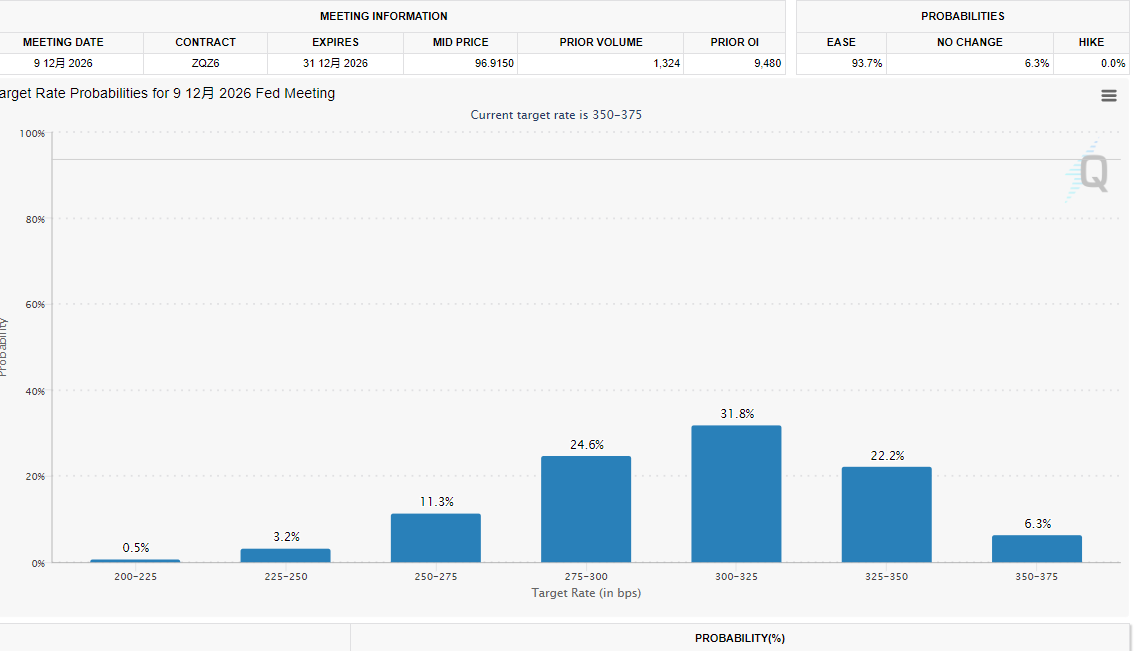

The key disagreement lies in the fact that the Fed's dot plot still shows only one more rate cut planned in 2026, but the market has completely abandoned this guidance and instead priced in the probability of two 25-basis-point rate cuts.

(The dot plot shows that the vote for interest rates below 3.25% in 2026 is 8/19, not exceeding 50%, while interest rate futures show more than 70%)

This "discrepancy between the Fed's official expectations and market pricing" constitutes the core engine of the dollar's weakness—investors continue to increase their short positions in the dollar based on the judgment that "the period of low interest rates will exceed the Fed's statements."

Major currency cross rates are flexing their muscles.

Euro/Dollar: The euro emerged as one of the biggest winners. The core logic behind the euro's strength lies in the fact that the European Central Bank (ECB) has clearly signaled that its pace of interest rate cuts will be much slower than that of the Federal Reserve, significantly enhancing the relative attractiveness of Eurozone assets.

GBP/USD: The pound strengthened in tandem, reaching a multi-week high. The Bank of England's (BoE) cautious stance on easing policies provided continued upward momentum for the pound.

USD/JPY: The market widely expects the Bank of Japan (BoJ) to be the next major central bank to raise interest rates. This extreme policy divergence has completely undermined the carry trade advantage of the US dollar.

The US dollar priced in Tuesday's belated non-farm payroll data.

On Tuesday, the U.S. Department of Labor will release the combined non-farm payroll data for October and November, including non-farm payrolls, unemployment rate, wage growth, and labor force participation rate.

Meanwhile, the U.S. Census Bureau released supplementary U.S. retail sales data for October (commonly known as "the terror data"), which directly priced in the dollar index in advance. These two data points have a significant impact on the dollar index and U.S. stocks.

Weak US labor market and economic data

Recent economic data has provided solid support for the Federal Reserve to shift towards easing, thereby suppressing the attractiveness of the US dollar.

Initial jobless claims surged to 236,000 in the week ending December 6, 2025, significantly exceeding market expectations. This data signals a cooling in the persistently tight U.S. labor market, and the weakness in the job market implies easing inflationary pressures, clearing the way for further interest rate cuts.

Manufacturing contraction: Various surveys and purchasing managers' indices (PMIs) all indicate that the manufacturing sector continues to be in contraction territory.

The foreign exchange market interpreted this series of weak data as a clear signal that the Federal Reserve prioritizes growth over inflation, and this policy orientation will inevitably lead to a weakening of the currency.

The interest rate spread advantage continues to narrow.

Interest rate differentials are the core anchor for exchange rate pricing. The Federal Reserve's interest rate cuts have directly narrowed the interest rate gap between the United States and the Eurozone, Japan, and the United Kingdom. As US Treasury yields decline, the momentum for global capital inflows into dollar assets has weakened significantly.

Fund managers seeking optimal risk-adjusted returns are accelerating the reallocation of funds to economies with stable or rising interest rates.

2026 US Economic Outlook and Dollar Forecast

Analyst consensus anticipates that major investment banks have lowered their forecasts for the US dollar index, believing it is unlikely to regain the 99 mark until at least mid-2026.

The core risk lies in the global economic slowdown: if the European or Chinese economies deteriorate faster than the US economy, the US dollar may briefly regain its safe-haven status, leading to a temporary reversal of the current downward trend. The key focus will remain on data, as the subsequent movement of the US dollar will still be entirely driven by data.

Traders should pay close attention to the following key data: the Consumer Price Index (CPI), the Non-Farm Payrolls (NFP) report, and dissenting votes at future FOMC meetings.

Against the backdrop of global policy coordination, the strength of the US dollar is always a relative concept, and the policy decisions of other central banks are crucial.

If the Bank of Japan raises interest rates as expected, the yen will appreciate significantly against the dollar; similarly, if the European Central Bank makes unexpectedly hawkish remarks, the euro will continue its upward trend, further suppressing the dollar index.

The Federal Reserve's rate cut in December 2025 officially confirmed the market's bearish view on the US dollar.

Under the triple pressure of the Federal Reserve's dovish policy shift, weak US economic data, and a continued narrowing of interest rate differentials, the US dollar index (DXY) has entered a clear weak pattern.

Meanwhile, technical analysis shows that the US dollar index is currently in the lower half of its trading range, leaning towards a weak consolidation trend. With the downward movement of moving averages such as the 5-day moving average, the dollar is expected to begin a new round of decline.

(US Dollar Index Daily Chart, Source: FX678)

At 17:46 Beijing time, the US dollar index is currently at 98.31.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.