3 days until the Bank of Japan's decision: Japanese government bond yields hit 1.95%, when will the window for a breakout in USD/JPY open?

2025-12-16 17:38:17

Ahead of the Bank of Japan's decision: Japanese government bond yields fluctuate within a range.

The Bank of Japan's policy decision this Friday is the core event for the market this week, with the market consensus expecting the bank to raise interest rates by 25 basis points to 0.75%. Against this backdrop, Japanese government bond yields are exhibiting a range-bound trading pattern.

10-year Japanese government bond yield: Currently hovering around 1.951%, with a previous high of 1.976%. The Bollinger Bands (20,2) show the middle band at 1.941%, the upper band at 1.991%, and the lower band at 1.891%. If it breaks through the upper band, it may test the psychological level of 2.00%. Otherwise, it will look towards the support levels of 1.90% and 1.85%.

In terms of technical indicators, the MACD (26,12,9) of the 10-year Japanese government bond futures contract shows DIFF 0.032 and DEA 0.038, which is in a slightly bullish zone, but the momentum is insufficient, reflecting the wait-and-see sentiment before the decision.

USD/JPY: Policy divergence and technical pressure combine to create a complex situation.

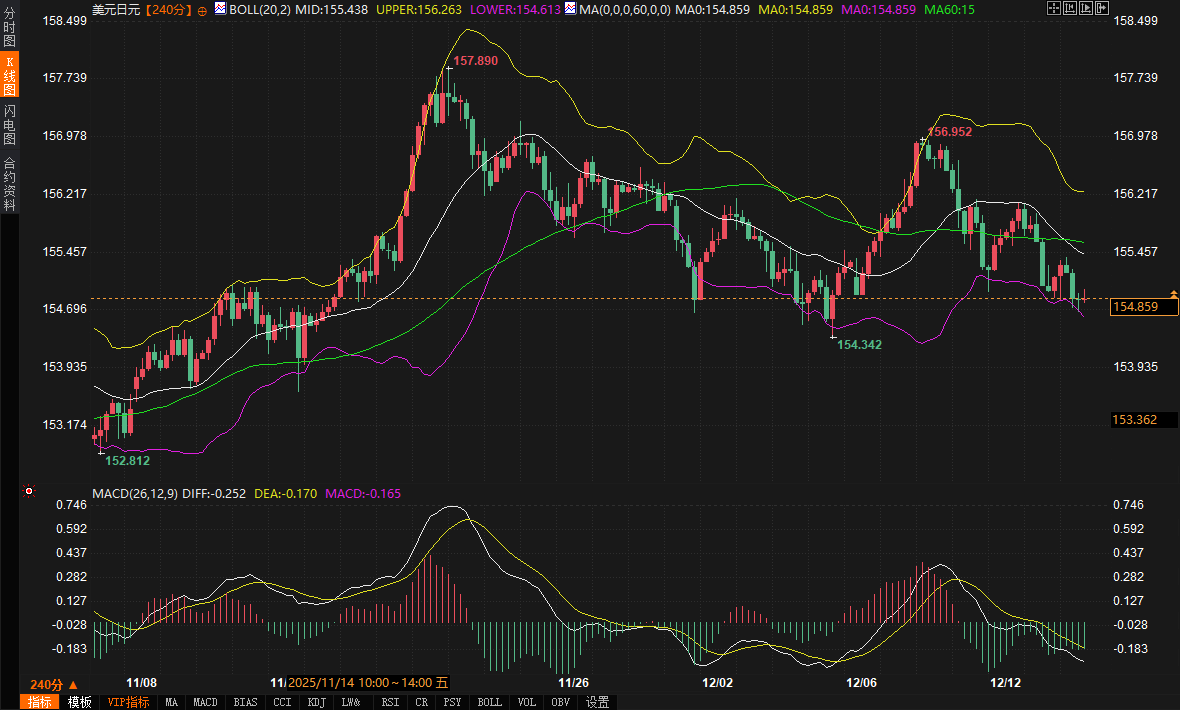

The USD/JPY pair has been trending downwards recently, breaking below the psychological level of 155.00 today. Both fundamental and technical factors are exerting downward pressure.

Policy divergence: The Bank of Japan's expected rate hikes and the Federal Reserve's dovish expectations (two rate cuts in 2026) are putting pressure on the narrowing interest rate differential, supporting the yen;

Technical Analysis: The 240-minute chart shows the Bollinger Bands (20,2) with the middle band at 155.438, the upper band at 156.263, and the lower band at 154.613. The current price is close to the lower band. The MACD indicator shows DIFF -2.52 and DEA -0.170, with the green momentum bars continuing, confirming that the short-term bears are in control.

Restraining factors: Concerns about Japan's fiscal situation (the Prime Minister's spending plan) have limited the yen's appreciation to some extent, keeping the exchange rate temporarily within the 154-155 range.

Key support and resistance levels and points to watch during trading.

Ahead of the decision, the breach or breach of key support levels will dominate short-term sentiment:

USD/JPY: Resistance levels are 155.438 (Middle Bollinger Band) and 156.263 (Upper Bollinger Band); Support levels are 154.613 (Lower Bollinger Band) and 154.342 (Recent Low).

10-year Japanese government bond yield: Resistance levels: 1.976 (previous high), 1.991 (upper band); Support levels: 1.941 (middle band), 1.891 (lower band).

Pay attention to the following during trading:

US data: The delayed October non-farm payrolls report, subsequent PMI data, and Thursday's CPI data will influence expectations for a Fed rate cut;

Japanese economic data: The manufacturing PMI contraction slowed, and the services PMI cooled slightly. Although this did not change the expectation of an interest rate hike, attention should be paid to the potential impact on the wording of the central bank's decision.

Market sentiment: Increased risk aversion (pressure on Asian stock markets) will support the yen, while decreased risk aversion will be bearish for the yen.

Post-Decision Outlook: Policy Signals Set the Direction

The Bank of Japan's decision this Friday will clarify the market trend for the next 2-3 days:

Hawkish rate hike: If the rate hike is 25 basis points and the wording is hawkish, the yield on Japanese government bonds will break through the resistance, the yen will appreciate, and the USD/JPY exchange rate may fall below the 154 mark.

Less than expected: If interest rates are maintained or the rate hike is insufficient, Japanese bond yields will fall, and the USD/JPY exchange rate will rebound to above 155.

Federal Reserve factor: Stronger-than-expected US data will delay expectations of interest rate cuts, supporting the dollar; conversely, weaker-than-expected data will be bearish for the dollar.

The market is expected to remain volatile ahead of the decision, while post-decision policy signals will be the core driver of short-term trends. Investors should closely monitor the central bank's interest rate decision and its statements regarding inflation and economic outlook to anticipate subsequent market movements.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.