Yen at a Crossroads: Strong Data Supports BOJ Rate Hike, But "Neutral" Commitment May Limit Bullish Gains

2025-12-17 15:21:21

Japan's exports grew faster than expected in November, mainly due to stable demand from the United States and the European Union.

Exports rose 6.1% year-on-year in the month (compared to 3.6% in October, with the market consensus forecast of 5.0%). The finalization of the US-Japan trade agreement and strong growth in global semiconductor demand were the main drivers of the significant increase in Japanese exports.

In terms of export destinations, exports to Asia increased by 4.5%, with significant growth in exports to Malaysia (14.3%) and Vietnam (14%). Exports to the United States and the European Union also increased substantially by 8.8% and 19.6%, respectively.

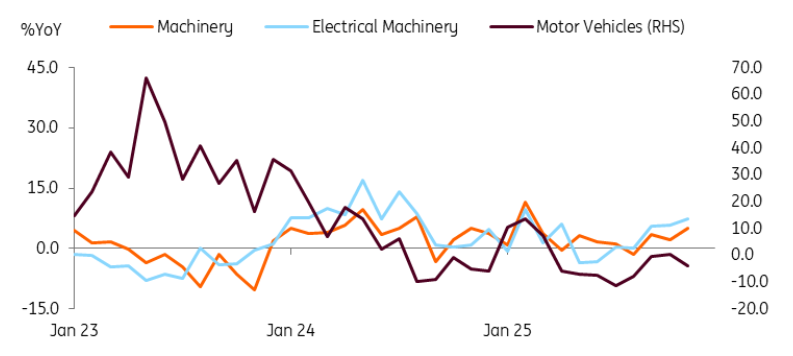

In terms of export product categories, exports of machinery increased by 5.1%, and exports of electrical machinery increased by 7.4%. Semiconductor exports increased by 13%, consistent with the growth trend of other major Asian chipmakers. Semiconductor exports remained strong across the Asian region. Automobile exports declined by 4.1%. However, automobile shipments to the United States increased slightly (1.5%), while exports to the European Union remained strong (up 25.7%).

Benefiting from stable demand for machinery products, Japan's exports are gradually recovering.

(Orange broken lines represent machinery/machinery; blue broken lines represent electric motors/electrical machinery; brown broken lines represent automobiles/motor vehicles)

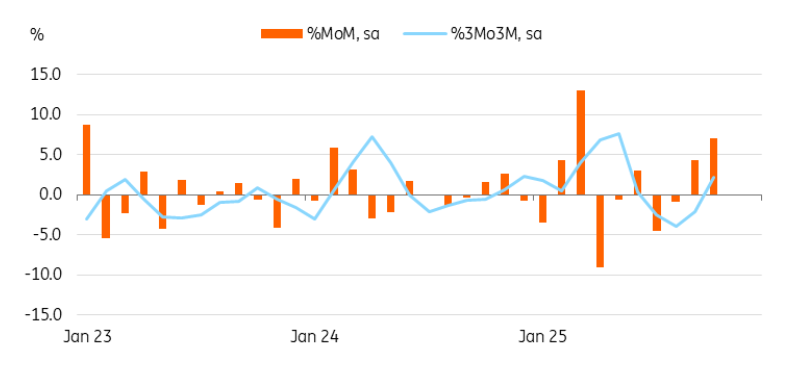

In another report, core machinery orders saw a significant increase for the second consecutive month.

Exports rose 7.0% month-over-month in October after seasonal adjustment, compared with 4.2% in September. Stronger overseas demand than domestic demand is likely to drive export growth in the coming months. However, weak non-manufacturing demand suggests that the recovery in corporate capital expenditure expectations may be weaker than previously anticipated.

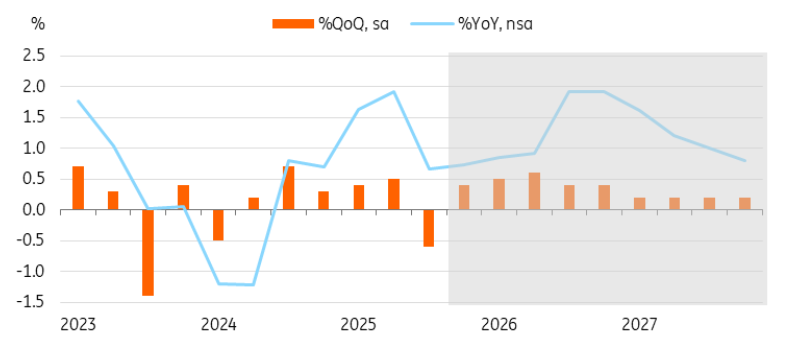

Recent industrial output, retail sales, trade data, and survey results have reinforced market expectations that economic growth will recover in the fourth quarter of 2025. The market currently projects a 0.4% quarter-on-quarter growth in the fourth quarter of 2025, with full-year GDP growth of 1.2% and 1.4% projected for 2026.

Core machinery orders have seen strong growth for two consecutive months.

(Orange represents the seasonally adjusted month-over-month growth rate of core machinery orders; blue represents the seasonally adjusted three-month month-over-month growth rate of core machinery orders.)

Ahead of the Bank of Japan's Policy Meeting

Market participants have almost fully priced in a 25 basis point rate hike, and the focus will now be on the comments from Governor Ueda Kazuo. Given heightened concerns about rising market interest rates, Governor Ueda is not expected to deliver any hawkish signals in his press conference. The Bank of Japan anticipates that real interest rates will remain in negative territory after the rate hike later this week, leaving room for further increases.

Current market expectations point to another interest rate hike in June or July next year. However, assessments suggest a higher probability of an October rate hike. The Bank of Japan is expected to maintain its current estimate of the neutral interest rate in the 1%-2.5% range for the foreseeable future. Recent market reactions to Governor Ueda's comments regarding a reassessment of the neutral interest rate appear to have been somewhat excessive. It is important to clarify that the neutral interest rate is a conceptual range, not a precise figure, and the Bank of Japan does not attempt to define it precisely.

Looking ahead, the Bank of Japan will closely monitor the economic impact of rising interest rates on corporate borrowing, bank lending, private consumption, and capital expenditures. Key indicators to watch in the near term include the spring wage negotiations and the yen's exchange rate movement.

Recent positive economic data suggest that GDP is expected to rebound in the fourth quarter of 2025.

(Orange represents quarter-on-quarter percentage; blue represents year-on-year percentage)

Overall assessment of the USD/JPY exchange rate

Short-term (before and after the decision): Exchange rate movements will be highly dependent on the tone and forward guidance of the Bank of Japan's decision and Governor Ueda's press conference. Given the "rate hike already priced in," any signal less hawkish than the market's implied hawkishness could trigger a rebound in USD/JPY (weakening of the yen). Conversely, a stronger hawkish indication will strengthen the yen. On Wednesday, influenced by a stronger dollar, USD/JPY fluctuated upwards, rising approximately 0.48%.

In the medium term: Confirmation of Japan's economic recovery (especially Q4 GDP data) and the global semiconductor demand cycle will continue to provide fundamental support for the yen. However, whether the yen can strengthen in a sustained upward trend depends more on whether the Bank of Japan's subsequent interest rate hikes are faster than the Federal Reserve's, and whether expectations of a narrowing US-Japan interest rate differential further strengthen.

(USD/JPY daily chart, source: FX678)

At 15:20 Beijing time, the US dollar was trading at 155.47/48 against the Japanese yen.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.