Did the Fed bet right? A report reveals: the job market is indeed in "recession".

2025-12-17 16:08:03

Nonfarm payrolls grew at a similar pace in November (+64,000), but the unemployment rate rose to 4.6%, a new high since the end of the pandemic, while retail sales grew by 0% year-on-year in November.

According to a report released by Goldman Sachs' analysis team led by Lizzie Dove, consumer trends in cities like Las Vegas have begun to decline, reminiscent of the weakness seen in the early stages of the economic recession.

At the same time, although the current consumption environment exhibits K-shaped differentiation and dual-track characteristics, this early signal warrants high vigilance from the market.

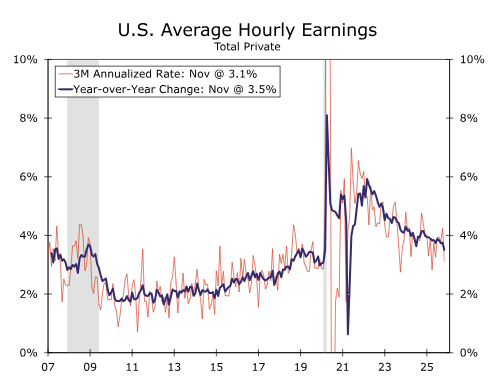

Wage growth also slowed significantly, at only 3.5% year-on-year, the lowest level since 2021, indicating that the outlook for the US economy is not optimistic.

Labor Market Continues to Weaken: Data Details and Structural Characteristics

The final employment report, to be released in 2025, indicates that the labor market will still struggle to gain a foothold.

Despite being delayed by 11 days due to the federal government shutdown, the November Employment Status Report is quite informative, and the first data from the October institutional survey was also released today.

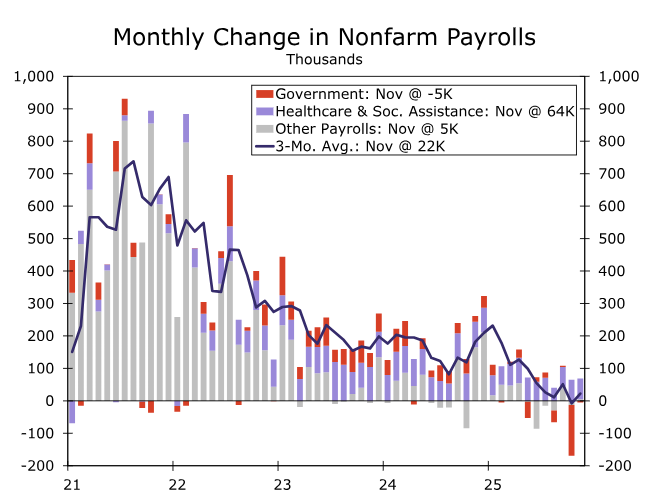

After nonfarm payrolls fell by 105,000 in October, they rebounded by 64,000 in November, bringing the total number of jobs down by 41,000 from September.

After accounting for a downward revision of 11,000 jobs added in September, the three-month average job growth rate is now only 22,000, compared to 62,000 before this report was released.

Although the October job losses (the largest since 2020) were significant, this overstated the recent weakening of hiring momentum.

The number of federal government employees plummeted by 162,000 as those who accepted the government's offer to delay their resignations earlier in the year were eventually removed from the payroll.

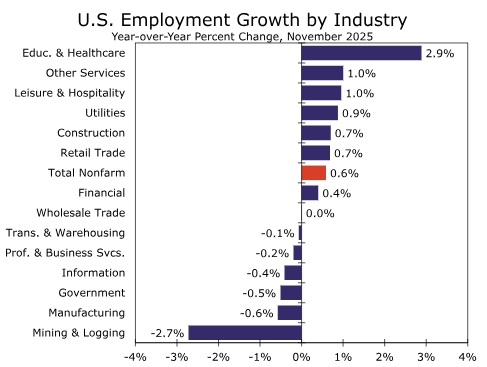

However, even excluding the special factor of October, the weak employment growth trend persists, with non-farm payrolls increasing by only 0.6% compared to November last year.

(Trend chart of US non-farm payroll data)

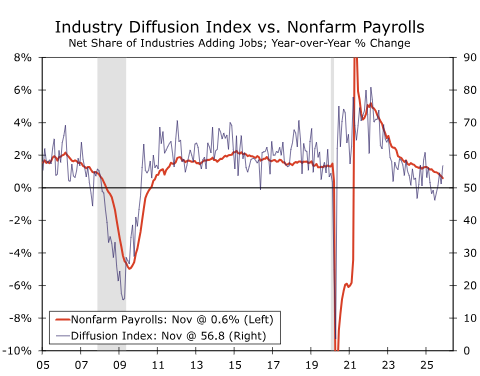

In recent months, the scope of hiring has expanded slightly, but job growth is still mainly driven by the healthcare and social assistance sector, which added an average of 64,000 jobs in October and November. Meanwhile, the sector diffusion index has continued to decline from its post-pandemic high of 75, indicating that the overall sector expansion is rapidly contracting.

(Overlay chart of non-farm payroll data and industry diffusion index)

Industries with stronger cyclicality continued to be under pressure, with employment declining in November in the manufacturing, transportation, information, finance, and leisure and hospitality sectors.

(Chart showing changes in the number of employees in different industries)

Rising Unemployment and Wage Pressure: A Deviation from Policy Mission

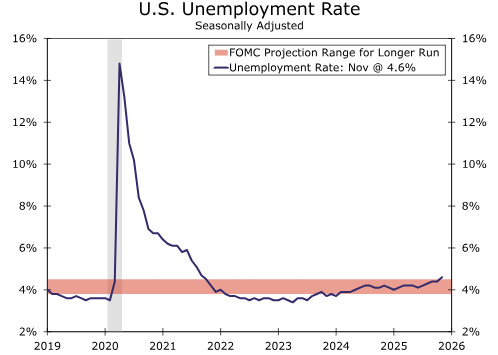

The weakening labor market is increasingly reflected in the unemployment rate, which rose to 4.6% in November from 4.44% in September (4.56% without rounding).

The reason for this upward trend is that, compared to September, the number of unemployed people increased by 228,000 in November, which exceeded the increase in the number of employed people as recorded by the household survey (+96,000).

Due to the government shutdown, the U.S. Bureau of Labor Statistics (BLS) was unable to collect data from the October household survey, and therefore noted that the standard error of the November unemployment rate was larger.

Therefore, Wells Fargo will be cautious about overemphasizing the November data, but this upward trend is consistent with other data, such as continuing jobless claims, the Conference Board's Labour Market Difference Index, and turnover rate, all of which indicate a continued weakening of the job market.

The current unemployment rate of 4.6% has exceeded the highest estimate of the long-term unemployment rate by FOMC members, indicating that the FOMC is no longer meeting the requirement of "full employment" in its dual mandate.

(US Unemployment Rate Trend Chart)

The widening range of labor market slack dampened wage growth, with hourly wages rising by an average of 0.3% after smoothing data from October and November. While the monthly growth rate remained consistent with the trend over the past year or so, the year-on-year growth rate fell to a cyclical low of 3.5% in November.

(Chart showing the trend of average hourly wages in the United States)

Data tracking and verification become a key focus

Due to the government shutdown, the November household survey may be subject to additional volatility. Therefore, Wells Fargo will be watching the December employment report, to be released on January 9, 2026, to confirm or refute the recent upward trend in the unemployment rate.

Nevertheless, there is substantial evidence beyond the jobs report that the labor market has been softening in recent months.

Wells Fargo believes that today's data is insufficient to prompt the Federal Open Market Committee (FOMC) to set a baseline expectation of another 25 basis point rate cut for its January meeting.

That said, if the November/December Consumer Price Index (CPI) data and the December employment report fall short of expectations, the current weakness in the data has already opened the door to further interest rate cuts.

Wells Fargo's baseline forecast remains a 25 basis point rate cut at the FOMC meetings in March and June of next year, with a greater likelihood of rate cuts in 2026 than fewer.

Federal Reserve Policy Outlook: The Door to Rate Cuts Remains Open

For the FOMC, today’s data may have made most committee members feel relieved about last week’s decision to cut interest rates, as they seem to have hit the nail on the head regarding the employment recession, with the three-month moving average of job growth at a meager 22,000.

Part of the reason stems from the special circumstances of employment in the federal government, but even excluding that factor, the record high unemployment rate and record low hourly wage growth provide further evidence of a continued weakening labor market.

Wells Fargo believes that today's data is insufficient to push the FOMC to include a further 25 basis point rate cut as the baseline expectation for its January meeting.

That said, if the November/December CPI data and the December employment report fall short of expectations, the current weakness in the data has already opened the door to an interest rate cut.

Wells Fargo's baseline forecast remains a 25 basis point rate cut at the FOMC meetings in March and June of next year, with the risk of further rate cuts in 2026 leaning towards more rather than fewer.

For asset prices, if the November/December CPI data and the December non-farm payroll report fall short of expectations, market bets on further interest rate cuts by the Federal Reserve will continue to weaken the dollar index and support gold. At the same time, the liquidity released by the interest rate cuts will also benefit risk assets such as equity markets.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.