Is silver's new high just the beginning of its upward trend? How can historical changes reshape the demand landscape?

2025-12-17 20:34:15

Silver has recently broken through its historical high, becoming the focus of the global commodity market. Silver's unexpected surge, which is usually seen as a catch-up to gold's rise, requires us to seriously re-examine its underlying logic.

The core trading logic behind silver leading the rise in gold.

The reason why silver has stood out in this round of market activity is that it possesses the dual attributes of both a precious metal and an industrial metal.

V.K. Vijaykumar, chief investment strategist at Geojit Investments, pointed out that while gold and silver are both safe-haven assets, silver has recorded a return of over 100% this year, with its key advantage being its wide range of industrial applications.

Silver is deeply tied to high-growth sectors such as electric vehicles, solar panels, electronics, and electrical products. The global clean energy transition and the expansion of the technology industry have boosted the demand for silver, but the supply of this scarce metal has not kept pace. This supply-demand mismatch has become the core driver of soaring prices.

ChoiceBroking commodities and foreign exchange analyst Amir Makda emphasized that silver's breakthrough of the $65 mark signifies a new phase in the market – its price has surpassed that of crude oil for the first time in 40 years, sending a market signal that "tangible, critical, and scarce assets will become core assets in the future."

This rare price inversion essentially reflects the strategic importance of industrial metals shifting towards that of energy commodities, and also provides structural logical support for silver trading.

Long-term support for industrial demand and the supply-demand gap

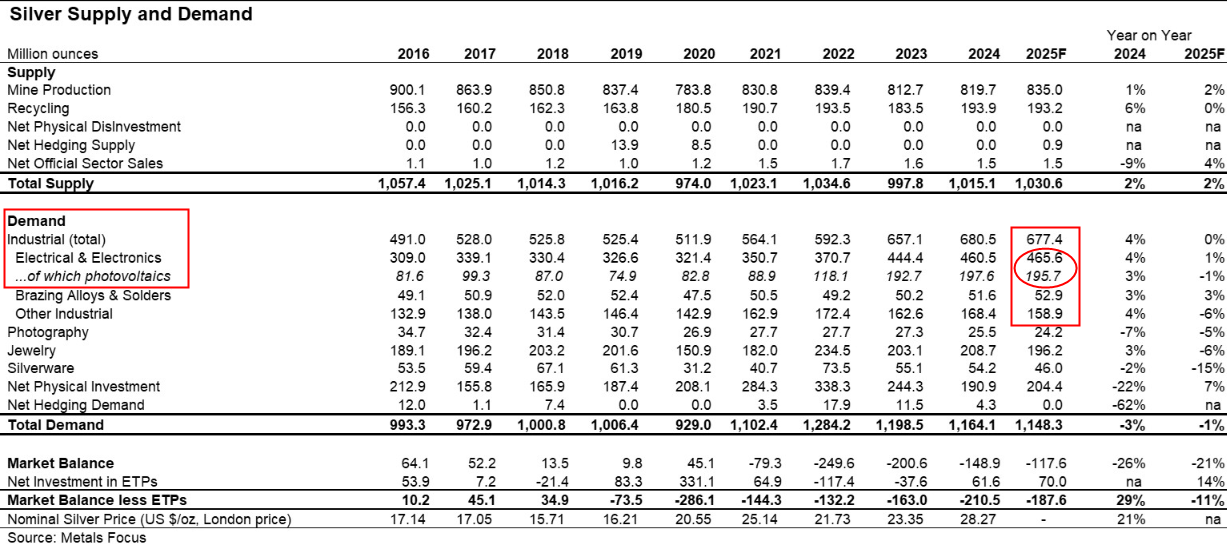

Industrial demand accounts for 70% of global silver consumption, including the continued growth in electrical solar power installations and the global promotion of clean technologies, which bring stable long-term demand growth for silver.

Electronics and electrical equipment account for 68% of industrial silver consumption, while photovoltaics account for 29%. Note that this is based on 2024 statistics. In 2025, with the large-scale electricity consumption of AI, the expansion of equipment in fields such as electrical transmission and energy storage will further increase the demand for silver, a scenario unprecedented in human history.

(Silver Supply and Demand Table)

Power shortages and new photovoltaic initiatives are expected to drive a surge in demand for silver.

According to Goldman Sachs' forecast, with the development of AI, the power demand of US data centers will climb to 77 gigawatts (GW) in 2028. Compared with the supply of 67 gigawatts, the power gap will reach 10 gigawatts, which is equivalent to the annual electricity consumption of about 7.5 million households.

From limited land and grid capacity to persistent chip shortages, supply chain pressures remain a major obstacle to data center construction.

Meanwhile, in Musk's latest space AI vision, he plans to deploy 100GW of solar-powered AI satellites annually, a scale comparable to a quarter of the total electricity consumption in the United States. Currently, academic research has developed solar cells with a photoelectric conversion rate of 27%.

Whether it's power transmission and transformation or photovoltaic equipment, both require a large amount of silver consumption, which will cause the silver consumption in the electrical and photovoltaic sectors to exceed 68% and 29% of the total industrial silver consumption, respectively. At the same time, it will also cause the industrial silver consumption to exceed 70% of the total silver demand.

Silver has been in a supply shortage for the fifth consecutive year. The contradiction between the growth in demand and the limited supply has formed a solid foundation for price increases. In addition, the fact that silver is priced in US dollars has amplified the price increase, pushing silver to a new high.

Silver supply growth remains weak.

In recent years, the annual growth rate of both mined silver and recycled silver has been at an extremely low level, with mining output having grown at almost zero over the past decade.

The core reason for this phenomenon is that silver rarely exists in its elemental form in nature; it mostly occurs as sulfides, associated with or in symbiosis with minerals such as lead, zinc, and copper.

Specifically, about 70% of the world's silver mines are associated mines, which makes the silver supply side significantly less sensitive to price fluctuations—rising silver prices are unlikely to effectively drive up mining activity, thus further exacerbating the tight supply situation in the market.

Meanwhile, the ore grade of major silver mines worldwide is declining at a rate of 5%-7% per year . Previously, mining one ton of rock could yield 300 grams of silver, but now it may only yield 150 grams. Subsequently, capital expenditures for silver mines are severely insufficient. In the past few years, mining giants have been busy with ESG practices and have no money to explore new mines. Coupled with strikes and policy risks in major silver-producing countries such as Mexico and Peru, increasing supply is extremely difficult.

Short-term catalysts for macroeconomic policies and market sentiment

The U.S. unemployment rate rose to 4.6% in November, reinforcing market expectations for further interest rate cuts by the Federal Reserve in 2026.

A weak job market, coupled with the dovish signals from the Federal Reserve's previous 25-basis-point rate cut, has significantly increased the attractiveness of non-interest-bearing assets like silver.

Meanwhile, the dollar index fell to a two-month low, providing passive support for dollar-denominated silver. Hedge funds and institutions increased their silver holdings to hedge against inflation and currency devaluation, and speculative buying further amplified the rally.

Furthermore, the combination of declining US Treasury yields and a weakening dollar has made precious metals a preferred asset allocation for global investors, with silver leading the sector due to its greater resilience.

Expert Opinions

Rajkumar Subramanian, head of PLWealth, pointed out that silver's dual nature makes it highly sensitive to interest rates, monetary strength, and manufacturing trends, and the long-term logic of structurally increasing silver demand remains unchanged.

The commodity market is currently undergoing significant structural adjustments, with the accelerated energy transition (especially in BRICS countries and developed markets) continuing to suppress structural demand for crude oil.

Expert consensus indicates that the long-term outlook for silver remains positive, with the core logic of industrial demand and limited supply remaining unchanged. Especially against the backdrop of the global economic transformation towards clean energy and technology-driven growth, its diversified allocation value is prominent.

However, one should be wary of profit-taking pressure after a sharp short-term rise, as blindly chasing high prices carries significant risk.

For traders, a precise positioning strategy is recommended: those holding positions at low levels can partially take profits and retain core holdings; new entrants should wait for a pullback window and build positions in batches based on key support levels.

At the same time, it is necessary to closely monitor the Fed's policy direction, the dollar's trend, and marginal changes in industrial demand data, and dynamically adjust positions to balance returns and risks.

Summary and Technical Analysis:

The fact that silver has repeatedly hit new historical highs means we cannot judge it solely based on past experience. Although silver has risen by more than 100% this year, given the macroeconomic backdrop of the AI revolution and surging electricity demand, silver is definitely an excellent trading instrument that can be repeatedly speculated on.

Spot silver has broken through resistance levels recently, and such rapid price increases usually present good profit-taking opportunities. However, when silver prices return to key support levels such as the 5-day moving average, it presents a more favorable entry point for bulls.

The next key level for silver prices is 70. The starting point of this wave was 30, the breakout point was 50, and the target price is 70. Although silver prices are strong, the area around 70 is still a worthwhile profit-taking point.

(Spot silver daily chart, source: EasyForex)

At 20:32 Beijing time, spot silver was trading at $65.95 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.