Bank of England Decision Preview: Sharp Drop in Inflation and Economic Contraction Provide Strong Justification for Interest Rate Cut!

2025-12-18 10:29:08

Traders and economists expect the Bank of England to cut its benchmark interest rate by 25 basis points to 3.75%, a near three-year low.

The Monetary Policy Committee is expected to ease policy for the first time since August, after holding rates steady in September and November. Bank of England Governor Andrew Bailey was originally expected to cast the decisive vote again, but Wednesday's sharp drop in inflation has increased the likelihood that one of the committee's four hawkish members may change their stance.

With evidence suggesting that inflationary pressures in the UK are easing, and last month's budget aimed at curbing inflation in the short term, the path to interest rate cuts has been paved. However, the Bank of England is gradually approaching the end of its current rate-cutting cycle, and if the central bank cuts rates as expected on Thursday, the market has only fully priced in one more rate cut.

Voting polarization

In November, Bailey reached an agreement with the hawkish camp on the Monetary Policy Committee, which includes Vice President Claire Lombardy and Chief Economist Hugh Peele. Bailey stated that with the government budget looming, he needed to see more evidence of slowing inflation before supporting further policy easing.

Since that meeting, the data has painted a more moderate picture. Inflation has fallen to its lowest level in eight months, with private sector wage growth slowing and the economy contracting for several consecutive months, as November's price decline exceeded expectations. These signs are expected to be enough to persuade Bailey to turn in favor of the four dovish members within the Bank of England.

This decision will still reflect the long-standing divisions within the Monetary Policy Committee, with surveys showing economists expecting another 5-4 split at this meeting. It's worth noting, however, that the survey was conducted ahead of Wednesday's unexpectedly weak inflation data. The Bank of England is likely to provide more details on its initial assessment, including those concerning the Chancellor of the Exchequer.

In either case, the market expects a greater than 90% probability of an interest rate cut and predicts another rate cut before the end of April next year.

Monetary policy guidance

The Bank of England's Monetary Policy Committee has previously taken a cautious approach to future interest rate cuts, and its policy guidance is not expected to change significantly. The market is closely watching for any signals the bank will release regarding the magnitude of subsequent rate cuts.

In November, the committee maintained its forecast of “gradual” rate cuts, provided that progress was made in curbing inflation. However, the statement also emphasized that policy constraints were diminishing as the benchmark interest rate gradually approached the neutral level—a range of interest rates that neither stimulates nor inhibits inflation.

Economists will look for clues about the ultimate direction of interest rates in the individual outlooks of these nine members—this is only the second time in the history of this series of forecasts that they have been made public.

Budget impact

The Bank of England may release details of its preliminary assessment of the impact of Chancellor Rachel Reeves' second budget on the economic outlook.

Lombardy has revealed that the Bank of England expects these plans—including freezing rail fares, cutting household energy bills, and reducing fuel taxes for drivers—to lower inflation by up to 0.5 percentage points next spring. She stated that the budget will provide a modest 0.2% boost to GDP in 2027.

The Bank of England's policymakers may signal their intention to ignore this short-term price-rising disturbance—unless it helps to lower persistently high inflation expectations. Most of the delayed tax increases and spending restrictions in the Chancellor's fiscal plan have impacts beyond the Bank of England's three-year forecast period.

Economic growth and inflation

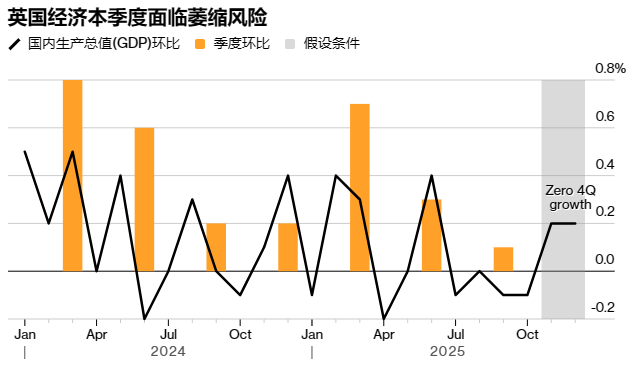

Given a series of weak economic signals following the last monetary policy meeting, the Bank of England may lower its growth forecast for the last quarter of 2025.

Although the bank had predicted in November that GDP growth for the last three months of the year would be 0.3%, official data released last week showed that UK output contracted for the second consecutive month in October, and multiple surveys indicated that the economy remained weak ahead of the November budget announcement. This prompted forecasting agencies to warn that the UK economy may face its first quarterly contraction in two years.

This could also highlight that inflation is lower than expected. The November CPI (Consumer Price Index) fell to 3.2%, compared with the Bank of England's forecast of 3.4% last month.

Tonight's volatility in the pound will most likely be determined not primarily by "whether to cut interest rates," but by "how to cut rates" and "what the future holds." Traders will analyze every wording change in the Bank of England's statement, every decimal point in economic forecasts, and every split vote, much like they analyze the Federal Reserve. The biggest risk lies in the details of the disagreements within the Monetary Policy Committee and any clear hints from Governor Bailey regarding the future path.

At 10:28 Beijing time, the British pound was trading at 1.3368/69 against the US dollar.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.