The first black swan event of 2026? The shooting in Venezuela: how to shatter market illusions of interest rate cuts?

2026-01-05 15:31:23

Trump’s influence, namely his ability to deter the Federal Reserve, has become a key variable. However, Trump’s influence has recently run into some problems. On the one hand, the US military arrested Venezuelan President Maduro, and on the other hand, the high inflation in the United States is constantly weakening his political influence over the Federal Reserve.

The upcoming inflation and employment data, along with the events in the US and Venezuela, will determine the Federal Reserve's policy direction and Trump's prospects in the midterm elections.

The US-Venezuela incident weakens Trump's political influence

The U.S. military's raid on Venezuela, codenamed "Absolute Resolve," and the subsequent arrest of President Maduro, is becoming a "reactionary engine" weakening Trump's political influence—the anger of the Democratic camp and the wave of public protests have created a double whammy.

Democratic lawmakers have accused the Trump administration of "blatantly lying" in previous classified congressional briefings. Secretary of State Rubio and Defense Secretary Hergsays had vehemently denied any intention to change the regime, yet they turned around and used military action to arrest foreign heads of state. House Armed Services Committee member Jason Crowe denounced this deception as "causing incalculable damage to America's reputation." Illinois Representative Delia Ramirez went even further, calling for Trump's impeachment. Discussions within the party regarding initiating impeachment proceedings or invoking the 25th Amendment continue to intensify.

Meanwhile, protests erupted in more than 100 cities across the United States. In Washington, people gathered outside the White House holding signs that read "No war on Venezuela," protesters in New York surrounded an Army recruiting office, and chants of "Stop interfering in Latin America" echoed through the streets of Boston. The public clearly opposed Trump's risky actions of dragging the United States into a new conflict.

This situation, characterized by "rising calls for impeachment within the party and widespread public protests," not only rendered Trump's tough stance on foreign policy completely ineffective but also severely damaged his already fragile political foundation before the midterm elections. Even some Republican lawmakers questioned this "chaotic and potentially illegal" action, further undermining his popular support and party backing.

Markets are betting on an interest rate cut before mid-year.

According to data from the prediction market platform Polymarket, the probability of a rate cut at the Federal Open Market Committee (FOMC) meeting in January is only 12%, with most market participants expecting rates to remain unchanged this month. However, looking at a longer timeframe, the situation will change dramatically. The probability of a rate cut climbs to 81% before April, and by June, this probability has soared to 94%.

Looking at the whole year, the scenario of two rate cuts has the highest probability at 24%, followed by three rate cuts (20%) and four rate cuts (17%). Therefore, the overall probability of two or more rate cuts exceeds 87%.

The interest rate futures market expectations reflected by the CME FedWatch Tool are similar.

The tool shows that the probability of interest rates remaining unchanged in January is 82.8%, which is basically consistent with Polymarket's data; the probability of at least one rate cut before June is 82.8%, and the probability of two to three rate cuts before the end of the year is as high as 94.8%.

The market consensus is very clear: keep rates unchanged in January, start a rate-cutting cycle in the first half of the year, and complete two to three rate cuts by December.

The Fed's hawkish stance signals no rush to cut interest rates.

However, a different narrative is emerging within the Federal Reserve. On January 4, Philadelphia Federal Reserve Bank President Anna Paulson made it clear that further interest rate cuts might not be justified until "later this year."

As a voting member of the Federal Open Market Committee in 2026, Paulson pointed out that only if inflation falls, the labor market stabilizes, and economic growth remains stable at around 2%, "it would be appropriate to make a small further adjustment to the federal funds rate."

She stated that the current policy stance "remains slightly tight," implying that the policy is continuing to play a role in curbing inflation.

This statement stands in stark contrast to market expectations for an interest rate cut in the first half of the year, and the signal from the Fed's hawkish camp is very clear: don't expect an interest rate cut in the short term.

December FOMC Meeting: Internal Divisions Within the Committee Intensify

The Federal Open Market Committee meeting in December laid bare the divisions within the Federal Reserve.

At this meeting, the committee decided to cut interest rates by 25 basis points, lowering the target range for the federal funds rate to 3.5%-3.75%.

However, the voting results showed a significant 9:3 split, further widening the gap compared to the previous 10:2 vote.

Among them, Schmid and Goultzby advocated keeping the interest rate unchanged; while Milan, who is widely regarded as being in line with the Trump administration's position, called for a one-time interest rate cut of 50 basis points.

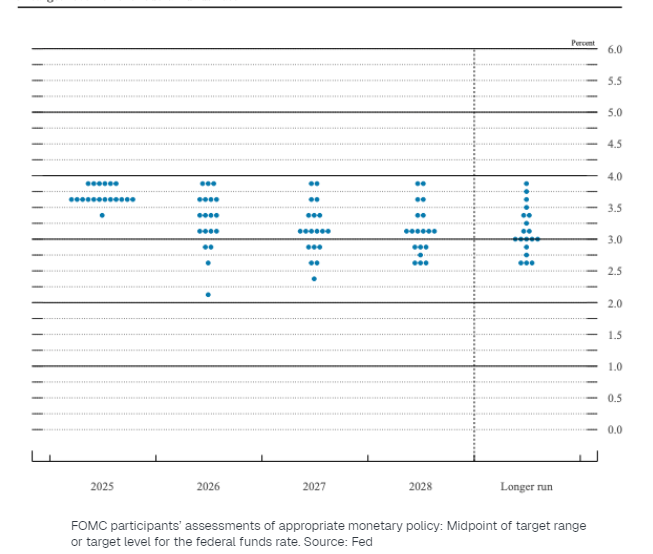

The dot plot reveals even more information. Although the median expectation among committee members for the number of rate cuts in 2026 is only one, the range of expectations is extremely wide.

Seven officials expect no interest rate cuts throughout the year, while eight others believe there will be two or more rate cuts. The most dovish forecast even suggests that interest rates could fall to a low of 2.125%.

The Federal Reserve's official guidance is for one rate cut, but the market is pricing in two. Why is this gap so difficult to bridge?

(December FOMC dot plot)

The underlying logic of market betting on a dovish stance: the Trump factor.

The core reason why the market refuses to accept the Fed's hawkish guidance is President Trump.

Since returning to the White House, Trump has been pressuring the Federal Reserve to lower interest rates. The December Federal Open Market Committee meeting, where a member aligned with Trump advocated for aggressive easing, was a microcosm of this pressure.

More importantly, Federal Reserve Chairman Jerome Powell's term will expire in 2026, and the power to nominate his successor rests with the president. Market participants generally expect Trump to appoint someone who is more aligned with his loose monetary policy stance.

Multiple structural factors are also reinforcing this expectation: historically, whenever the labor market weakens, the Federal Reserve turns to cutting interest rates; the divisions within the Federal Open Market Committee are deepening; and there are concerns that tariff policies may drag down economic growth, thereby increasing pressure on the Federal Reserve to ease monetary policy.

The market's betting logic is straightforward and simple: Trump's pressure, coupled with the potential risk of an economic slowdown, will ultimately force the Federal Reserve to give in.

The Midterm Election Paradox: Inflation Becomes Trump's Fatal Weakness

This forms the core contradiction: if Trump wants to effectively pressure the Federal Reserve, he must have enough political capital, but it is precisely inflation and the US-Venezuela issue that are constantly eroding his political capital.

Recent polls show that Trump's approval rating on economic policies has fallen to 36%. In a poll conducted jointly by PBS, NPR, and Marist College, 57% of respondents expressed dissatisfaction with his ability to govern the economy.

A CBS/YouGov poll also found that 50% of Americans believe their finances are deteriorating under Trump’s policies.

The culprit behind all this is primarily the persistently high prices. Data from the U.S. Bureau of Labor Statistics shows that since July 2020, the price of ground beef has surged by 48%; the price of a McDonald's Big Mac meal has also risen from $7.29 in 2019 to over $9.29 in 2024.

Egg prices have fluctuated even more dramatically, with a price increase of approximately 170% between December 2019 and December 2024. "Affordability" has become the most pressing economic issue for Americans. In a poll conducted by NPR/Channel News/Mariister College, 70% of Americans said the cost of living in their area is "unaffordable" for the average family, a significant increase from 45% in June.

Public discontent has begun to manifest in the votes. In the New York City mayoral election last November, Democratic State Representative Zohran Mandani won with a platform focused on improving the city's affordability. In the gubernatorial elections in Virginia and New Jersey, Democratic candidates also won governorships by emphasizing cost-saving measures for residents.

With the November midterm elections approaching, more than 30 Republican members of the House of Representatives have announced they will not seek re-election. Political analysts are increasingly inclined to believe that the Republican Party may lose the election, and Trump may face a "lame duck" ruling predicament.

The key to victory: upcoming core economic data and subsequent developments in the US-Venezuela situation.

The upcoming economic data will be a decisive variable influencing the direction of the Federal Reserve's policy and Trump's political fate.

Consumer Price Index (CPI): If the data declines, it will not only enhance the rationale for interest rate cuts but also alleviate political pressure on Trump; if the data continues to rise, the Federal Reserve's room for interest rate cuts will be compressed, and voters' dissatisfaction with the Trump administration will be further intensified.

Producer Price Index (PPI): As a leading indicator of consumer prices, a decline in PPI suggests that CPI is likely to slow down in the future; while a rise in PPI may mean that price pressures caused by tariff policies are gradually emerging.

Employment data (non-farm payrolls, unemployment rate): A weakening labor market will increase pressure on the Federal Reserve to cut interest rates, but it will also drag down Trump's economic performance; if the job market remains stable, the Federal Reserve has ample reason to maintain its current cautious stance.

At the same time, it is necessary to closely monitor the development and escalation of the US-Venezuela incident.

Conclusions and Technical Analysis:

The US-Venezuela incident has weakened Trump's political influence and may reduce his intervention in the Federal Reserve, while the US dollar has also begun to rebound ahead of schedule.

The Federal Reserve has signaled that it will cut interest rates once in 2026, and hawkish officials, represented by Paulson, have even suggested that the rate cut may not happen until the second half of the year.

However, the market continues to price in two to three rate cuts, betting that Trump's continued pressure and the change in Powell's successor will eventually force the Federal Reserve to shift to easing.

But the core paradox lies here: persistently high inflation and the Venezuelan crisis are eroding Trump’s political base, thereby weakening his influence over the Federal Reserve.

The very economic conditions that make interest rate cuts politically attractive to Trump would actually render them economically unjustifiable—or directly strip him of the political capital to demand them.

Trump may want to preserve his political career while also pushing for interest rate cuts, but economic laws are unlikely to give him the opportunity to have both.

From a technical perspective, as mentioned in previous articles, the US dollar index may rebound around a double bottom. Currently, it has rebounded to a key resistance level, with 98.65 as the resistance level, followed by around 98.90, and support around 98.10.

(US Dollar Index Daily Chart, Source: FX678)

At 15:24 Beijing time, the US dollar index is currently at 98.65.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.