A chart shows that the Baltic Dry Index fell for the fourth consecutive day, with Capesize and Supramax freight rates declining.

2026-01-08 23:17:02

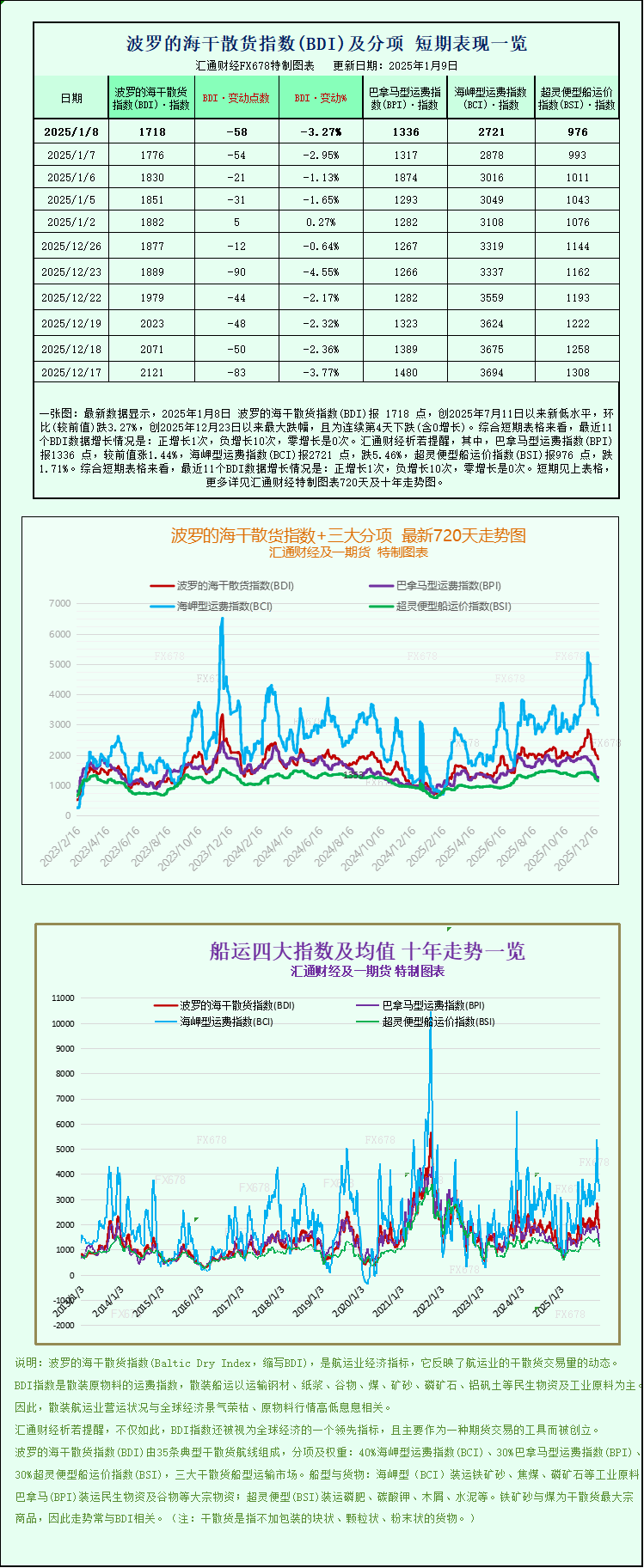

The Baltic Dry Index (BDI) fell for the fourth consecutive trading day on Thursday, mainly dragged down by weaker rates for Capesize and Supramax vessels. The index reflects global charter rates for vessels transporting dry bulk commodities such as iron ore, coal, and grain, and its trend is often seen as an important indicator of global commodity demand and the health of the shipping market.

The main index fell 58 points to 1,718. The index is projected to rise approximately 88% for the year 2025, reflecting a strong recovery in the dry bulk market over the past year, but the recent pullback suggests that market sentiment is becoming more cautious.

The Capesize index fell 157 points, or 5.5%, to 2,721. Capesize vessels primarily transport bulk commodities such as iron ore and coal, and their freight rate fluctuations are often closely related to changes in demand from major consuming countries such as China.

The average daily charter rate for Capesize vessels fell by $1,416 to $21,179. This vessel type typically has a deadweight tonnage of around 150,000 tons and is one of the mainstays of the dry bulk shipping market; changes in its charter rates have a significant impact on shipping company profitability.

Iron ore futures prices retreated as investors took profits near the key psychological level of $110 per tonne, while also worrying about potential regulatory measures from China, the world's largest consumer. As a major driver of global iron ore demand, China's policy moves often have a significant impact on market sentiment.

Among smaller vessels, the Supramax index fell 17 points to 976. Supramax vessels primarily transport small bulk cargoes, and their market performance is typically more influenced by regional demand and port congestion.

Meanwhile, the Panamax index rose 19 points, or 1.4%, to 1,336, becoming one of the few sectors to rise that day.

Average daily charter rates for Panamax vessels rose by $177 to $12,028. These vessels typically have a deadweight to 60,000-70,000 tons and primarily transport coal and grain; the rate increase likely reflects improved demand on some regional routes.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.