2026 Silver Outlook: Supply-Demand Gap, Technological Upswing, and Policy Variables

2026-01-07 21:54:53

Many investors still cling to preconceived notions and ignore silver until silver prices climb to a level that even seasoned commodity investors pause in, at which point a familiar question resurfaces: Why is silver rising, and can it continue to rise?

Silver typically exhibits a fluctuating behavior among investment products. During periods of uncertainty, it behaves like a precious metal; while during periods of economic expansion, it displays the characteristics of an industrial commodity, especially with the emergence of artificial intelligence, represented by OpenAI DeepSeek, in 2025 amplifying silver's industrial attributes.

This dual nature gives it unique market depth, but also makes its prices extremely sensitive to changes in market sentiment, policy shifts, and trading dynamics.

This article will dissect the core factors currently driving silver prices, clarify the boundaries of long-term rational logic and the starting point of short-term excessive volatility, and explain why recent actions by exchanges or governments are more important than many people realize.

Institutions are warning of a bubble, but this cannot obscure silver's excellent trading properties.

On December 29, 2025, the CME Group raised the initial and maintenance margin requirements for silver futures on the COMEX exchange twice in one week, following an earlier increase earlier that month.

According to a notice issued by CME and an announcement from the exchange, the margin requirements for silver futures have been increased by more than 20% in less than three weeks.

This indicates that, from an official perspective, there is a risk of speculation in silver trading. The tool originally intended to hedge the term structure of silver has been used for excessive one-sided speculation, raising official concerns.

This is also the reason why spot silver led the market to plummet on December 29, but silver soon hit a new high. It should be noted that as a futures commodity, the daily fluctuation exceeded 15%.

Official data and market feedback mutually confirm the industrial demand for silver.

Every year, the Bureau of Commerce publishes a list of qualified silver export companies, along with information on the applicant companies and the application rules. On the surface, it is just a routine matter at the end of the year.

In 2025, China approved 44 companies to have silver export qualifications, two more than the previous year, but this approval concealed some important information.

The key information is the change in the review of export company qualifications. Xia Yingying, an analyst at Nanhua Futures, said that the management of company qualifications is more stringent than in 2025.

The export licensing system clearly defines the hard threshold requirements for enterprises' output, export performance, certification, etc. The 2026 policy document positions silver as a "rare metal", highlighting its strategic intent.

Data from 2025 shows that my country's silver exports will account for 23.4% of global trade, amounting to approximately 9,126 tons, while domestic inventories will decrease significantly.

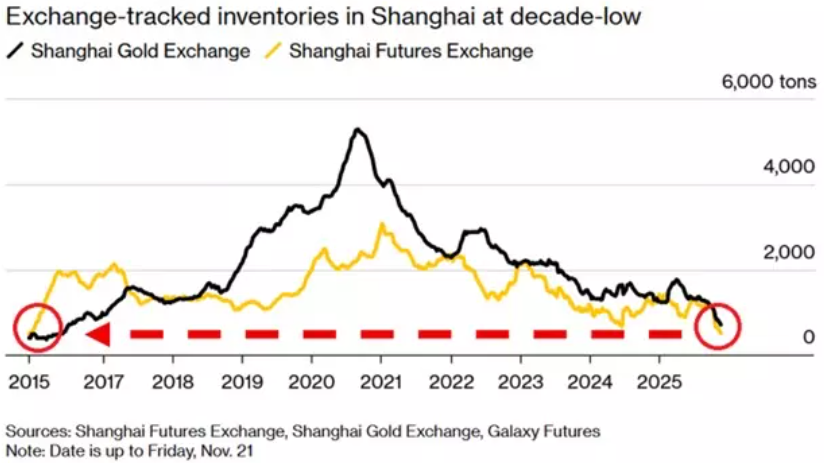

(Shanghai Futures Exchange silver inventory trend chart)

After the new policy is implemented, the market expects exports to decrease significantly, equivalent to a reduction of 4,500 to 5,000 tons in global annual supply. More importantly, the global silver supply-demand gap reached 3,660 tons in 2025, marking the fifth consecutive year of shortage, and the gap may further widen to 7,000 to 8,000 tons in 2026.

Elon Musk, the world's richest man, posted on social media platform X: "This is not a wise move. Silver is an irreplaceable core raw material in many industrial manufacturing processes." It's worth noting that silver is a necessity in the technology sector, widely used in electric vehicles, artificial intelligence data centers, and other fields.

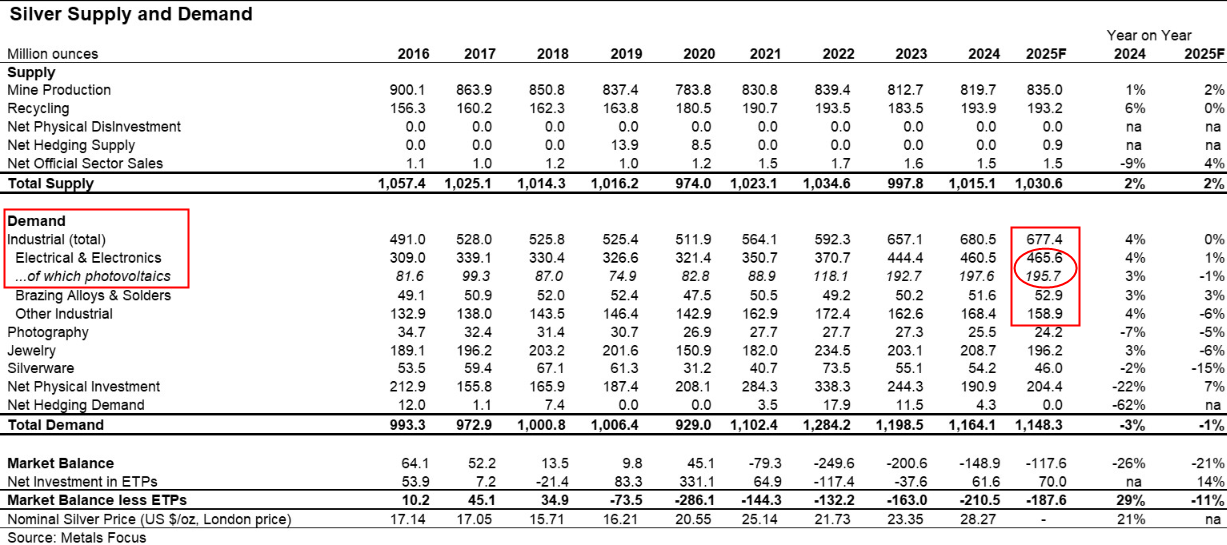

(Industrial demand for silver)

Some analysts believe that the recent silver export restrictions confirm the growing industrial demand for silver in the context of AI narratives.

Silver experienced an epic surge in 2025. As the price climbed to its midpoint, the market began to realize that the explosive demand from the technology sector was one of the core driving forces. I was also fortunate enough to publish an article on December 17th that directly pointed out the industrial demand under the AI narrative of silver, and stated that the rise in silver was just the beginning.

Silver is a key raw material for artificial intelligence data centers and the electric vehicle industry chain. It is widely used in the production of core components such as batteries, circuit boards, and switches, which directly spurs strong demand in the two major markets of China and India.

Geopolitical risks strengthen the basic security margin of silver

Some market analysts also attributed this week's simultaneous rise in gold and silver prices to the black swan event of the US arrest of Maduro.

Maduro has been sued in New York, and US President Donald Trump has made a strong statement, declaring that the United States will have "full control" over Venezuela.

Tim Water, chief market analyst at KHS, said: "The sudden change in the situation in Venezuela has reignited the market's demand for safe-haven assets, with gold and silver becoming the preferred safe havens for funds, as investors rush in to hedge against geopolitical risks."

Uncertainties in other parts of the world, particularly the diplomatic friction between the United States and European countries over Trump's ambitions for Greenland, have also been a significant factor contributing to the surge in precious metal prices.

European leaders have spoken out intensively this week, vowing to defend Greenland's sovereignty with all their might. Danish Prime Minister Mette Frederiksen went so far as to say that if Trump insists on annexing Greenland, the NATO alliance will come to an end.

Summary and Technical Analysis:

Cross-verification by CME, Chinese government officials, and industry capital representatives such as Elon Musk reveals a profile of silver: it possesses excellent trading attributes, abundant industrial applications on the demand side, and demand-driven price increases are typically very sustained. On the supply side, declining precious metal ore grades, rigid production, and subtle government intervention all contribute to silver continuing to be in a state of strong demand, limited supply, and active trading.

Silver remains a highly attractive investment and a top performer in 2026.

The monthly chart for silver shows that after breaking through 30 yuan, silver headed straight for 60 yuan, with the current target price at 90 yuan. 60 yuan is a very solid bottom area as the 5-day moving average on the monthly chart.

(Spot silver daily chart, source: EasyForex)

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.