Financial markets sound alarm bells: US debt risks and hidden dangers for non-bank institutions

2026-01-13 15:54:54

Worryingly, the two parties in the U.S. political arena have consistently lacked the will to reach a consensus and take action on reversing the trend of the underlying fiscal deficit.

Of course, the dollar's status as the global reserve currency gives the United States the confidence to "live beyond its means"—relying on a global monetary and bond market system centered on itself, the United States has been able to maintain a level of spending far exceeding its own financial resources for a long time.

However, this model is not without its costs. The continued expansion of US debt is profoundly affecting the trend of capital prices in global markets. Its direct consequence is that it pushes up the financing costs for US households and businesses, thereby suppressing economic vitality.

Market alarm bells have sounded: the dual risks of interest rates and non-bank institutions.

While politicians are turning a blind eye to the risks of high debt levels, the financial markets have already sounded the alarm.

The term risk premium of US Treasury bonds continues to rise. Even though the Federal Reserve has started a rate-cutting cycle, long-term interest rates are still rising against the trend. This is a vote of no confidence in the sustainability of US debt.

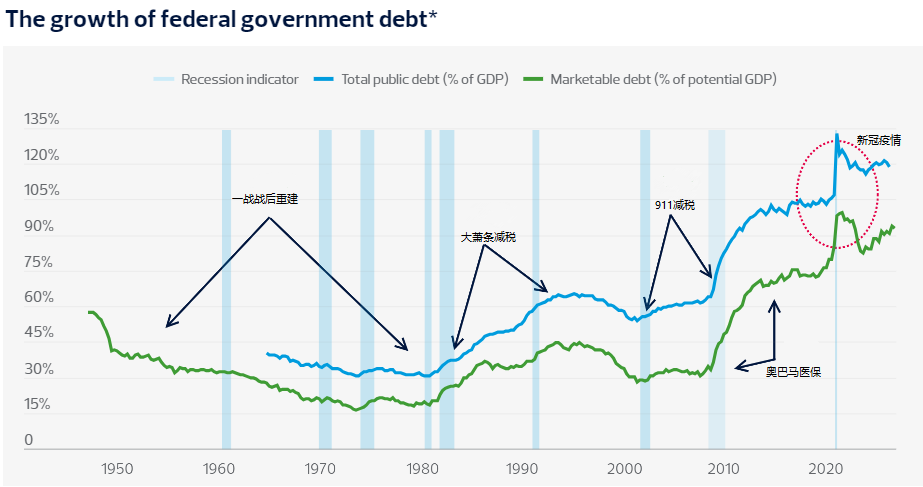

Looking back over the past 15 years, the rate at which the US government debt has expanded has been staggering, and the inaction of both parties on the debt issue has only exacerbated this risk.

Coupled with the structural changes in the global economy in the post-pandemic era, high inflation and high interest rates have gradually become the norm, and the potential destructive power of debt problems has also increased accordingly.

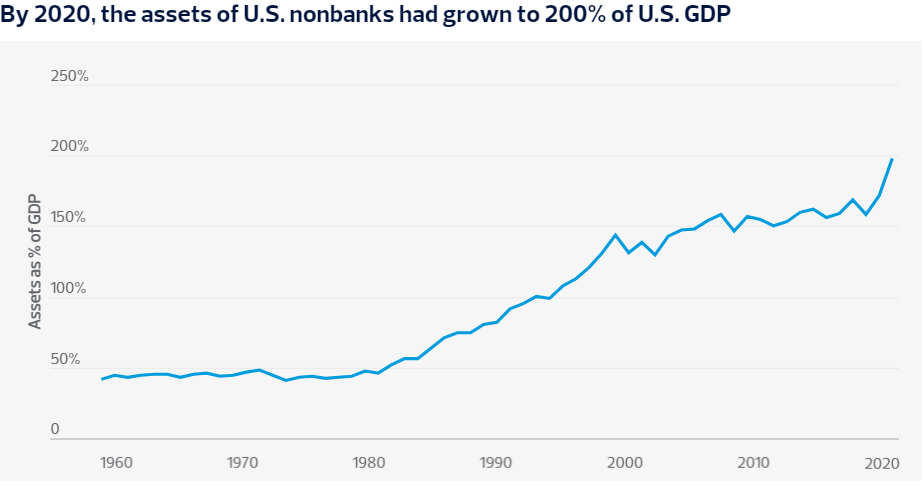

In a recent speech, the General Manager of the Bank for International Settlements emphasized that the expansion of government debt is accompanied by the rapid rise of non-bank financial intermediaries and the proliferation of short-term, highly leveraged trading positions.

These institutions operate outside of a strict regulatory system, and the risks they pose are self-evident.

The financial crisis of 2007-2009 has already demonstrated that the disorderly expansion of non-bank institutions can have a fatal impact on the economy.

The monetary and fiscal stimulus policies introduced by countries after the crisis to save their economies have further distorted market financing mechanisms, exacerbated public debt burdens, and created a vicious cycle that is difficult to break.

In essence, the runaway growth of government debt creates a "crowding-out effect," robbing investment funds that could flow to the private sector and ultimately dragging down the economy's potential growth.

The Roots of the Deficit Pattern: Procyclical Policies and Historical Lessons

In fact, the ratio of US government debt to the size of the economy has been on a continuous upward trend since the 1980s.

So-called fiscal expenditures without funding sources refer to government-committed expenditures that cannot be covered by tax revenue and can only be filled by issuing more government bonds.

Undeniably, such spending can effectively prevent the economy from sliding into a deep recession under sudden shocks like the pandemic. However, during an economic upswing, this pro-cyclical expansionary fiscal policy is tantamount to adding fuel to the fire, not only exacerbating inflationary pressures but also further pushing up interest rates.

Despite the claim that economic growth can automatically resolve deficits, this argument has never been validated in reality since the 1980s.

What all market participants should really think about is how long the US model of living on debt can be sustained.

(Chart showing the historical trend of US debt levels)

The Transformation of the Financial System: A New Landscape of Speculation Dominated by Non-Bank Institutions

Judging from the current market performance, the US bond market seems to remain resilient, with trading partners still willing to pay for US debt in exchange for geopolitical security guarantees and access to the US market.

However, it cannot be ignored that the operating logic of the global financial system has been quietly changed due to the surge in US debt.

Today, non-bank institutions with weak regulation are using U.S. Treasury bonds as a tool for short-term speculation, and the focus of market speculation has shifted from private sector debt to ever-expanding public debt.

According to statistics from the International Monetary Fund, more than half of the world's financial assets are currently held by institutions that are not subject to the banking regulatory system. These non-bank entities, including investment funds, hedge funds, and insurance companies, are profiting in the sovereign bond market by leveraging high leverage strategies.

On the surface, the participation of non-bank institutions has broadened financing channels and provided more funding options for governments, businesses and residents, but hidden risks are lurking beneath the surface.

(Trend chart of asset size of non-bank institutions)

Hidden Risks: Maturity Mismatch and the Hidden Dangers of High Leverage

The International Monetary Fund has explicitly pointed out that the expansion of non-bank institutions has amplified the risk of "bank runs"—some money market funds adopt a "borrowing short and investing long" operating model, but promise investors liquidity that can be redeemed at any time. This maturity mismatch is itself extremely vulnerable.

Once a liquidity crisis erupts in non-bank financial institutions, governments and central banks will have to step in to bail them out, ultimately transferring the risk to the entire financial system.

At the same time, analysis by the Bank for International Settlements also shows that the low-margin, high-leverage model is becoming increasingly prevalent in sovereign bond trading, and large hedge funds are gaining higher leverage due to their stronger market bargaining power, which undoubtedly exacerbates market fragility.

The combination of unregulated non-bank institutions and highly leveraged transactions is becoming a major threat to financial stability, and there is an urgent need for countries to strengthen regulation in a coordinated manner at the domestic and international levels.

Key warnings about the primary deficit: historical peak and future concerns

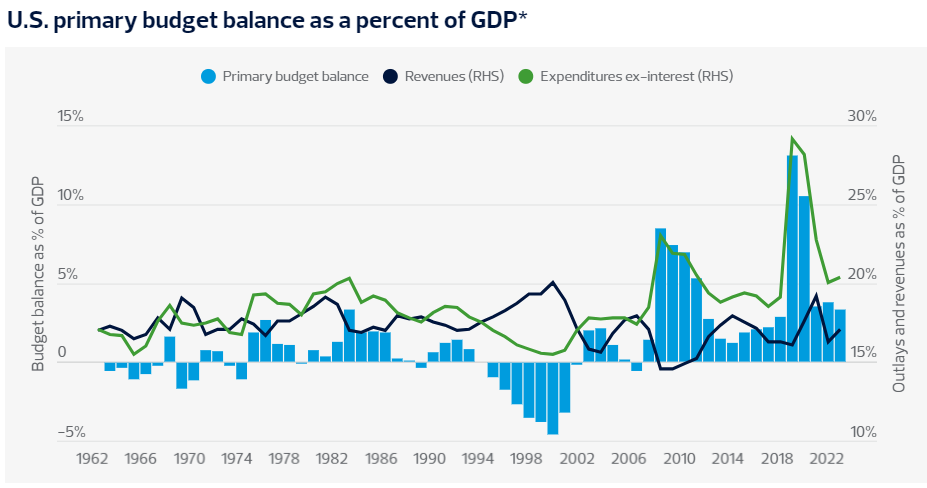

The primary fiscal deficit is a core indicator for measuring whether government spending is excessive. It is calculated by subtracting non-interest-bearing expenditures from fiscal revenue and is usually expressed as a percentage of GDP.

The last time the United States achieved a fiscal surplus was from 1995 to 2001, a surplus that benefited from the productivity dividend during the Clinton administration. However, the subsequent impacts of the financial crisis and the pandemic have led to a sharp increase in the size of the US primary fiscal deficit.

Although the current deficit has fallen from its peak, the level for 2022-2024 is still higher than any single year since 1983—around 1983, when the global economy was mired in a double-dip recession.

If financial markets lose confidence in investing in U.S. sovereign debt, interest rates could jump, and the soaring cost of debt financing would severely dampen investment and economic growth—this is no exaggeration.

(US government deficit situation, the part greater than zero on the Y-axis represents the annual growth of the government deficit)

A global preference for deficit spending: commonalities in the debt structures of the US and Japan

Today, a deficit preference has become a common problem for many countries. Take Japan as an example: its government debt-to-GDP ratio has exceeded 100% for nearly 30 years. Despite prolonged economic stagnation, the yen exchange rate has not been subjected to large-scale speculative shocks due to its key position in US debt financing.

The Bank for International Settlements (BIS) points out that inherent flaws in the political decision-making mechanisms of various countries have led to a persistent deficit preference, especially during economic downturns. Coupled with the pressure on welfare spending brought about by an aging population, the expansion of fiscal deficits has become uncontrollable.

(Trend chart of government debt ratio)

The paradox of interest rates and debt: The heavy burden of interest rates under the illusion of low interest rates

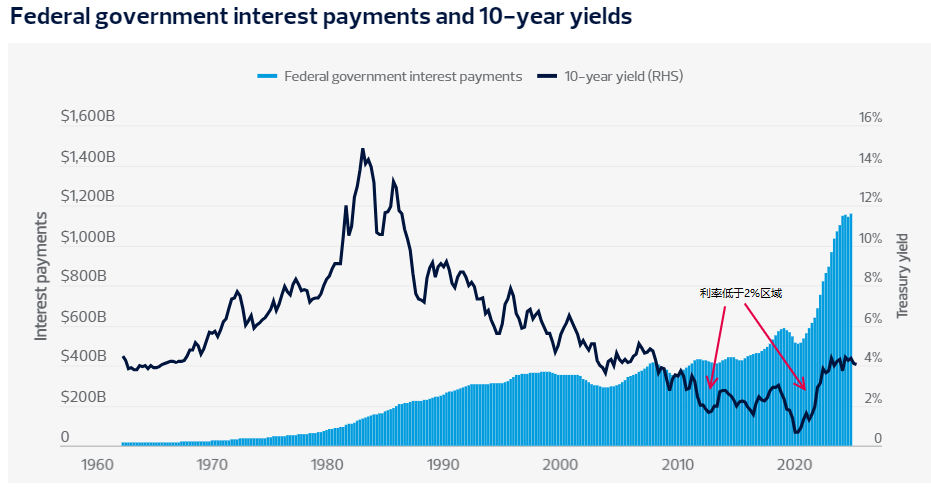

Following the financial crisis, the illusion of "free money" fostered by zero-interest-rate policies provided an excuse for governments around the world to expand fiscal spending.

However, attributing debt sustainability solely to interest rate levels is undoubtedly a one-sided view.

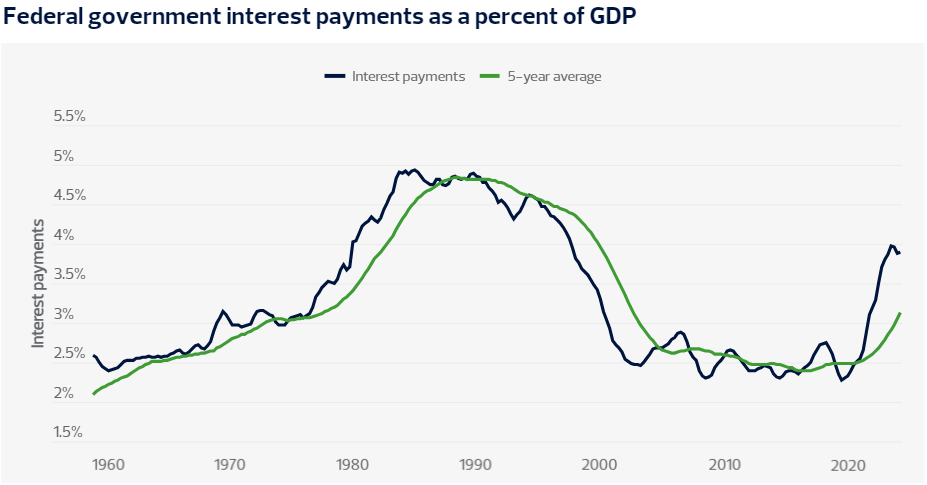

Since the 1980s, long-term interest rates in the United States have generally declined, but deficit spending has become increasingly normalized. Even when interest rates fall below 2%, debt interest payments continue to rise.

Over the past two years, the yield on 10-year US Treasury bonds has remained stable in the 4%-5% range, and the US government’s interest payments have jumped significantly as a result.

All of this serves as a reminder to the market that the US debt problem is not a short-term disturbance, but a Damocles' sword hanging over the global financial market, whose final moment of impact will profoundly reshape the global financial landscape.

(Chart showing the trend of US government interest expenditure)

(Trend chart of US government interest expenditure as a percentage of GDP)

Summarize:

The U.S. government's debt is high and unsustainable, with an average daily borrowing of $7 billion and a deficit of nearly $2 trillion this fiscal year. Bipartisan inaction exacerbates the risks.

While the dollar's status as the reserve currency provides support, debt expansion is driving up financing costs and suppressing the economy, prompting warnings from financial markets.

The high leverage of non-bank financial institutions amplifies financial vulnerabilities, and coupled with the normalization of high inflation and high interest rates, the US debt problem has become a major hidden danger to the global financial market.

Even the world's largest economy eventually faces debt problems.

This also serves as a reminder to traders that, to varying degrees, countries around the world face the risk of worsening government debt. If the global economic recovery is hampered, high levels of government debt could easily lead to a collapse of faith in sovereign debt, resulting in a sharp increase in financing costs and severely suppressing investment and the real economy.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.