Yen trading has returned to a high-market trading strategy, with a clear depreciation trend.

2026-01-13 19:31:02

On January 12 (Japanese market holiday), the exchange rate briefly fell below 159 before quickly rebounding to the 158 range. It is currently only a step away from the psychologically important 160 level that the market is widely watching. Looking at recent trends, since January, USD/JPY has been steadily rising from around 156, showing a clear and strong depreciation trend.

US political turmoil strengthens the safe-haven appeal of the US dollar.

The primary driver of the yen's sharp decline stems from political and policy uncertainty in the United States. The Trump administration's push for a criminal investigation into Federal Reserve Chairman Jerome Powell focuses on the veracity of his congressional testimony regarding the $2.5 billion renovation of the Fed's headquarters.

This event initially sparked market concerns about the Federal Reserve's independence, putting short-term pressure on the dollar. However, key Republican figures quickly criticized the move, and the impact of the controversy subsided rapidly. Instead, the market formed a new expectation: if Powell were to succumb to political pressure and drastically cut interest rates, it could lead to runaway inflation, causing investors to demand higher bond risk premiums, pushing up US Treasury yields, and ultimately benefiting the dollar.

Furthermore, the potential risk of the Supreme Court overturning Trump's tariff policies has been interpreted by the market as a form of implicit fiscal stimulus. These multiple factors combined have strengthened the safe-haven appeal of the US dollar, allowing it to regain its footing and becoming one of the core drivers of the USD/JPY's rise.

Expectations of an early general election in Kaohsiung triggered selling pressure on the yen.

A more crucial driving factor is Japanese Prime Minister Sanae Takaichi's plan for a snap election. News on January 13th indicated that Takaichi had clearly conveyed her intention to senior members of the Liberal Democratic Party (LDP) to dissolve the House of Representatives on January 23rd, the opening day of the Diet, and hold a snap election.

Kaohsiung's cabinet approval rating remains high, with multiple polls showing support ranging from 70% to 78%, and the latest JNN survey reaching 78.1%. Support is particularly strong among younger generations, with nearly 90% of men in their 20s showing approval. Leveraging its high popularity, Kaohsiung plans to use the general election to expand the Liberal Democratic Party's majority in the House of Representatives and overcome the obstacles to bill implementation. Core objectives include pushing for constitutional amendments and large-scale fiscal stimulus.

The general election will most likely adopt one of two schedule options: one is to announce the results on January 27 and hold the vote on February 8; the other is to announce the results on February 3 and hold the vote on February 15.

Market reaction

The election expectations ignited the market's "high-market trading" logic: expansionary fiscal policies were intensified, and low interest rates remained unchanged for a long time, pushing Japanese stocks up while forcing Japanese bond yields to rise, making the yen a target for short selling in the market.

As a result, the Nikkei 225 index broke through 53,000 points during trading on the 13th, reaching a high of 53,814.79, and closed up 3.1% at 53,549.16 points; the yield on 30-year Japanese government bonds surged 12 basis points on Tuesday, with the long-term rate climbing to 2.140% at one point, a new high in 26 years and 11 months, and the pressure on the yen to depreciate continued to increase.

Intervention and observation: Depreciation rate becomes the core threshold, 160 is not the only red line.

Faced with the continued depreciation of the yen, Japanese authorities have sent a clear signal. Finance Minister Satsuki Katayama has repeatedly criticized the yen's "unilateral depreciation," "speculative" nature, and "excessive" depreciation, and has received echoing support from the US Treasury Secretary, which is seen by the market as a "green light" for intervention.

Market consensus indicates that the core focus of intervention is the speed of depreciation rather than a single exchange rate level. 160 is considered an informal psychological support level; Japan intervened near this level four times in 2024, a record-breaking number. However, if a rapid depreciation occurs in the short term (such as jumping from 158 to above 159), or exhibits unilateral speculative characteristics that deviate from the Japan-US interest rate differential, the authorities may intervene earlier, without waiting for the 160 level.

Historical experience shows that interventions are often chosen during periods of low volatility and light market positions, and are frequently launched "surprise" before or after the release of important US data (such as CPI) to maximize the impact. Currently, market volatility is relatively mild, and late January to early February (peak of election uncertainty + US data season) is considered a high-risk window for intervention.

Experts point out that verbal warnings have limited binding force on the market. Intervention after the yen broke through 155 in 2024 caused a brief rebound of nearly 400 points, but the long-term depreciation trend remains unchanged. The market needs to wait for substantial foreign exchange purchases to truly reverse the short-term trend.

Increased risk of intervention

The continued depreciation of the yen has triggered a chain reaction in global assets, shaking investor confidence in fiat currencies and driving prices of safe-haven assets such as gold to record highs. The Chicago Mercantile Exchange (CME) has adjusted its margin calculation method for precious metals to cope with market volatility.

In the short term, the yen's weakness is likely to continue until the February election results are announced, with "high-market trading" remaining the dominant logic. However, the risk of intervention has increased significantly. If the yen approaches 160 or the depreciation rate gets out of control, the probability of the Japanese authorities intervening will increase sharply.

Traders should pay close attention to three key dates: Congressional developments on January 23, the release date of important US economic data, and statements from Japanese Ministry of Finance officials. In terms of trading strategy, it is recommended to use small positions, strictly set stop-loss orders, and avoid betting against central bank policies.

The safest trading strategy right now is to remain calm and observe, focusing on key signal changes, and avoid blindly chasing the USD/JPY pair higher during this policy-sensitive period.

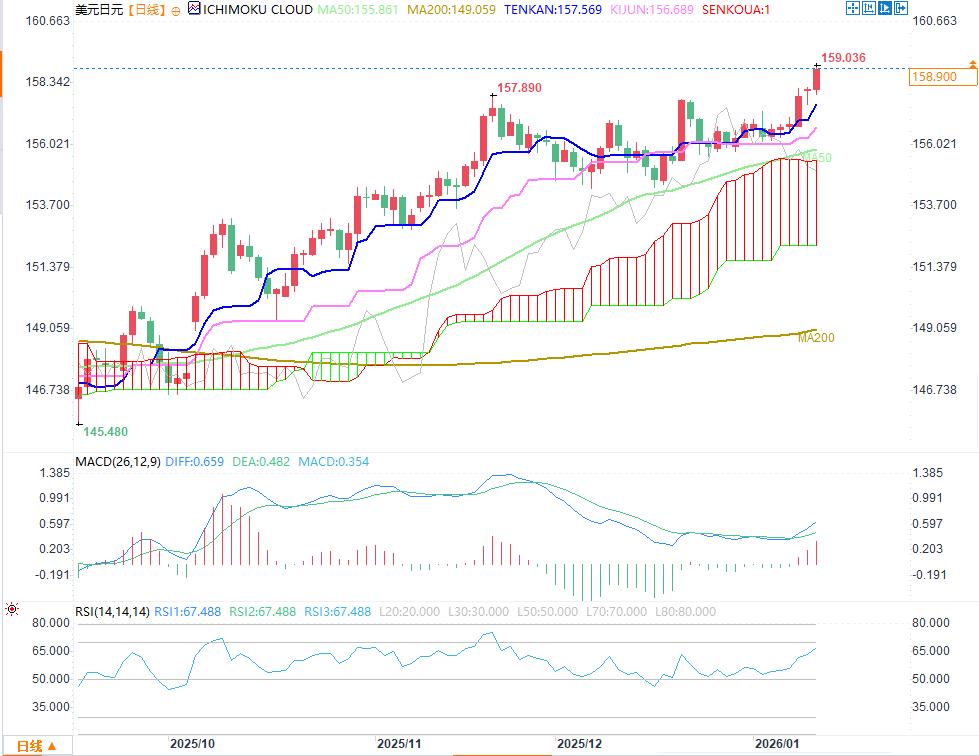

Technical Analysis

(USD/JPY daily chart source: EasyForex)

The USD/JPY pair's Ichimoku Cloud conversion line and baseline are aligned in a bullish pattern, strengthening its overall upside potential. The 14-day RSI momentum indicator has not yet reached overbought levels. The pair has broken through the 2025 high of 158.88, paving the way for a move towards the psychological level of 160. Consider buying on dips.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.