One chart: Baltic Dry Index falls: Freight rates across all vessel types drag down the market.

2026-01-13 23:34:06

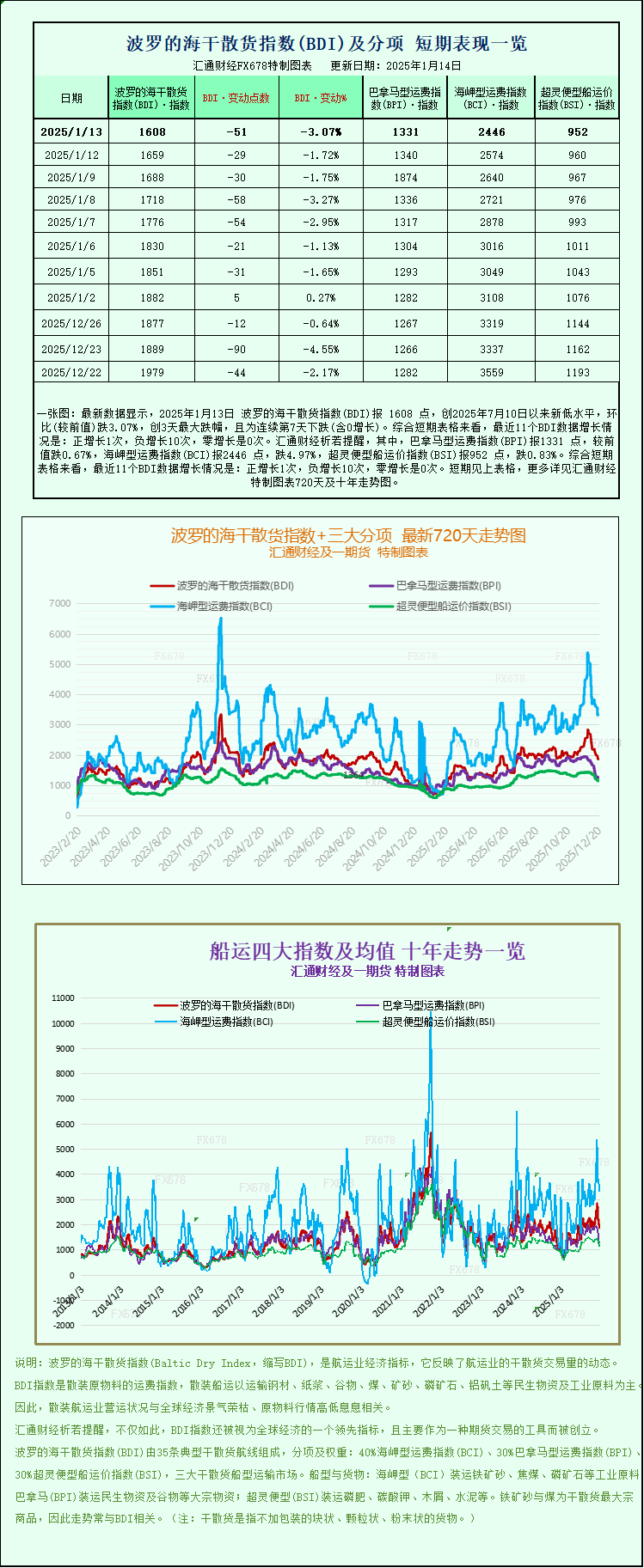

On January 13, the international dry bulk shipping market continued its sluggish trend, with the Baltic Dry Index (BDI) declining for the seventh consecutive trading day. The simultaneous drop in freight rates across all vessel types was the core factor weighing on the market, further spreading pessimism. As a "barometer" of the global dry bulk shipping market, the continued decline of the BDI not only reflects the current weakness in shipping demand but also reveals multiple pressures within the global commodity trade chain.

Specifically, the main index, which covers the three core ship types of Capesize, Panamax and Supramax, performed weakly, falling 51 points to 1608 points in a single day, a drop of 3.1%. This figure not only marks the lowest record since July 2025, but also represents a decline of more than 40% compared to the same period in 2025, indicating the continued weakness of the market.

Among them, the Capesize market, a "giant" in the dry bulk shipping market, saw the most significant decline, with its index plunging 128 points in a single day, a drop of 5%, closing at 2446 points. The corresponding daily average earnings also decreased by $1161 to $18677. Capesize vessels primarily handle the transoceanic transport of bulk industrial raw materials such as iron ore and coal, and the sharp decline in their freight rates is closely related to the weakness in the upstream commodity market.

It is worth noting that as the world's largest consumer of iron ore, the operating conditions of China's steel industry directly impact iron ore transportation demand. Recently, domestic iron ore prices have remained volatile at high levels, while demand in the steel market has not recovered in tandem. This has led to a continuous squeeze on the production profits of steel companies, with many choosing to reduce capacity or postpone procurement. This has directly weakened the demand for imported iron ore, thereby suppressing the demand for Capesize vessels and pushing freight rates down. At the same time, the iron ore futures market has also weakened, further exacerbating risk aversion in the market. This has made shipping companies more cautious about future market prospects, with some shipowners even choosing to suspend order taking or reduce speeds to control costs.

Besides the Capesize market, the Panamax market was also affected. The Panamax index fell 9 points, or 0.7%, to close at 1331 points, corresponding to a decrease of $80 in average daily earnings to $11,978. These vessels mainly transport 60,000 to 70,000 tons of cargo such as coal and grain. The decline in freight rates was partly due to the slowdown in global energy market demand—as the winter heating season in the Northern Hemisphere gradually comes to an end, global coal trade volume has declined; and partly due to the seasonal off-season in international grain trade, with major global grain exporting countries slowing their shipments, further reducing demand for Panamax vessels.

The small vessel market also remained sluggish, with the Supramax index falling 8 points to 952. Supramax vessels primarily serve regional dry bulk shipping, and their declining freight rates reflect weak demand in regional commodity trade. Currently, many economies globally are facing pressure from a slowing economic recovery. Weak manufacturing activity has led to reduced demand for industrial raw materials, while seasonal adjustments in the agricultural sector have kept food transportation demand low. These multiple factors combined make it difficult for the Supramax market to escape its weakness.

Industry analysts believe that the recent continuous decline in the Baltic Dry Index is not accidental, but rather the result of multiple factors, including a sluggish global economic recovery, weak demand for commodities, and a relative oversupply in the shipping industry. Looking ahead, if major global economies fail to implement effective economic stimulus policies, demand in the commodity market will be difficult to substantially improve, and the dry bulk shipping market may continue to fluctuate at low levels. Meanwhile, with increasingly stringent environmental policies in the global shipping industry, some older vessels will face retirement, which may have a certain impact on shipping supply in the long term, but is unlikely to change the weak market trend in the short term. For shipping companies, the current focus should be on cost control and route optimization, while closely monitoring changes in the commodity market and the global economy to cope with market uncertainties.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.