Trump administration pressures Federal Reserve? Central banks in multiple countries voice support for Powell.

2026-01-14 19:50:21

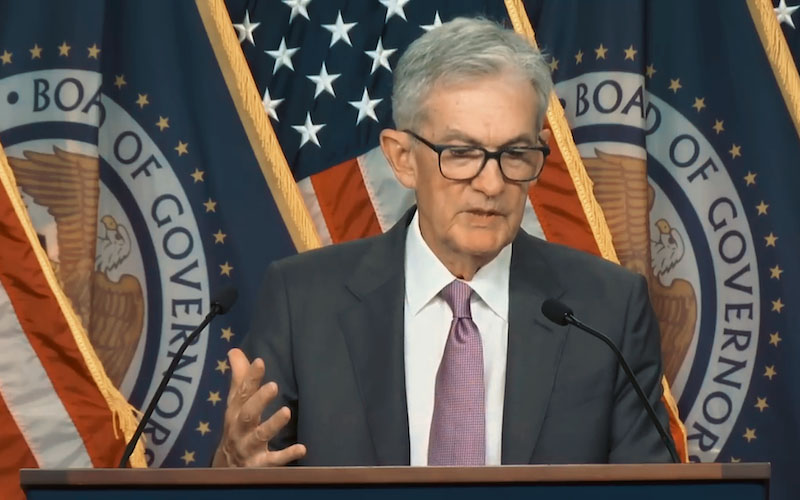

In response to the investigation, Powell released a strongly worded video statement, directly characterizing the investigation as a "pretext." This characterization is entirely reasonable—considering the administration's previous actions, this investigation is essentially the latest attempt to coerce the Federal Reserve into setting monetary policy according to President Trump's wishes, even though the current inflation rate is still above the target level, the government is still demanding that the Fed drastically cut interest rates to boost US demand.

Powell's stance: strong resistance and commitment to his term.

Powell's tough response was no accident. For observers of monetary policy making, this principled resistance aligns with the core values of central bank officials—the idea of "independence" is deeply ingrained in their minds. Like his predecessor, Governor Cook, Powell will serve at least until the end of his term as chairman in May 2026.

It should be noted that although Powell's term on the Federal Reserve Board of Governors exceeds his term as chairman, it is customary for former chairs not to remain on the Board after leaving office. The analysis emphasizes that even if Powell leaves the Board at the end of his term, it should not be interpreted as a success of the Trump administration's pressure tactics. After all, Powell clearly does not want his legacy to be that of a "Federal Reserve chairman who compromised under political coercion."

The core value of the central bank's "operational independence"

Behind Powell's resistance lies the principle of "operational independence" universally upheld by central banks worldwide. Central bank officials firmly believe that having "instrumental independence" (i.e., operational independence) is key to formulating sound policies, a principle supported by solid theory and practice.

At the theoretical level, the distinction between "objective independence" and "instrumental independence" was first proposed in a groundbreaking paper in the early 1990s by the renowned scholar and central bank expert (the late) Stanley Fischer and his collaborator Guy Debelle. Its core logic is that while the government or parliament has the right to determine the objectives of central bank policy, the specific methods for achieving those objectives should be determined independently by the central bank. It is noteworthy that Debelle subsequently became Deputy Governor of the Reserve Bank of Australia (RBA) and further elaborated on the meaning of central bank independence in a speech in 2017.

In practice, central bank officials are acutely aware of the serious consequences of a lack of operational independence—not only are there historical examples from the 1970s, but the recent experiences of Argentina and Turkey also amply demonstrate this. Furthermore, operational independence is not a principle exclusive to central banks; it also applies to national statistical agencies. The recent dismissal of the director of the U.S. Bureau of Labor Statistics is a significant backdrop to Powell's strong response. Federal Reserve officials generally believe that this administration's investigation has crossed the line of normal political interaction.

Central banks and economists from multiple countries jointly support

The Department of Justice's unconventional move has also triggered a strong international reaction. On January 13, several central bank governors and the Bank for International Settlements (BIS) jointly issued a brief statement, clearly supporting Powell and emphasizing that central banks must have operational independence. Prominent American economists, including three former Federal Reserve chairmen, have also issued similar statements individually.

Judging from the details of the statement, its distribution was widespread, appearing on multiple central bank websites, and it was likely organized by the Bank for International Settlements (BIS) and the European Central Bank (ECB)—ECB President Christine Lagarde had previously publicly expressed her support for the Federal Reserve. The signatories include heads of central banks from several major economies, including Reserve Bank of Australia Governor Michelle Bullock, the ECB President, the Bank of England Governor, and heads of central banks from Sweden, Denmark, Switzerland, Norway, Canada, South Korea, Brazil, South Africa, and New Zealand.

The absence of some G20 member countries, such as Japan and Mexico, from the initial signatory list is not seen as a special signal, but rather a pragmatic consideration reflecting the parties' desire to release the statement as soon as possible—some central bank governors need to consult with their respective central bank's board of directors or complete the translation of the statement before it can be published on their national websites. In fact, the Reserve Bank of New Zealand has already added these signatories to a later version of the statement.

This international solidarity is inseparable from the exchange platforms established by various international conferences. The Bank for International Settlements (BIS) plays a crucial role, holding a central bank governors' meeting every two months. Even though this requires a significant time commitment for Asian member countries located in different time zones, these countries still attach great importance to and actively participate in the event. Furthermore, meetings of the International Monetary Fund (IMF) and various regional forums provide regular opportunities for interaction among the heads of major central banks. Long-term exchanges have allowed these governors to become familiar with each other, so their proactive support when their counterparts face injustice is both unexpected and reasonable. This international support undoubtedly provided crucial moral support for Powell's strong stance of resistance.

Outlook: The central bank sector may be facing a turbulent period.

This week's events, while demonstrating the limitations of the Trump administration's ability to coerce central banks, have also sown the seeds of future problems. The most crucial question remains: who will be the next Federal Reserve Chairman? The position has not yet been announced, and this investigation could influence the decisions of potential candidates. Whether a candidate would accept the position knowing they might face a fabricated criminal investigation while serving in the U.S. government is a matter of considerable concern.

Furthermore, the Federal Open Market Committee (FOMC) meeting in late January could become a new flashpoint for conflict. The market widely expects the meeting to keep the federal funds rate unchanged; if this expectation is met, it could trigger a new round of pressure from the Trump administration. Meanwhile, analysts predict that potential candidates for the next Federal Reserve Chair are likely to explicitly state their support for the principle of operational independence—Kevin Hassett has reportedly already made such a statement. Overall, the global central bank landscape is likely to be fraught with uncertainty in the coming days and weeks.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.