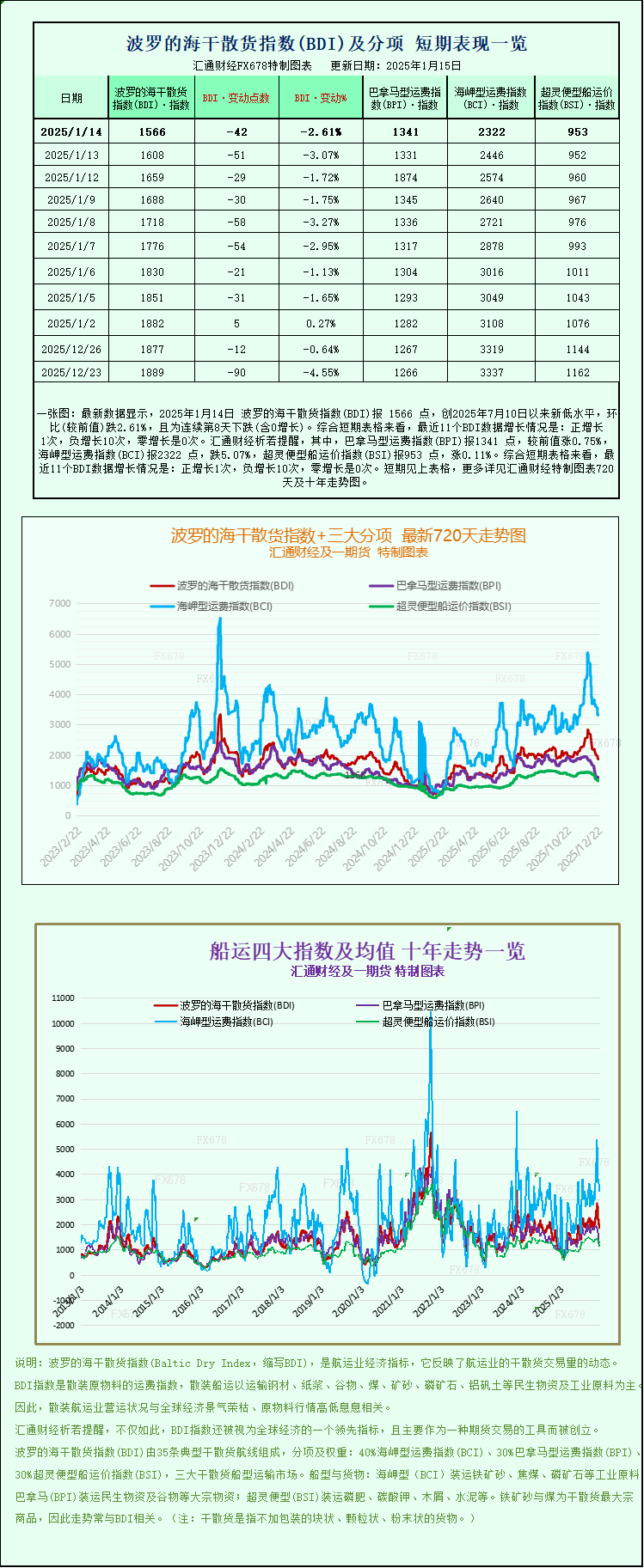

A chart shows that the Capesize shipping sector dragged down freight rates, causing the Baltic Dry Index to fall to a six-month low.

2026-01-14 23:01:08

The Baltic Dry Index fell for the eighth consecutive trading day, hitting its lowest level in six months. This decline was mainly dragged down by a significant weakening in the capesize shipping sector. As a core indicator of the global dry bulk shipping market, the index's fluctuations directly reflect the maritime transport demand and freight rate trends for commodities such as iron ore, coal, and grain.

Details of core index changes

The Baltic Dry Index, which covers the three main vessel types—Capemax, Panamax, and Supramax—fell 42 points, or 2.6%, to close at 1,566 points, its lowest level since July 2025, marking a sustained downward trend in the dry bulk shipping market over the past six months.

The Capesize freight rate index was the main driver of this decline, plunging 124 points in a single day, a drop of 5.1%, to close at 2322 points. These large vessels, with a deadweight tonnage of approximately 150,000 tons, primarily transport industrial raw materials such as iron ore and coal across the ocean, and their freight rate fluctuations have a significant impact on the pace of global heavy industry production. As a result, the average daily charter rate for Capesize vessels decreased by $1117 to $17560 per day, further squeezing shipowners' profit margins.

It is worth noting that although the dry bulk market as a whole was under pressure, the Supramax freight rate index ended its 23-day consecutive decline, rising slightly by 1 point to 953 points on the day, injecting a slight glimmer of hope into the market. These small and medium-sized vessels are mainly responsible for regional bulk cargo transportation, and the stabilization of their freight rates may reflect a phased recovery in demand in some regional markets.

The Panamax freight index also bucked the trend, rising 10 points, or 0.8%, to close at 1341. These vessels, with a deadweight tonnage between 60,000 and 70,000 tons, primarily transport commodities such as coal and grain. Their average daily charter rate increased by $94 to $12,072 per day, making them the relatively stable performer among the three vessel types.

Key factors behind market changes

Filipe Gouveia, shipping analysis manager at BIMCO (Baltic International Shipping Council), explained that the Capesize and Supramax shipping sectors were most significantly impacted by the decline in Chinese coal imports, with demand for coal transport ton-miles for these two vessel types plummeting by 44% and 19%, respectively. At the same time, these sectors also faced fierce competition from the Panamax shipping market, further squeezing their freight rate margins. In particular, the demand for Capesize vessels was additionally dragged down by weak Colombian coal exports, and the combination of these multiple negative factors led to the largest drop in freight rates.

Customs data shows that China's coal imports in 2025 decreased by 10% year-on-year to 490.27 million tons, confirming the shrinking market demand for coal transportation. Looking back at December 2025, the dry bulk shipping market already showed signs of weakness, with the Capesize freight rate index falling by approximately 26% that month, and the Supramax freight rate index also declining by 20.6% during the same period. This continued downward trend set a weak tone for the market at the beginning of 2026.

However, there are also some positive signals in the market. China recently announced record monthly iron ore imports, while steel exports also hit a new record, which boosted Dalian iron ore futures prices slightly. As the core cargo transported by Capesize vessels, the increase in iron ore imports should have provided support, but the sharp decline in coal transportation demand in the short term had a more significant impact on the market and failed to reverse the downward trend of the index.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.