2026 Copper Price Outlook: Institutional Fund Rotation, Supply Shortages, and Technical Analysis

2026-01-19 19:19:26

Gold and Silver: Strong Gains as Funds Seek New Opportunities

Throughout 2025 and into 2026, gold prices hovered near historical highs, supported by persistent inflation, geopolitical uncertainty, and safe-haven demand. Many large institutions remain optimistic about gold's medium-term prospects.

Silver's performance has been even more impressive, not only hitting a new all-time high but also entering a new bull market cycle. Since the beginning of 2025, silver has risen by more than 100%, far outperforming gold. This surge is not only due to its safe-haven properties but also driven by increased industrial demand, particularly in the renewable energy and electronics sectors.

As gold and silver have become "expensive" in terms of valuation, institutional investors are beginning to look for opportunities in metals with stronger structural supply and demand fundamentals. Copper has thus become one of the top choices.

Copper: From Industrial Metal to Strategic Asset

In January 2026, copper prices on the London Metal Exchange (LME) once reached $13,238 per tonne, or about $6 per pound, setting a new historical high on the LME chart.

This surge not only reflects the normal economic cycle but also highlights copper's increasingly important strategic position in the global economy. With real yields on many other assets remaining unattractive, copper is transforming from a traditional industrial commodity into an asset class closely watched by institutional investors.

Why are major investors "choosing copper"?

Strong long-term demand

Copper is irreplaceable in power infrastructure, smart grids, and electric vehicles—all rapidly growing sectors in the global energy transition. Each electric vehicle uses far more copper than a traditional gasoline-powered vehicle.

Demand is also rising in the high-tech industry, particularly in data centers and artificial intelligence infrastructure, which use copper extensively in cabling, cooling, and power transmission. This is a key factor driving global copper demand.

The supply-demand balance is becoming increasingly tight

JPMorgan Global Research predicts a shortage of approximately 330,000 tons of refined copper in 2026, with an average price of nearly $12,075 per tonne, reaching a high of approximately $12,500 per tonne in the second quarter.

Citigroup believes that if supply shortages and low inventory levels persist, copper prices could break through $13,000 per tonne in 2026 and approach $15,000 per tonne. The main reasons are the delayed commissioning or production disruptions at large mines, and the failure of new mine investment to keep pace with demand growth.

Institutional Fund Rotation

There are indications that large investors are gradually reallocating their portfolios from gold and silver to base metals such as copper. This trend reflects that market interest in copper extends beyond its industrial applications, viewing it more as an attractive investment avenue.

As copper prices rise, major mining companies such as Freeport-McMoRan, one of the world's largest copper producers, have attracted strong investor interest. The company's share price has performed positively, reflecting growing market confidence in copper and the potential upside for producers amid tight supply and strong demand.

2026 Copper Price Outlook

Current forecasts from major institutions (JPMorgan Chase, Citigroup) indicate that copper's position as a strategic investment asset may be further solidified in 2026.

The market generally expects copper prices to range between $11,000 and $14,000 per ton. In an optimistic scenario, this range could be broken if technology-related demand grows faster than expected.

Despite the attractive medium-term outlook, risks remain, as part of this rally has been speculative and prices may see a correction later this year.

As the world's largest copper consumer, China's economic growth remains a key factor. Insufficient stimulus could drag down demand. Furthermore, material substitution and technological innovation may also affect long-term copper consumption.

Technical Analysis: Optimistic Scenario

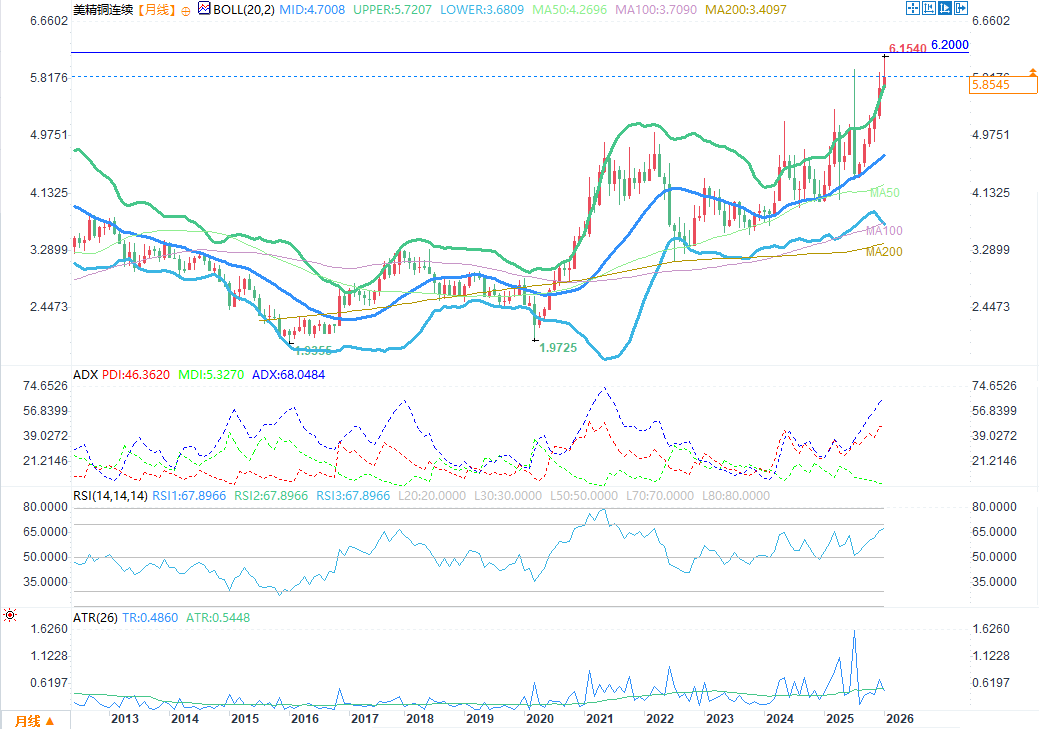

(US copper monthly chart source: EasyForex)

As of January 2026, copper prices are currently trading at approximately $5.83–5.85 per pound, setting a new all-time high on the monthly chart. The price structure exhibits a clear long-term upward trend, with both highs and lows consistently rising.

The price is running close to the upper Bollinger Band, indicating strong momentum and that it is in an expansion phase rather than a mean reversion.

ADX indicator: The current value is 68.05, which is much higher than 40, and +DI (46.36) is significantly higher than -DI (5.33). This not only confirms the strong trend, but also indicates that it is currently in a very strong trend acceleration phase, with the trend's persistence and strength being very prominent.

RSI(14): The current value is 67.85, which is close to the overbought zone, but there is no top divergence yet. This indicates that in the current strong upward trend, the price still has room to rise further, and there is no need to predict the top too early.

ATR(26): The current value is 0.5448 and it is in an upward channel, reflecting the continued expansion of market volatility. This is a typical characteristic of the trend acceleration phase, which means that price volatility may intensify in the short term.

Key technology price levels in 2026 include:

Short-term support: approximately $5.1 per pound

Deep support: approximately $4.4/lb

Upside target: around $6.20/lb; if momentum continues, it could potentially test $7.00/lb.

If prices can hold above $5.1/lb and the uptrend structure remains intact, then the main trend for copper in 2026 is expected to remain bullish.

in conclusion

2025–2026 marks a significant shift in the metals market. Gold and silver have attracted substantial inflows due to their safe-haven properties and industrial applications. However, copper, as a key metal for the digital economy and clean energy, is increasingly becoming a strategic asset in the eyes of institutions.

The rotation of funds from precious metals to base metals, the tightening supply-demand balance, and the growth in high-tech applications are making copper a focal point for investment in 2026. Higher price expectations and volatility present both opportunities and challenges for investors.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.