Is the end of American exceptionalism a false proposition? Three signals reveal the imminent return of a strong dollar.

2026-01-19 20:36:26

Economic dormancy period: a pattern of building momentum under rolling recession

Over the past three years, the U.S. economy has experienced a typical rolling recession beneath the surface of positive real GDP growth.

In response to the supply chain disruptions following the COVID-19 pandemic, the Federal Reserve drastically increased the federal funds rate from 0.25% to 5.5% over a 16-month period from March 2022 to July 2023, a 22-fold increase. This directly suppressed capital expenditures in the real estate, manufacturing, and non-AI sectors, while severely damaging consumer confidence among low- and middle-income groups.

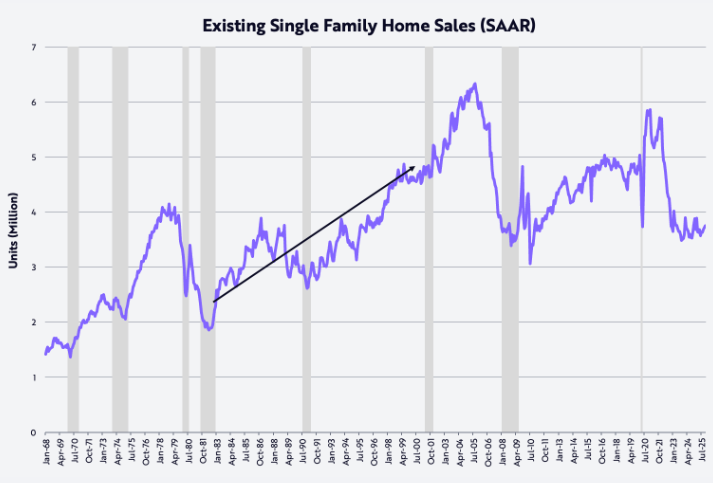

Looking at the core data, the annualized sales volume of existing homes fell from 5.9 million units in January 2021 to 3.5 million units in October 2023, returning to the low level of 2010. Moreover, the current sales volume has fallen to the level of the early 1980s, when the US population was 35% smaller than it is now. This data is enough to demonstrate the strength of the US economic downturn. Meanwhile, the manufacturing PMI has been in contraction territory for three consecutive years, and the industry's prosperity continues to be sluggish.

(Chart showing the trend of existing home sales in the United States)

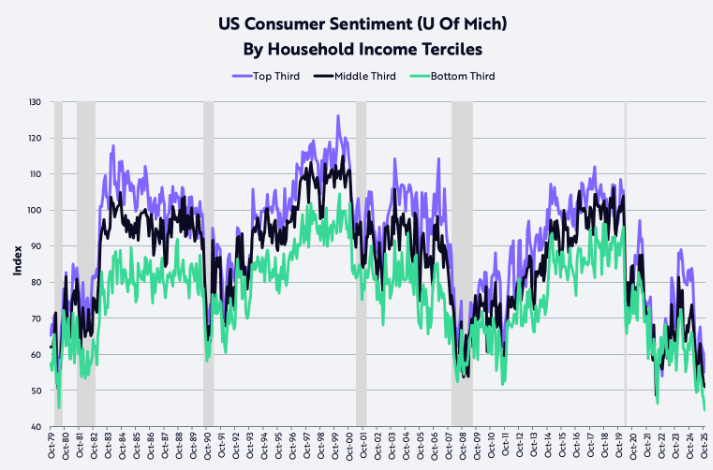

At the same time, the consumer confidence index for low- and middle-income groups has fallen to its lowest point since the early 1980s, while the confidence of high-income groups has also shown a downward trend in recent months.

(University of Michigan Consumer Confidence Index Trend Chart)

It is this comprehensive dormancy that has allowed the US economy to act like a tightly wound spring, brewing strong rebound momentum under the catalysis of policy dividends, and this trend will become the core logic driving the reversal and upward movement of the US dollar index.

Policy dividends working in tandem: the core driver of economic rebound

Currently, multiple positive factors are working together to inject strong momentum into the US economic rebound.

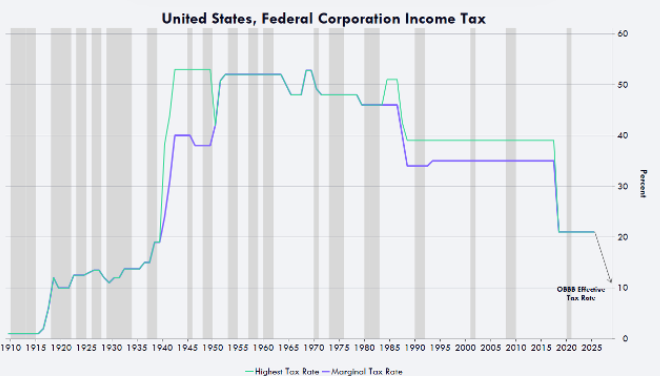

Regulatory easing has fully unleashed innovation across industries (with the introduction of the Big Beauty Act), accelerating industrial upgrading, particularly in the fields of AI and digital assets. Tax relief policies for tips, overtime pay, and social security contributions are expected to bring substantial tax refunds to consumers this quarter, driving the annualized growth rate of real disposable income to surge from 2% in the second half of 2025 to 8.3%. Accelerated depreciation policies have lowered the effective tax rate for businesses to a globally low level of 10%, significantly boosting corporate profits and investment intentions.

(Trend forecast of US corporate tax rates after the bill's release)

The dual benefits from both the business and consumer sides will drive the US economy from a rolling recession to a full recovery, thereby enhancing the global attractiveness of US assets and laying a fundamental foundation for the rebound of the US dollar index.

Clear downward trend in inflation: a key support for the Fed's policy shift

The downward trend in inflation is clear, further solidifying the foundation for a dollar rebound. West Texas Intermediate crude oil prices have plummeted 53% from their 2022 high, highlighting the suppressive effect of energy prices on inflation.

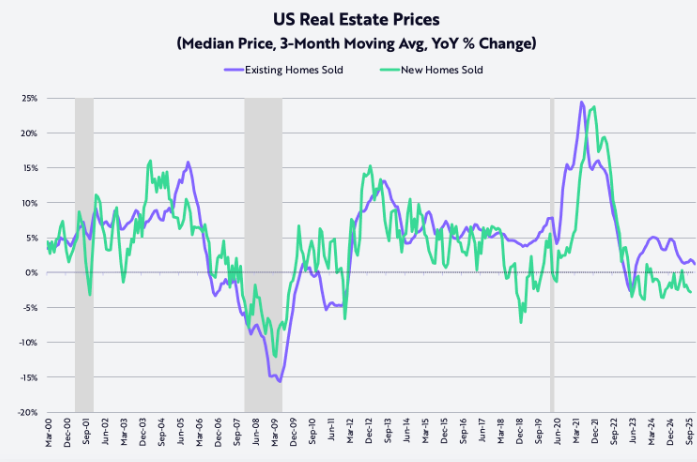

The price of newly built detached houses has fallen by 15% from its peak, and the year-on-year increase in the price of existing houses has fallen from 24% to 1.3%. The price reduction and inventory reduction measures of the three major real estate companies will continue to be transmitted to the CPI in the coming years.

(US House Price Index Trend Chart)

Non-agricultural labor productivity bucked the trend and grew by 1.9%, while the unit labor cost inflation rate was suppressed at 1.2%, completely shaking off the shadow of cost-push inflation of the 1970s.

More noteworthy is that Truflation's inflation rate has fallen to 1.7%, nearly 100 basis points lower than the official CPI data. The substantial easing of inflationary pressures has provided room for the Federal Reserve to shift its policy, and the orderly realization of market expectations for interest rate cuts will further optimize the allocation value of dollar assets.

(CPI trend chart calculated by Truflation)

US Dollar Index Reversal: A Replica of the Reagan Era Bull Market Expected

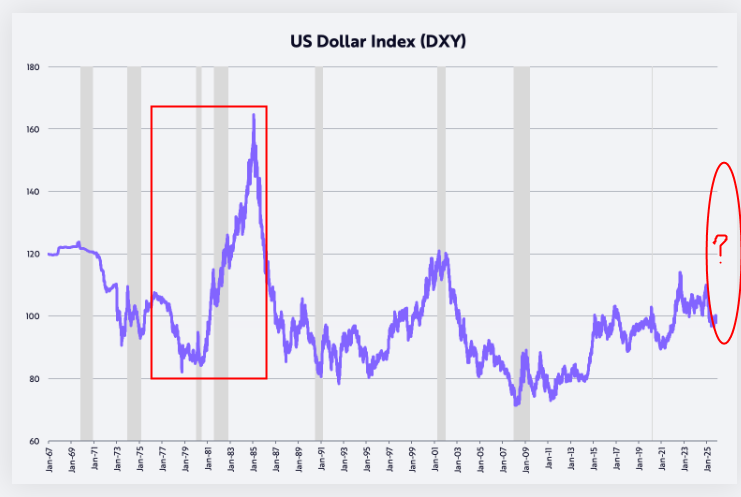

Looking back over the past year, the US dollar index (DXY) fell by 11% in the first half of the year and by 9% for the whole year, marking its worst performance in many years, and the argument that "American exceptionalism is over" was once rampant.

However, from a trading perspective, the US economic rebound and the concentrated release of policy dividends will significantly increase the return on US asset investment relative to other global economies, and the profit-seeking nature of capital will drive the US dollar index to start a new round of bull market.

The policy mix currently being pursued by the Trump administration is highly similar to that of early Reaganomics in the 1980s, when policy dividends drove the dollar index to more than double.

Currently, supported by a robust economy, favorable policies, and declining inflation, the US dollar index is at the starting point of a rebound cycle, and there is a possibility that it will replicate the strong performance of the Reagan era.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.