The US dollar suffers a double blow; is the record high gold price just the beginning? Institutions warn: historical highs have already been reached.

2026-01-19 21:41:24

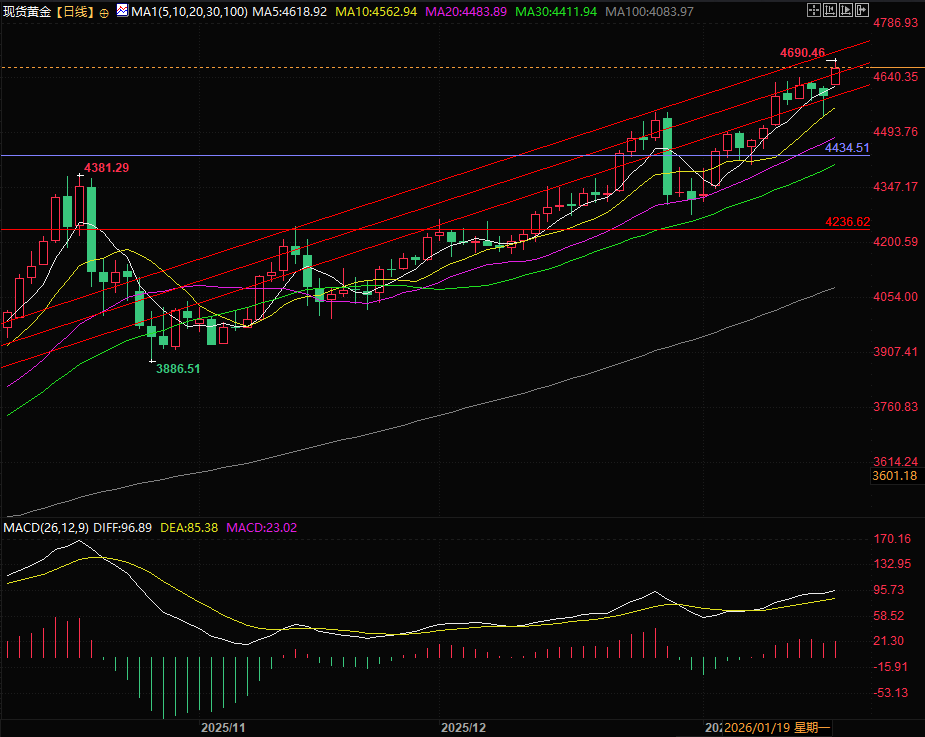

International spot gold prices rose 1.5% on the day, trading at $4,668.85 per ounce, after briefly surging to a record high of $4,690.46 during the session; US gold futures for February delivery rose 1.6% in tandem. Spot silver also performed strongly, gaining 3.2% to $92.89 per ounce, with an intraday high of $94.09, and a cumulative increase of over 30% year-to-date.

Core Driver: Geopolitical Escalation Dominates Market Trends

The recent surge in precious metal prices is primarily driven by escalating geopolitical risks. Last Saturday, Trump issued a strong threat to several European allies, stating that if they are not granted permission to acquire Greenland, he will gradually impose tariffs on those countries. This move further exacerbated the dispute between the United States and Denmark over the Arctic island.

European officials responded swiftly, stating that they would introduce countermeasures and directly accusing the US of using coercive diplomatic tactics.

Market risk appetite quickly declined, with funds flowing into safe-haven assets such as gold, the Japanese yen, and the Swiss franc, directly suppressing global stock markets and the dollar exchange rate. Note that since the dollar index is largely based on the euro, if the Eurozone chooses to sell dollars and allocate other foreign exchange reserves, the dollar index will suffer a double blow: a decline in the dollar due to geopolitical risks in the United States, and a decline in the dollar due to the outflow of euro holdings. This will be doubly beneficial to gold.

Senior market analyst Chen Lin pointed out that against the backdrop of overlapping institutional and policy risks, the reallocation of funds to safe-haven assets is often very rapid, and gold, with its hard asset attributes, has once again become the market's preferred target.

Policy expectations boost: Fed easing bets solidify support for gold

The Fed's policy expectations provided another layer of support for the gold price rally. However, it was not that the Fed's rate cut expectations had increased, but rather that the Fed's rate cut expectations had slightly decreased. The probability of a rate cut this year is now only slightly over 60%. However, gold is rising under these conditions. The Fed's refusal to cut rates is like a spring. If the Fed loosens its grip, this spring will bounce gold high.

Federal Reserve Vice Chair for Supervision Michelle Bowman stated last Friday that the U.S. job market is currently fragile and could weaken rapidly, and the Fed should be prepared to cut interest rates again if necessary.

This news acted like a spring, giving gold a jolt.

Despite widespread market expectations that the Federal Reserve will maintain current interest rates at its policy meeting on January 27-28, bets on at least two 25-basis-point rate cuts this year have not wavered, and the existence of easing expectations continues to boost the allocation value of gold.

In fact, gold's strength is not accidental. In 2025, the cumulative increase in gold prices exceeded 64%, and the increase at the beginning of 2026 further expanded to more than 8%. Under the dual catalysis of geopolitical turmoil and increased economic uncertainty, the safe-haven value of gold continues to stand out.

Fund flows: Holdings data confirms market enthusiasm.

Judging from market positions and trading sentiment, there is a clear trend of funds chasing precious metals. As of last Friday, the holdings of SPDR Gold Trust rose 1.01% week-on-week to 1085.67 tons; the holdings of the main silver ETF also remained at a high level of 16073 tons, and the trading volume of SLV on January 16 even exceeded 132 million shares, indicating significant signs of intense fund turnover.

It is worth noting that the precious metals market was already crowded with funds, and there was a technical pullback on January 15-16 due to traders taking profits. However, gold still recorded an increase that week, which set the stage for subsequent market movements.

Institutional opinions diverge: Gold's fundamentals have a stronger long-term advantage.

Institutional opinions are divided regarding the future trend of gold and silver. JPMorgan Chase has clearly expressed its preference for gold, believing that compared to silver, gold's upward logic is clearer and its fundamental support is more solid.

The agency pointed out that if silver prices experience a significant correction, it may have a short-term transmission effect on the gold market, but this will also create a good opportunity to buy gold at a lower price.

Gold price valuations raise warnings

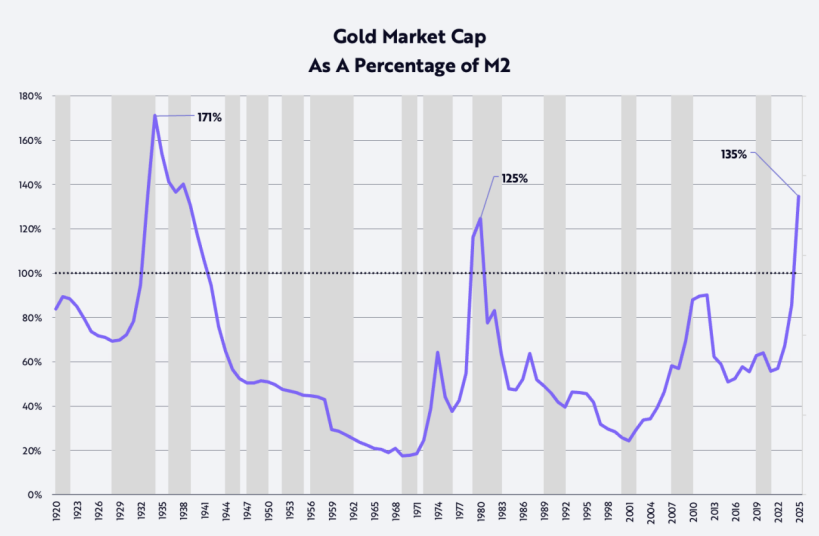

Measured by the ratio of market capitalization to M2, gold prices have only exceeded this ratio once in the past 125 years, during the Great Depression in the early 1930s.

At that time, the price of gold was fixed at $20.67 per ounce, while M2 decreased by about 30%. That is, if this 30% increase in M2 were made up, the peak of 171% would be revised to 119.7.

Recently, the ratio of gold to M2 has once again surpassed its previous peak; the last time such a peak occurred was in 1980, when both inflation and interest rates climbed to double digits. In other words, from a historical perspective, current gold prices have reached extremely high levels.

(Trend chart of gold market value / US M2 total)

Summary and Technical Analysis:

If Trump does indeed TACO, then this could indeed be a high-price range for gold, and the high gold price could lead to a correction. However, if Trump does not back down on tariffs and Greenland, gold could continue to rise.

From a technical perspective, both spot gold and spot silver have recovered their 5-day moving averages, indicating that prices will continue to rise. Spot gold has never even closed below its upward trend line.

Gold is currently building key support around the $4,600 level, while the historical peak of $4,720 has become the core resistance level for the next upward move, and also the upper rail of the channel.

While the overall trend remains bullish, the upcoming geopolitical uncertainties and the approaching Federal Reserve policy decision suggest that market volatility may be more pronounced, and traders should be wary of the risk of short-term profit-taking.

(Spot gold daily chart, source: FX678)

At 21:37 Beijing time, spot gold was trading at $4970.12 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.