A broad-based bearish outlook for the yen? Stay calm! A turning point may be around the corner.

2026-01-22 18:03:43

Today's yen depreciation is due to market expectations that the Bank of Japan will keep interest rates unchanged on Friday. At the same time, this yen depreciation is also intertwined with multiple factors such as changes in global risk appetite, concerns about the health of Japan's fiscal situation, and uncertainty about the Bank of Japan's policies. The Bank of Japan's two-day monetary policy meeting, which will conclude on Friday, is becoming the core focus that will influence the short-term direction of the exchange rate.

Global risk appetite rises, weakening demand for the safe-haven yen.

The primary reason for the yen's current pressure is the waning demand for safe-haven assets.

US President Trump's recent reversal of his stance on Greenland, coupled with his withdrawal of the threat to impose high tariffs on several European countries and the announcement at the Davos Forum of a consensus reached with NATO on a framework for future cooperation on Greenland, significantly boosted global risk sentiment. The S&P 500 index strengthened sharply, and the spillover effect propelled Asian stock markets to rise across the board on Thursday. The attractiveness of traditional safe-haven assets declined, and the demand for the Japanese yen as a typical safe-haven currency was directly weakened.

Domestic pressures: Fiscal concerns coupled with bond market volatility are suppressing the yen's valuation.

At the same time, concerns about Japan's domestic fiscal health and volatility in the bond market further suppressed the yen's valuation.

Japan's current fiscal situation is already in dire straits, and with the parliamentary elections approaching on February 8, all parties, both ruling and opposition, have expressed their support for suspending the 8% consumption tax on food for two years in order to win over voters.

It's worth noting that the Japanese government already relies on issuing government bonds to cover a quarter of its expenditures, and the consumption tax is a major source of government revenue. This situation may further exacerbate market concerns about the sustainability of Japan's fiscal policy, leading to a depreciation of the yen.

The Japanese bond market was hit hard on Wednesday, and the lackluster auction of 20-year government bonds amplified negative sentiment, pushing long-term government bond yields to record highs.

Although the sharp rise in Japanese government bond yields should have supported the depreciation of the yen, this support failed to materialize effectively due to the offsetting effects of fiscal stimulus expectations and a bond market sell-off. The good news is that Yuhiro Nagata, global market head of Sumitomo Mitsui Financial Group, said in an interview that once the full-scale purchase is completed, the group's Japanese government bond portfolio is expected to double in size to the current 10.6 trillion yen (approximately US$67 billion), meaning that Japanese banking conglomerates have begun to buy Japanese bonds, which is a positive sign for the yen.

Supporting factors: Hawkish expectations from the central bank, and the continued strengthening of the tightening logic.

The Bank of Japan's hawkish policy expectations have provided some support for the yen. Previously, the Bank of Japan raised its benchmark interest rate to around 0.75% in December, the highest level since 1995, when the bank judged that the feasibility of achieving the 2% inflation target was continuing to improve.

However, the depreciation of the yen suggests that the market believes the Bank of Japan will not raise interest rates in January, and there are reports that some policymakers within the Bank of Japan believe that a rate hike may be initiated as early as April.

Central Bank Governor Kazuo Ueda also stated that if the economy and price trends meet expectations, the central bank will continue to raise interest rates when the time is right. He also emphasized that, considering the inflation level, current interest rates are still in a significantly low range.

The continued improvement in inflation data further strengthens the logical support for the Bank of Japan's subsequent tightening policy.

A Bank of Japan survey released on Tuesday showed that most Japanese households expect prices to continue rising in the coming years; while data released last Friday showed that Japan's inflation rate has been above the central bank's 2% target for four consecutive calendar years.

For resource-poor Japan, a weaker yen will further raise expectations of rising inflation, while continued wage increases will provide a reasonable basis for the Bank of Japan to tighten monetary policy.

In addition, the Japanese government has previously introduced an economic stimulus package of 21.3 trillion yen (approximately US$135 billion) aimed at alleviating the burden of rising prices on households, which may indirectly contribute to stabilizing inflation.

Slight improvement in exports provided a backdrop for the yen's rebound.

Although Japan has experienced a trade deficit for the fifth consecutive year, the total trade deficit for 2025 is projected to be ¥2.65 trillion ($17 billion), a reduction of nearly 53% compared to the previous year, indicating a significant improvement in terms of trade. However, the trade surplus in December was ¥105.7 billion ($669 million), a year-on-year decrease of 12%. US tariff policies and strained Sino-Japanese diplomatic relations are the main contributing factors.

Improved terms of trade usually lead to the appreciation of the yen domestically, which in turn leads to its appreciation externally.

Potential buffer: Expectations of policy intervention limit the scope for depreciation.

The expectation of potential policy intervention also limited the yen's depreciation potential.

Japanese Finance Minister Satsuki Katayama hinted last week that he did not rule out the possibility of joint intervention in the foreign exchange market with the United States to address the recent depreciation of the yen. While this statement did not trigger aggressive betting by yen bulls, it did make short sellers hesitant as the exchange rate approached a key level, resulting in a strong wait-and-see attitude in the market.

Summary and Technical Analysis:

Overall, waning safe-haven demand and fiscal concerns are putting downward pressure on the currency, while central bank intervention and improved data are providing long-term support.

In the short term, the market is awaiting the Bank of Japan's interest rate decision. Given the recent continuous depreciation of the yen, if the central bank announces that it will maintain the interest rate unchanged, the exchange rate may have already priced in the negative news, and the USD/JPY exchange rate may rise first and then fall, or even experience a false breakout. However, if the Bank of Japan raises interest rates more than expected, there may be an unexpected phenomenon of a sharp drop in the USD/JPY exchange rate on that day. In other words, regardless of the central bank's choice, the USD/JPY exchange rate will most likely undergo a correction.

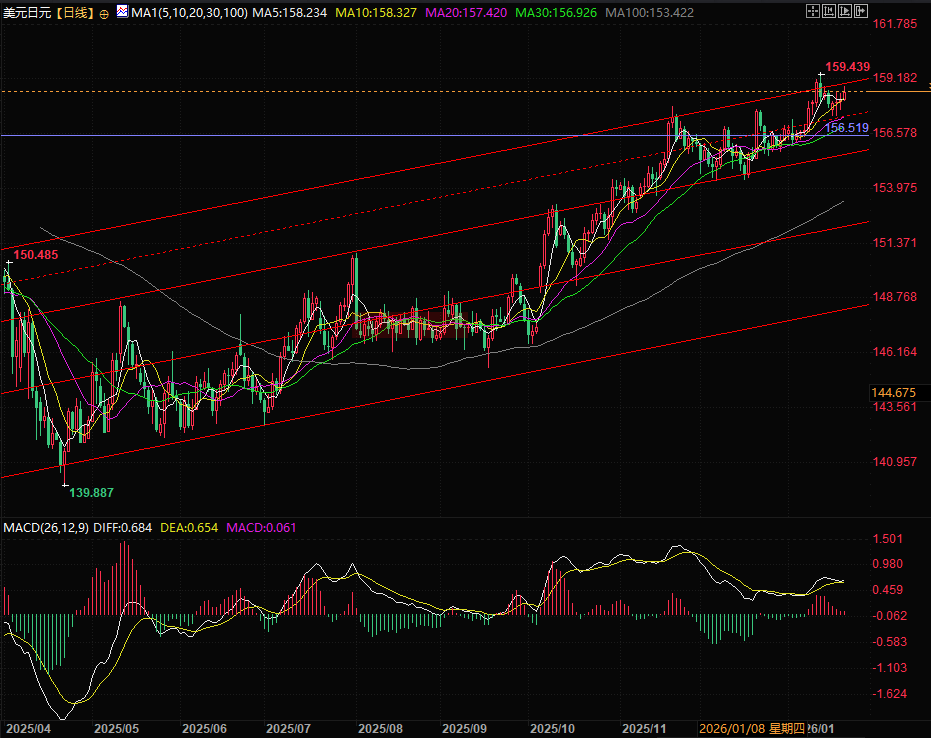

Technical analysis shows that the bullish trend of USD/JPY remains intact. The exchange rate may break through the upward channel momentarily based on the Bank of Japan's decision to pause interest rate hikes. The current support level is at the 5-day moving average, and the resistance level is at the previous high of 159, which is also the upper rail of the upward channel.

(USD/JPY daily chart, source: FX678)

At 17:55 Beijing time, the USD/JPY exchange rate is currently at 158.65/66.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.