Davos Report Reveals: Three Major Risks and Unmissable Opportunities

2026-01-23 21:26:09

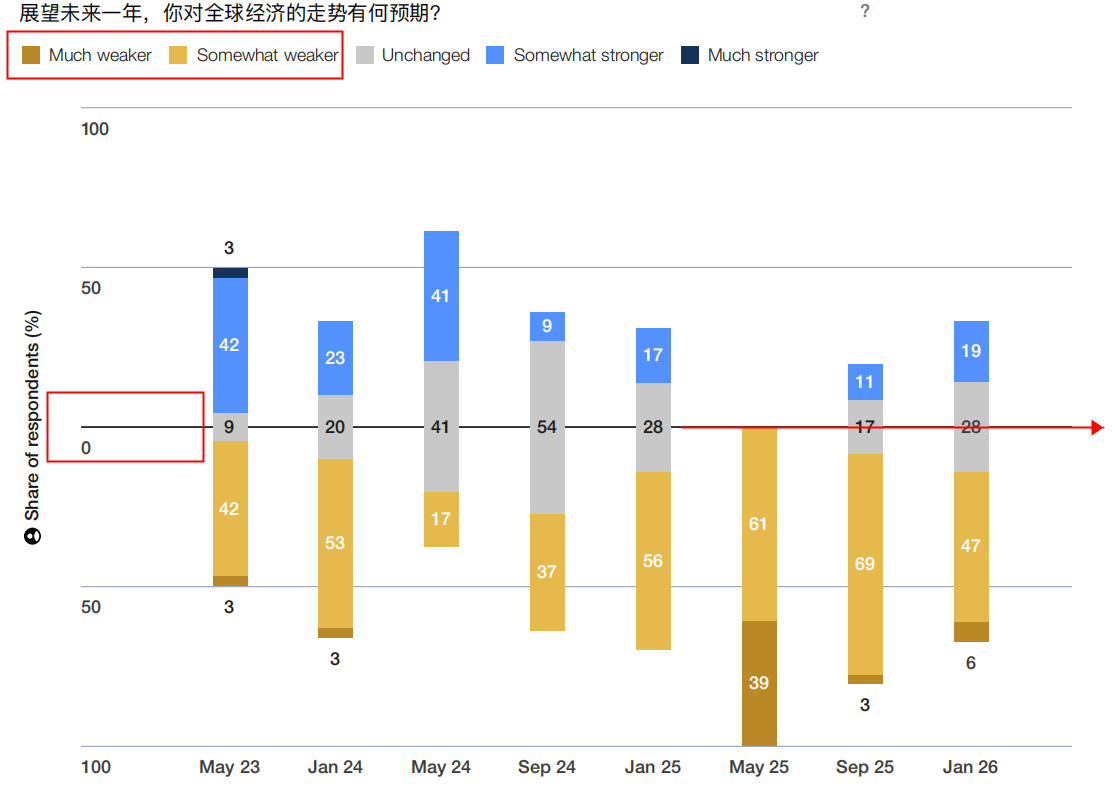

53% of chief economists expect the global economic situation to worsen, 28% believe it will remain unchanged, and 19% anticipate a strengthening economy. Therefore, the global economic outlook for the coming year is skewed negative—although market sentiment has improved compared to last year's expectations.

This article reveals the understanding and viewpoints of mainstream economists by extracting the core content of the research report.

2026 may be another year where we can't be too aggressive.

53% of chief economists expect the global economic situation to worsen, 28% believe it will remain unchanged, and 19% anticipate a strengthening economy. Therefore, the global economic outlook for the coming year is skewed negative—although market sentiment has improved compared to last year's expectations.

As shown in the figure, the forecasts are mostly concentrated below the 0 axis, indicating a pessimistic outlook for economic growth in 2026.

(Economic forecasts)

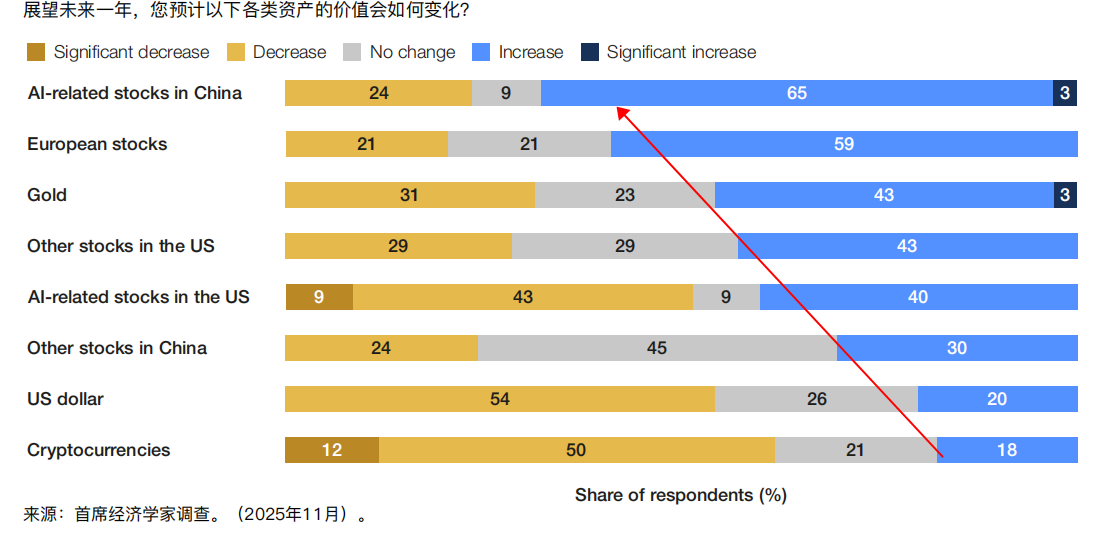

Even if gold experiences a significant surge, it remains a worthwhile asset to allocate to.

The chart shows that gold's investment value is still higher than that of US stocks and even higher than that of US AI stocks. Now, with the outbreak of crises in Greenland, Venezuela, and Iran, gold's investment value has become even more prominent.

(Chart showing economists' return forecasts for different asset classes)

Unveiling the Core Assets that Influence Asset Prices

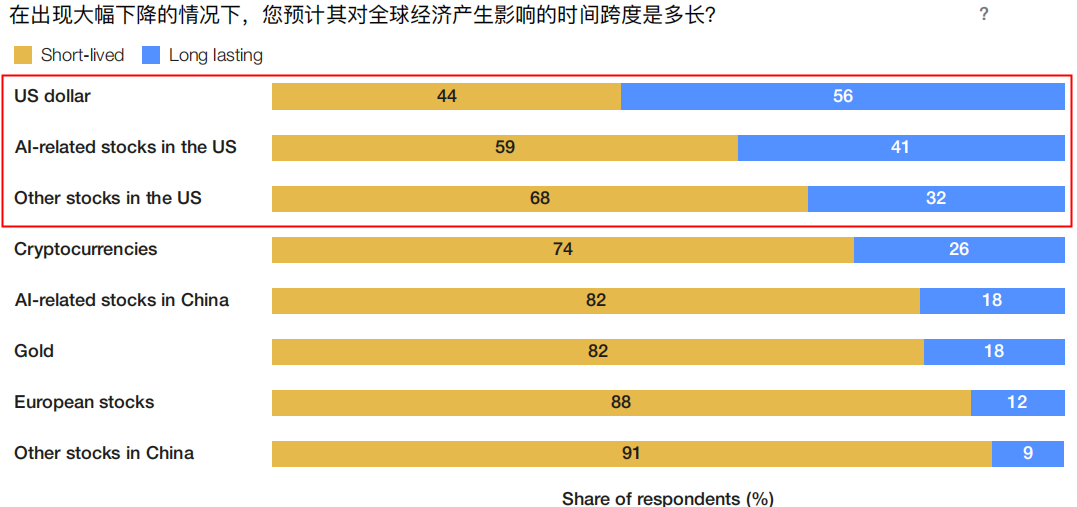

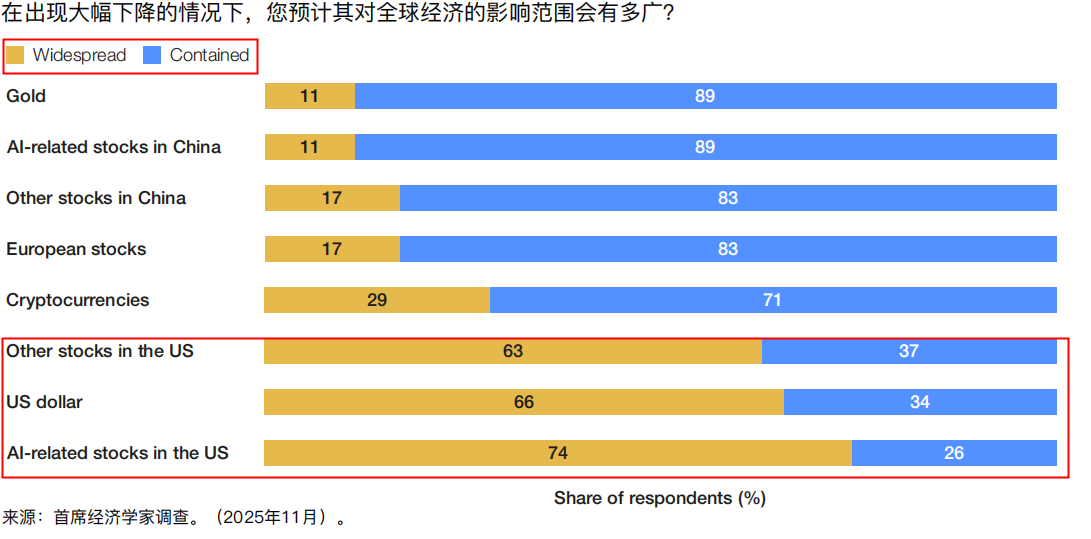

As shown in the figure, the three assets with the greatest impact on the global economy are the US dollar index, US stocks, and US AI stocks. Changes in these three assets have the greatest impact on the market and in terms of both scope and degree. This will also affect the prices and trends of other assets.

As I often write in my analysis articles, I frequently refer to US AI stocks to represent the industrial attributes of gold, silver, and copper, and the US dollar index as a signal of sentiment and trading. When you see copper or precious metals rising, the reason may lie in the capital expenditure of a confirmed AI direction.

(Ranking of the duration of the impact of sharp declines in different financial instruments on the world economy)

(Ranking of the breadth of impact of sharp declines in different financial instruments on the global economy)

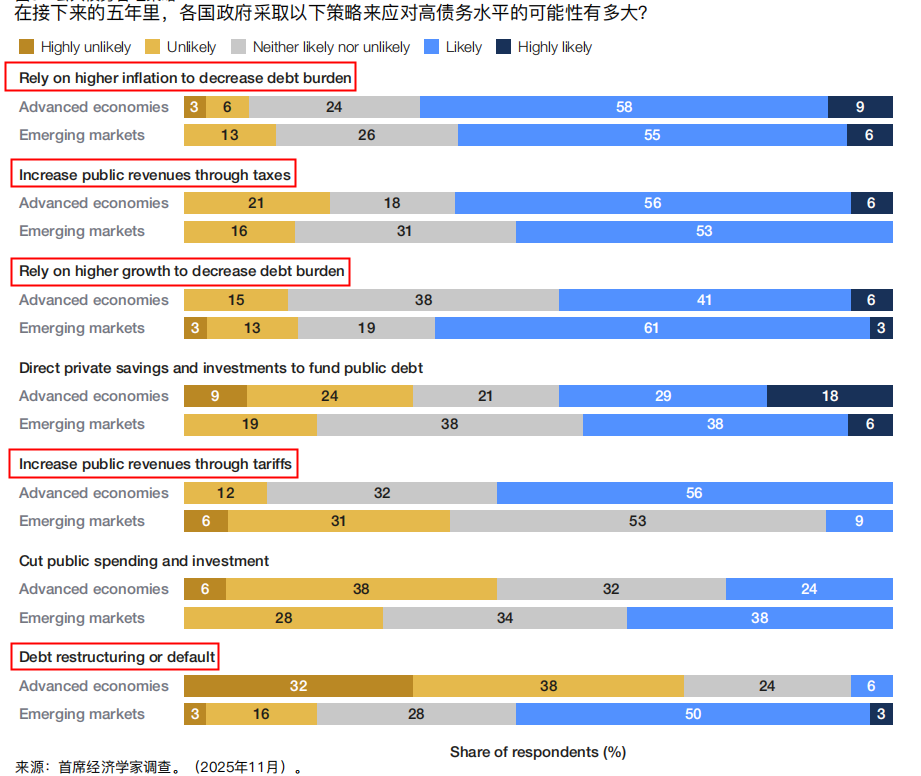

How do emerging and developed economies deal with high debt levels?

As shown in the figure, the top-ranked methods are: indirectly diluting debt through inflation, increasing public revenue through taxation, and repaying debt through high economic growth. However, for developed economies, another effective method is to increase public revenue by raising tariffs. For emerging economies, stalling and debt defaults are also considered to be more common.

(A summary of the main approaches governments take to deal with high debt)

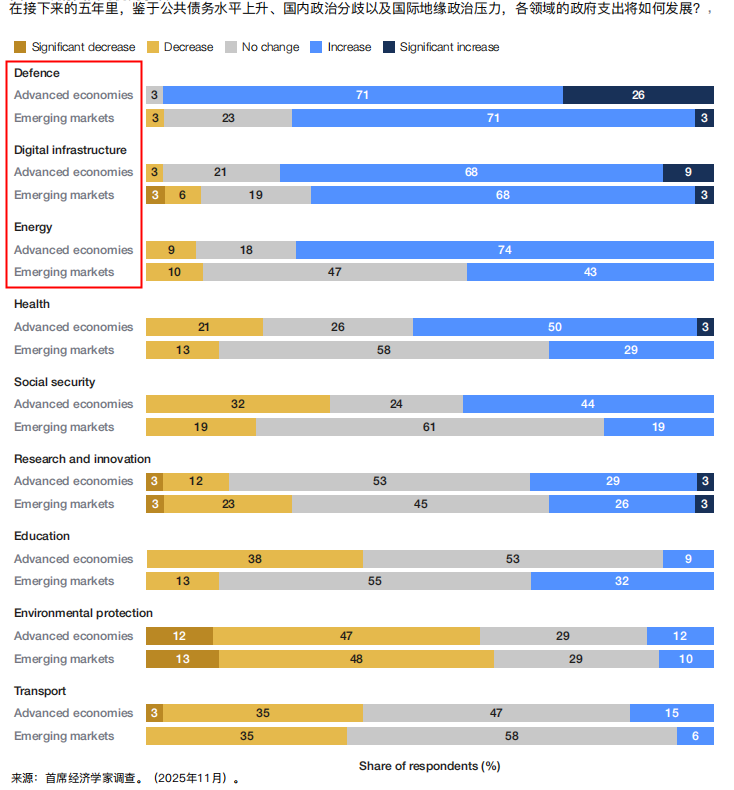

Government Investment Direction Revealed Amid High Debt

As previously discussed, most economists believe that there is a high probability of a global economic recession in 2026, and government debt is also very serious. In this case, every expenditure by the government should be used wisely. So, under such a severe financial background, where will the money of various economies go?

Surveys show that defense, digital infrastructure, and energy remain core issues that countries cannot avoid, especially the military industry. The global arms race is also a small reason for the resilience of gold prices, after all, what if a conflict breaks out?

(List of major government expenditures)

Summary, Outlook and Supplement

Regarding economic growth and geopolitics, trade tensions between the US and China have eased somewhat, but fundamental frictions remain unresolved. Regional and bilateral trade agreements are expected to increase, and the global trade outlook is mixed.

In terms of regional economic growth, the US saw a surge in investment in AI and data center infrastructure; China sought a balance between external demand and domestic pressures; Europe was hampered by demographic trends and regulatory fragmentation; and South and East Asia remained bright spots.

Impact on employment: 57% of economists expect AI to lead to a reduction in long-term jobs, while 32% expect it to increase employment. The short-term disruption to the job market is expected to be relatively mild.

Productivity potential: AI may bring significant productivity gains, but the actual effect depends on factors such as model capabilities, adoption rates among SMEs, task redesign, and skills training.

Risks: Asset valuations are concentrated and excessively high. The valuations of the seven largest U.S. tech companies ("Magnificent Seven") have reached the top 10% of their historical distribution, accounting for 35% of the total market capitalization of the S&P 500 (compared to 20% in November 2022). 52% of economists expect U.S. AI-related stocks to fall, while 40% expect them to continue rising.

Debt pressure: Global public debt is projected to reach a record $102 trillion in 2024 and will approach 100% of GDP by 2029. 47% of economists believe that emerging markets may experience a sovereign debt crisis.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.