One chart: Baltic Dry Index remains unchanged, freight rates for all types of vessels are generally stable.

2026-01-23 22:50:23

On Friday, the Baltic Dry Index was virtually unchanged. Although Capesize and Panamax freight rates fluctuated slightly during the session, they remained generally stable, resulting in a narrow consolidation in the overall dry bulk market.

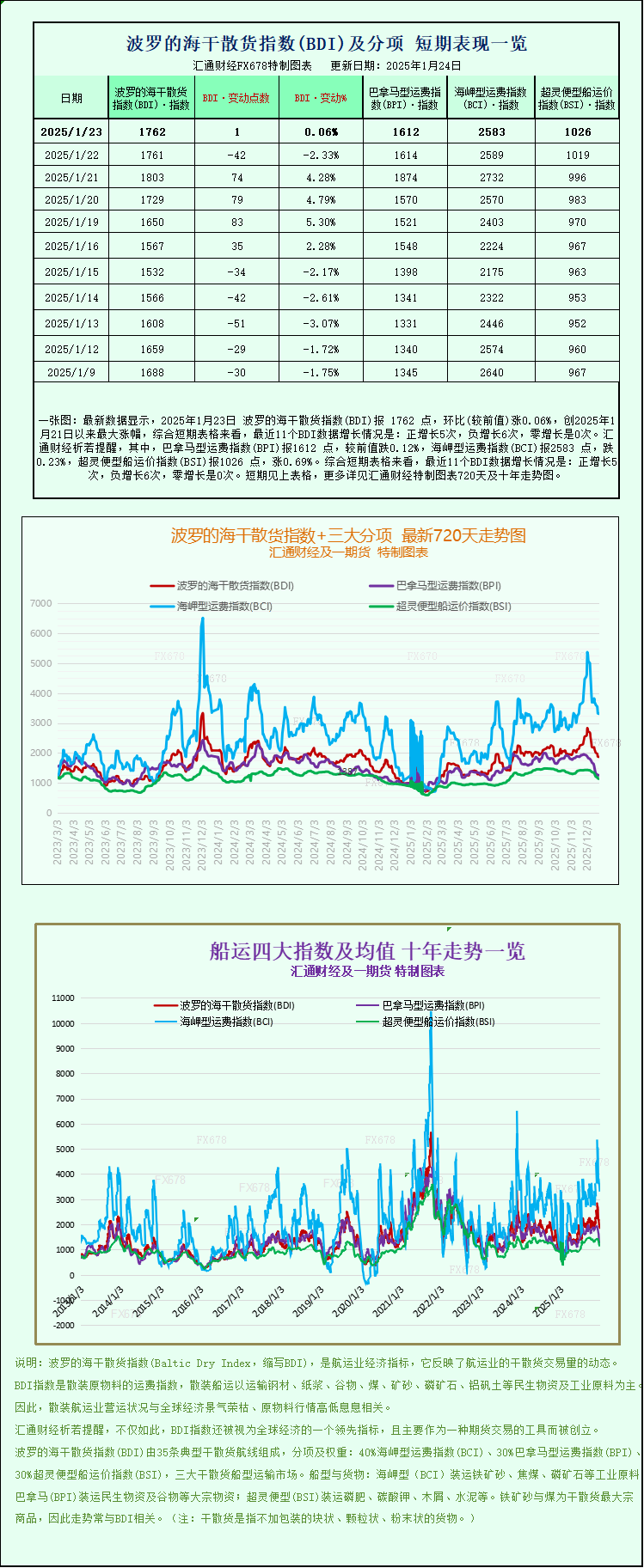

The Baltic Dry Index (BDI) rose slightly by 1 point, or 0.1%, to close at 1,762. While the daily performance was lackluster, the index showed strong overall performance this week, accumulating a 12.4% gain. This increase was mainly driven by a rebound in demand for large bulk carriers this week, particularly increased orders for iron ore and coal shipments from China and Europe, which fueled a temporary recovery in freight rates.

The Capesize index fell 6 points, or 0.2%, to close at 2,583. Despite the slight pullback, the index still recorded a significant gain of 16.1% this week, reflecting signs of recovery in the large vessel market after a previous downturn. Capesize vessels, typically used to transport bulk commodities such as iron ore and coal up to 150,000 tons, saw their average daily earnings decline by $48 to $19,928.

It's worth noting that iron ore futures ended a six-day losing streak on Friday, with prices rebounding slightly. Market analysts believe that the continued low prices of some steelmaking raw materials have eased cost pressures on steel mills, making them more willing to increase raw material purchases, thus providing some support for iron ore demand. This change also provides a psychological boost to the Capesize vessel market, although the actual recovery in shipping demand may still take time to materialize.

The Panamax index dipped slightly by 2 points, or 0.1%, to close at 1,612. This follows a strong weekly gain of 10.6%. Panamax vessels, which primarily transport 60,000 to 70,000 tons of coal or grain, saw their average daily earnings decline by $21 to $14,504. Market analysts noted that the rise in the Panamax market was mainly driven by increased demand for grain transport on Atlantic routes and rising coal shipments due to winter heating needs in some regions.

In the small vessel sector, the Supramax index rose 7 points to close at 1,026, a cumulative increase of 6.1% for the week. The Supramax market benefited from active regional trade, particularly in Southeast Asia and the Middle East, where demand for cargoes such as fertilizers, cement clinker, and agricultural products remained stable.

Overall, the dry bulk market saw a comprehensive rebound this week. Although indices showed mixed results on Friday, overall sentiment was relatively positive. Market participants are focusing on the pace of production resumption at Chinese steel mills in the coming weeks, iron ore shipments from Brazil and Australia, and changes in global coal demand. These factors will all have a significant impact on dry bulk freight rates.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.