The tug-of-war between gold bulls and bears intensifies; how should traders cope with volatile market conditions?

2026-02-05 20:09:40

The core driver of this surge is safe-haven buying triggered by the escalating geopolitical conflict between the US and Iran. Meanwhile, hawkish expectations for the Federal Reserve's policies have simultaneously put the brakes on the rise. Amid the battle between bulls and bears, the high volatility of gold trading has become increasingly apparent, providing traders with new opportunities for swing trading.

Safe-haven buying surges: Immediate catalyst from the US-Iran conflict

Gold's safe-haven properties were fully demonstrated in this market movement, and the trigger was the new variables in the US-Iran geopolitical situation.

According to foreign media reports, the US military shot down an Iranian drone that approached the USS Abraham Lincoln aircraft carrier in the Arabian Sea, an incident that directly fueled market concerns about an escalation of military conflict.

From a trading perspective, when geopolitical risks escalate, funds tend to withdraw from risky assets such as stocks and shift to defensive assets like gold—this is also a classic pricing pattern in gold's history during periods of military conflict, financial turmoil, and declining risk appetite.

The surge in gold prices triggered by the recent US-Iran conflict is a continuation of this logic, making gold's hedging value a core focus of trading once again.

However, the market is not simply betting on an escalation of the conflict: the US and Iran have confirmed that they will hold diplomatic talks in Oman, and this sign of de-escalation has become a "hidden concern" for the bulls.

Traders need to closely monitor the progress of the negotiations: if a substantial breakthrough is achieved, the recovery in risk appetite will trigger profit-taking in gold; if the conflict continues to escalate, safe-haven funds will flow in further, pushing gold prices to continue to rise. This tug-of-war is the core reason for the current increased short-term volatility in gold.

High volatility has become the norm: Trading requires abandoning trend-following thinking

Regarding the future fluctuations in gold prices, most institutions believe that "the wide-range volatility is far from over."

Niklas Westermark, head of commodities trading at Bank of America, pointed out that even if recent extreme volatility has subsided, gold volatility will still be higher than the historical average.

From the perspective of the trading environment, the current precious metals market is in a "highly sensitive mode," with gold prices reacting significantly faster to news: sudden geopolitical news, central bank policy statements, better-than-expected macroeconomic data, and speculative capital flows can all quickly trigger price fluctuations.

This means that traders can no longer stick to the mindset of "one-sided trend" and must adapt to the rhythm of "quick in and quick out" swing trading, and be wary of the risk of short-term reversal.

Hawkish Fed Expectations: The Core Restraint on Gold's Upside

Despite strong safe-haven demand, gold has not experienced an "out-of-control one-sided rally," primarily due to the suppression by the Federal Reserve's policies.

From the perspective of asset pricing logic, gold, as a non-yielding asset, is highly negatively correlated with interest rates and the US dollar: when a rate-cutting cycle begins, the US dollar weakens, and US Treasury yields decline, gold often experiences a trend of rising prices.

However, the Fed's current policy signals are leaning towards a hawkish stance: after pausing rate hikes in January, market expectations for "aggressive rate cuts" have cooled significantly, especially given the possibility of a more hawkish change in the Fed leadership, which could keep borrowing costs high for an extended period. According to the CME FedWatch Tool, the market is pricing in only a 46% probability of a rate cut in June, a figure that directly reflects a decline in short-term easing expectations.

For traders, the Fed's hawkish stance means there is a clear ceiling to gold's upside: the recent rise in US Treasury yields has kept interest rates high, which increases the opportunity cost of holding gold and supports a stronger dollar. Under this double pressure, gold is unlikely to break out of its current one-sided trend, which is also the key reason why bulls dared not add to their positions after breaking through $5,005.

The $5,000 mark: An anchor for trading sentiment and a watershed for trading decisions.

The $5,000/ounce mark is not only a technical level for gold trading, but also an emotional anchor.

From a practical trading perspective, round number levels typically serve three roles: confirming a breakout of a key resistance level, triggering a trend, and acting as a benchmark indicator of market sentiment.

In terms of specific operations, if the price of gold can hold above $5,000, trend-following funds will likely enter the market to add to their buying, pushing the price of gold to test higher levels.

Conversely, if geopolitical tensions ease or US economic data exceeds expectations, the $5,000 mark will become a "profit-taking line," and short-term selling pressure will emerge rapidly.

For traders, this level is not only the dividing line between bullish and bearish trends, but also an important reference for setting stop-loss and take-profit levels.

Trading Practice Guide: Key Tracking Indicators

To seize future trading opportunities in gold, it is crucial to closely monitor five key variables, as any unexpected changes could alter the direction of gold prices:

US core inflation and non-farm payroll data: These are the core basis for the Fed's policy adjustments. Stronger-than-expected data will further strengthen hawkish expectations and suppress gold prices.

Speeches by Federal Reserve officials: Pay attention to marginal changes in policy wording, especially statements regarding the pace of interest rate cuts and the balance sheet;

Progress in US-Iran negotiations: This is the "switch" for short-term risk aversion, and every step forward in the negotiations will trigger fluctuations in gold prices;

The US dollar index and US Treasury yields are inverse indicators for gold; a stronger dollar and rising yields will directly suppress gold prices.

Global central bank rate cut signals: If other major central banks take the lead in cutting interest rates, it will indirectly affect the pace of the Federal Reserve's policy, providing room for gold to rise.

Summary and Technical Analysis:

In summary, gold's breakthrough of the $5,005 mark is essentially the result of a game between "safe-haven demand" and "policy constraints".

In the short term, geopolitical risks will continue to support gold prices, but the Fed's hawkish expectations will limit upside potential. As the most popular commodities recently, gold and silver will likely experience high volatility.

In addition, we must be vigilant about a reversal in market sentiment: once there is significant progress in the US-Iran negotiations, or the Federal Reserve releases a clear hawkish signal, we must adjust our positions immediately and not be fixated on a single-direction prediction. In the current gold market, the unilateral trend is shifting towards a volatile trend, and taking profits when they are available may be more important than holding positions and waiting for further gains.

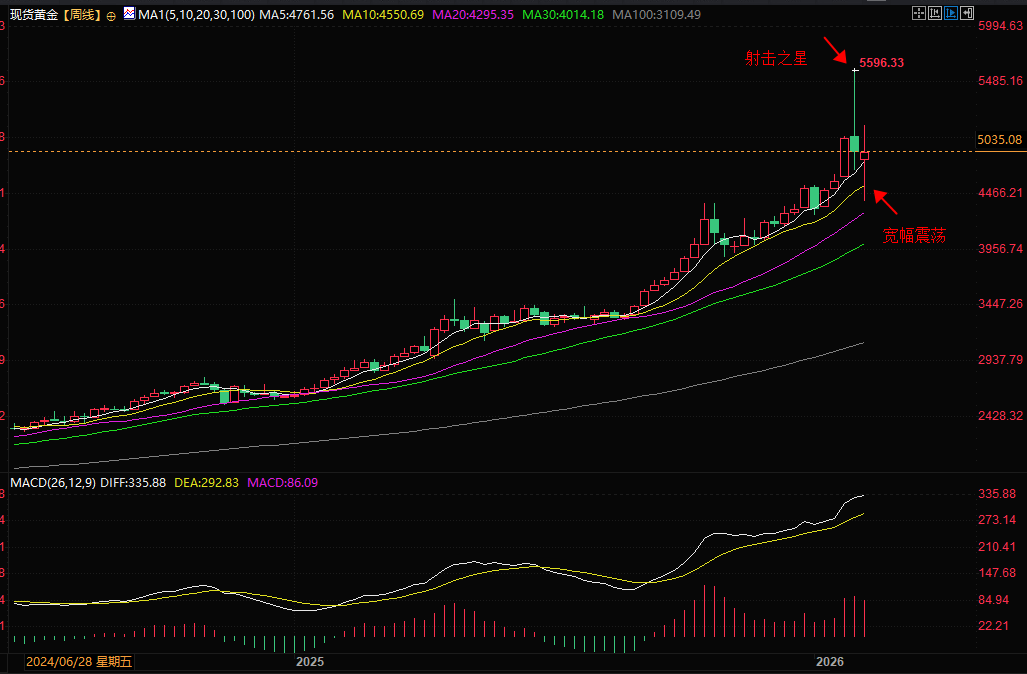

From a weekly perspective, gold is still in an upward trend and has not broken the 5-day moving average. However, the long upper shadow of last week is very close to a shooting star pattern, and the wide range of fluctuations this week indicates that the market sentiment is unstable and there is a lot of disagreement.

During the subsequent divergence phase, gold will exhibit wide-range fluctuations, meaning that the sustainability of both upward and downward movements will be weaker than in a one-sided market. Traders are more likely to chase highs and cut their losses at lows.

At this point, contrarian thinking can play an important role. That is, observe the trend. When there is a position that requires stop loss and panic, a rebound is likely to start. The same applies to the upward trend. When emotions are high, it is the peak of the wave.

(Weekly chart of spot gold, source: FX678)

At 20:08 Beijing time, spot gold is currently trading at $4,853 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.