A pivotal week for the battle between bulls and bears: a weak euro meets a wave of layoffs in the United States.

2026-02-05 21:52:24

The ECB's decision to keep interest rates unchanged supported a stronger currency.

The European Central Bank announced on Thursday that it would maintain its monetary policy unchanged, keeping the main refinancing rate at 2.15% and keeping borrowing costs stable, despite recent weak economic data.

The Eurozone's December retail sales data released on Thursday morning was a double whammy: the actual contraction was 0.5%, far exceeding the market expectation of 0.2%; more noteworthy was that the November retail sales data was revised down from the previously estimated 0.2% increase to 0.1%.

Despite a surprise 7.8% surge in German factory orders in December (compared to market expectations of a 2.2% contraction), and a revised 5.7% increase in November from 5.6%, this single positive factor failed to have an effective transmission effect – the short-term rebound in industrial orders is unlikely to change the underlying weakness of the Eurozone's economic recovery.

This data directly reflects the weakness in Eurozone consumption, significantly weakening the euro's valuation basis and providing clear upward momentum for the US dollar index. However, as the euro announced that it would maintain its interest rate unchanged, the exchange rate reversed course, and the euro exchange rate rebounded slightly.

US Data: Short-term Disturbances Amidst Divergence Are Unlikely to Change the Core Trend

Recent economic data released by the United States has shown a clear divergence, putting short-term downward pressure on the US dollar index.

The Challenger Report, released on February 5, showed that the U.S. job market in January was facing a severe situation of "soaring layoffs and a hiring freeze".

Local employers announced 108,435 layoffs that month, a surge of 118% year-on-year and 205% month-on-month, setting a record high for the same period since January 2009, and also the highest monthly peak since October 2025.

The number of job openings that month was only 5,306, a new low for January since the data began being tracked in 2009, representing a year-on-year and month-on-month decline of 13% and 49%, respectively. In terms of industry distribution, transportation, technology, and healthcare were the main sectors for layoffs, with large-scale layoffs at UPS and Amazon being the core drivers. The chemical industry saw increased layoffs due to its intelligent transformation, while only the media industry experienced a slight easing of layoff pressure.

The main reasons for layoffs are contract losses, weak economic fundamentals, and corporate restructuring. AI's direct impact on employment accounts for only 7%, and the impact of tariffs has also subsided significantly.

This data clearly reflects the pessimistic outlook of US businesses for the 2026 economic outlook, and the signs of a cooling job market are clear. This further strengthens market bets on a Fed rate cut in March, indirectly providing policy-level support for the dollar index.

The ADP report showed that private sector employment increased by only 22,000 in January (far below the market expectation of 48,000), and the December data was revised down from 41,000 to 37,000, which briefly triggered concerns about the labor market.

Positive factors: The ISM Services PMI came in at 53.8, unchanged from the previous reading and higher than the market expectation of 53.5, confirming that US business activity maintained a robust expansion, providing some fundamental support for the US dollar index;

Key to intraday trading: Two major US data releases will dominate subsequent price movements.

Following the ECB's decision, market focus has shifted entirely to subsequent US economic data. Initial jobless claims and JOLTS job openings will be the core drivers of the US dollar index trading today, and traders should pay close attention.

The market generally expects initial jobless claims for the week ending January 30 to rise slightly to 212,000 from 209,000. This data will directly reflect the short-term health of the US labor market.

Meanwhile, job openings in December are expected to rise modestly to 7.2 million from 7.146 million in November. This data is a core indicator reflecting the supply and demand situation in the US labor market. The US non-farm payroll data has also been postponed to next Wednesday.

Summary and Technical Analysis:

Overall, the European Central Bank's decision to keep interest rates unchanged and weak US domestic employment data limited the dollar's rebound.

However, the data from Europe is equally impressive. But due to the recent significant pullback in the euro, it is currently consolidating. Without a significant rebound, there is a risk of further depreciation, which could help push the dollar to continue to strengthen.

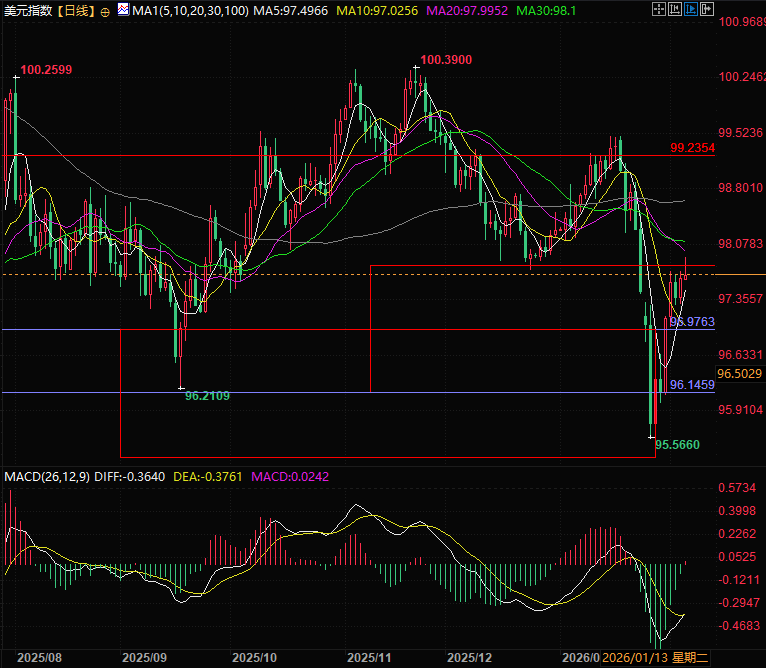

The US dollar index is currently far from the 5-day moving average and close to the upper edge of the trading range. It is necessary to observe whether there is any intraday weakness. If it can maintain this position, that is, far from the 5-day moving average and hovering near the upper edge of the trading range, there is a possibility of further breaking through the trading range and continuing to strengthen upwards.

(US Dollar Index Daily Chart, Source: FX678)

At 21:51 Beijing time, the US dollar index is currently at 97.68.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.