A chart shows that the Baltic Dry Index fell for the fourth consecutive day, with Capesize and Panamax freight rates being the main drags.

2026-02-05 22:59:16

The Baltic Dry Index, a key indicator of the global dry bulk shipping market, fell for the fourth consecutive trading day on Thursday. This index directly reflects changes in the maritime transport costs of key commodities such as iron ore, coal, and grains. The decline was primarily driven by the continued significant drop in freight rates for the two main vessel types, Capesize and Panamax, further highlighting the pressure of a short-term supply-demand imbalance in the market.

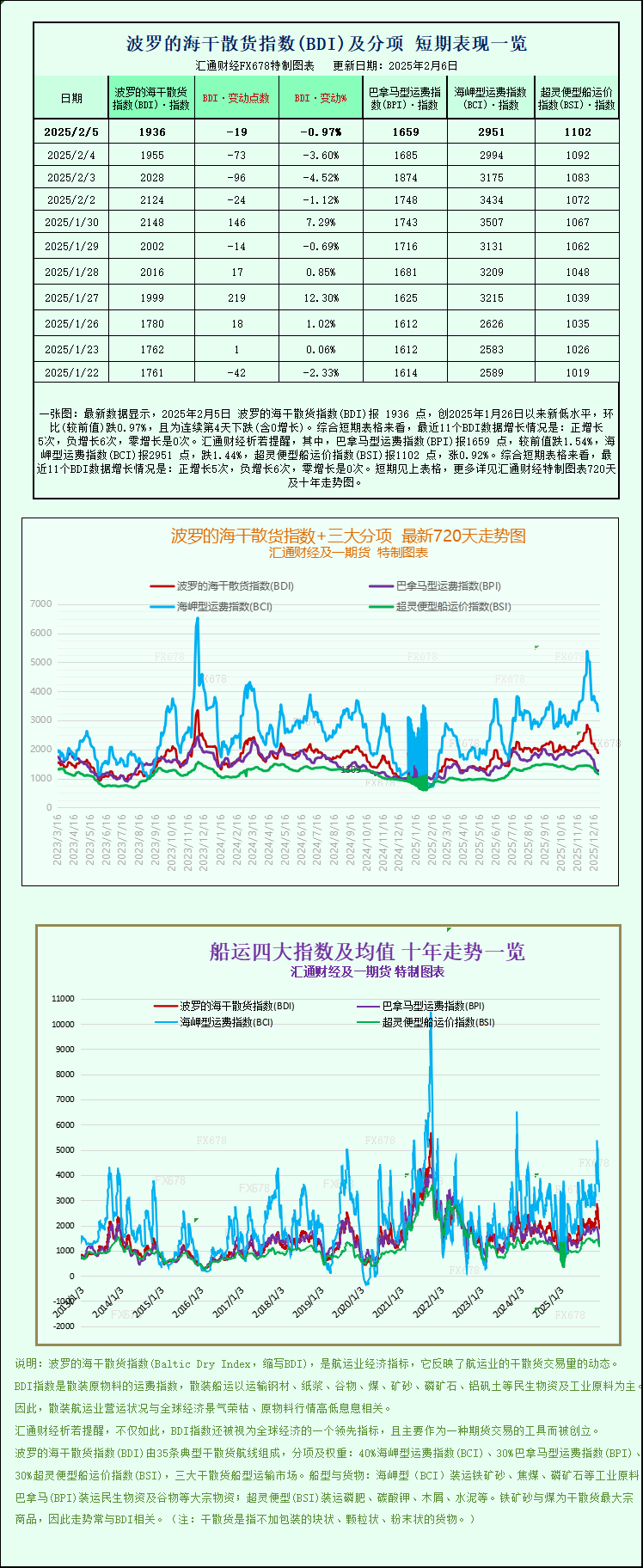

The composite freight rate index, which covers the three core dry bulk shipping categories—Capesize, Panamax, and Supramax—fell 19 points, or 1%, to close at 1936 points, the lowest level since January 26. Looking back at recent trends, the index has been gradually under pressure since late last week. Four consecutive trading days of adjustment have weakened market optimism regarding the short-term prospects of the dry bulk shipping sector. This volatility reflects the combined effects of a slowdown in global commodity trade and relatively ample shipping supply, as well as the weak demand in some sectors during the current global economic recovery.

The Capesize freight index weakened on the day, falling 43 points, a drop of over 1.4%, to close at 2951 points. As the "giant" of the global dry bulk shipping market, Capesize vessels typically have a deadweight tonnage of up to 150,000 tons and are the core capacity for long-distance transoceanic transport of basic industrial raw materials such as iron ore and metallurgical coal. Their freight rate fluctuations are closely related to the global steel industry's health. Affected by this, the average daily earnings of Capesize vessels decreased by $390 to $23,263 per day. Although the current average daily earnings are still within a relatively reasonable range, the continuous decline over several days reflects a temporary contraction in the raw material procurement demand of steel companies and the pressure of excess supply of Capesize vessels in the international shipping market.

Echoing the trend in Capesize freight rates, iron ore futures prices also showed a moderate downward trend during the same period. Market analysis points out that current global iron ore port inventories remain at high levels. This phenomenon is due to the stable operation of steel mill blast furnaces, resulting in a relatively loose supply and demand situation in the iron ore market. Limited demand growth has limited the momentum for significant price increases, and the cooling of iron ore trading activity has further transmitted to the transportation sector, exacerbating the downward pressure on Capesize freight rates.

The Panamax freight index also showed a downward trend on the day, falling slightly by 26 points, a decrease of 1.5%, to close at 1659 points. Panamax vessels, the mainstay of medium-volume dry bulk shipping, have a deadweight tonnage between 60,000 and 70,000 tons and primarily handle intercontinental and regional transport of bulk commodities such as coal, grain, and alumina. Their freight rate fluctuations are closely related to the energy market and the health of agricultural trade. Affected by seasonal adjustments in global energy demand and a slowdown in grain trade, the average daily earnings of this type of vessel decreased by $235 to $14,931 per day. The continuous decline in earnings over several days has put some pressure on the short-term profitability of related shipping companies.

It is worth noting that while freight rates for large vessels generally declined, the market for small vessels bucked the trend and rose. The Supramax freight rate index rose 10 points, or 0.9%, to close at 1102 points, reaching its highest level since December 24, 2025. Supramax vessels mainly focus on short-haul dry bulk shipping within regions, and their freight rates better reflect the supply and demand dynamics of regional markets. This counter-trend increase is attributed to both the steady growth in demand for building materials transportation and short-haul agricultural product distribution in some coastal areas, and the relatively tight supply of small vessels. This has, to some extent, offset the impact of the decline in freight rates for large vessels on the overall market, demonstrating the differentiated characteristics of the global dry bulk shipping market's internal structure.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.