A V-shaped reversal from the 4655 low! Geopolitical risks and a weak dollar helped gold reverse its course in the European session.

2026-02-06 18:58:25

A resurgence in safe-haven demand is currently the main supporting force for gold prices. Global stock markets continued their sell-off, particularly the plunge in tech stocks which exacerbated selling pressure on Wall Street. Asian stocks fell for the second consecutive day, driving funds into gold, a traditional safe-haven asset. Furthermore, the US-Iran nuclear negotiations began in Oman on Friday, with the White House reiterating that diplomacy is President Trump's preferred approach to Iran, while warning of the continued existence of military options. This keeps geopolitical risks in place, further strengthening gold's safe-haven appeal. Despite significant differences in the negotiation agenda, the market is closely watching the progress. Positive signals could temporarily suppress gold prices, but current uncertainty remains a positive factor for gold.

The pressure on the US dollar index provided additional support. Some dollar selling occurred, weakening the dollar's downward pressure on gold. Expectations of Federal Reserve policy continued to support gold prices: the CME FedWatch tool showed that traders were pricing in a high probability of at least two 25-basis-point rate cuts by 2026. This expectation was exacerbated by weak US labor market data this week—ADP private sector job growth in January was only 22,000, far below the previous figure of 37,000 (revised) and the expected 48,000; JOLTS job openings fell to 6.542 million (previous figure revised from 6.928 million); initial jobless claims rose to 231,000, higher than the previous figure of 209,000 and the expected 212,000. These data reinforced concerns about an economic slowdown, fueling expectations of rate cuts, which is beneficial for non-interest-bearing gold.

However, potential limiting factors cannot be ignored. US President Trump stated that if Kevin Warsh had the will to raise interest rates, he wouldn't have nominated him as Federal Reserve Chairman, emphasizing that a Fed rate cut is "virtually a foregone conclusion." However, the market is concerned that Warsh, as the incoming Fed Chairman (nominated on January 30th), might adopt a less dovish stance, which could limit further upside for gold prices. Later today, the preliminary Michigan Consumer Sentiment Index, inflation expectations data, and statements from Fed officials will be the focus, directly impacting dollar demand and gold price movements. Overall, gold prices are supported in the short term by a resurgence in safe-haven demand, a weaker dollar, and expectations of rate cuts, but uncertainties remain regarding the outcome of geopolitical negotiations and Fed policy signals. Investors should be wary of increased volatility and are advised to pay attention to resistance above $4,900 and support below $4,700.

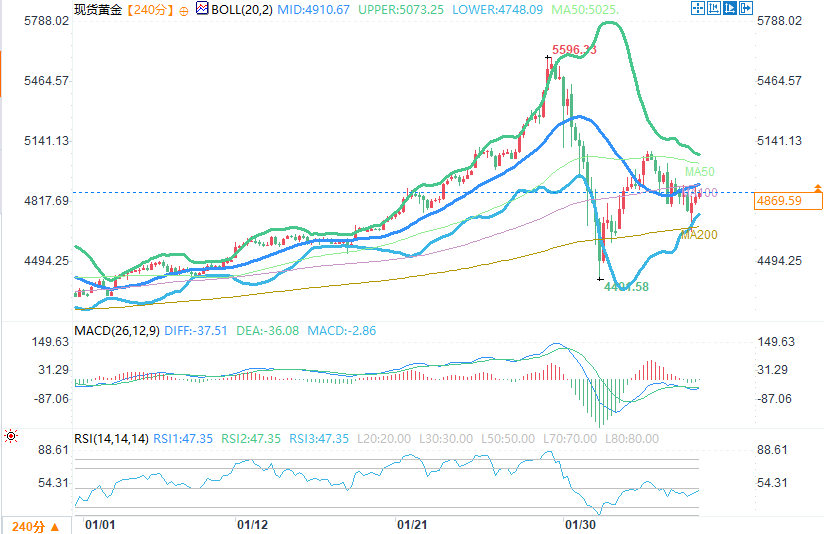

Technical Analysis

(4-hour chart of spot gold source: EasyForex)

The 4-hour chart shows that a short-lived surge in gold prices has ended. After reaching above $5,500, prices experienced a significant pullback, briefly dipping to the $4,450-$4,500 range. Gold then rebounded to the $5,000-$5,050 area, but remained under pressure from the key resistance level of $5,100-$5,150 and below the Bollinger Band's middle line. The overall price structure indicates that after an overheated rally, gold is currently in a phase of high volatility and a redistribution of power between bulls and bears.

(Spot gold 1-hour chart source: EasyForex)

On the 1-hour chart, after a sharp drop, gold prices formed a local bottom in the $4650-$4700 range and began a recovery. Currently, the price has returned to the Bollinger Bands and is consolidating near the middle band in the $4820-$4850 range. From a technical perspective, the current rebound in gold prices is a corrective move, with market volatility continuing to decline and the balance between bulls and bears temporarily at rest.

Summarize

Overall, the decline in gold reflects a market reassessment of asset value: fading geopolitical anxieties, coupled with rising market expectations for further easing by the Federal Reserve, have gradually eliminated the core factors that previously fueled the speculative surge in gold. Technically, this sell-off represents a high-volatility correction in line with market dynamics after an overheated price increase.

Although gold prices have shown signs of short-term stabilization, the overall trend remains fragile below key resistance levels at higher cyclical levels. Short-term gold price movements will likely depend on subsequent US economic data releases – their performance will either strengthen or weaken market expectations for a dovish rate cut by the Federal Reserve. Meanwhile, the ongoing diplomatic negotiations in the Middle East will also be a significant factor influencing gold prices.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.