A chart shows the Baltic Dry Index is poised for a weekly decline due to lower rates for Capesize and Panamax vessels.

2026-02-06 23:06:37

The Baltic Dry Index continued its decline on Friday and is set to record a weekly loss, primarily pressured by persistently low rates for Capesize and Panamax vessels. This index is a key indicator of the global dry bulk shipping market, tracking freight rates for vessels transporting dry bulk commodities such as iron ore, coal, and grain. Its fluctuations directly reflect the activity of global dry bulk trade and market supply and demand.

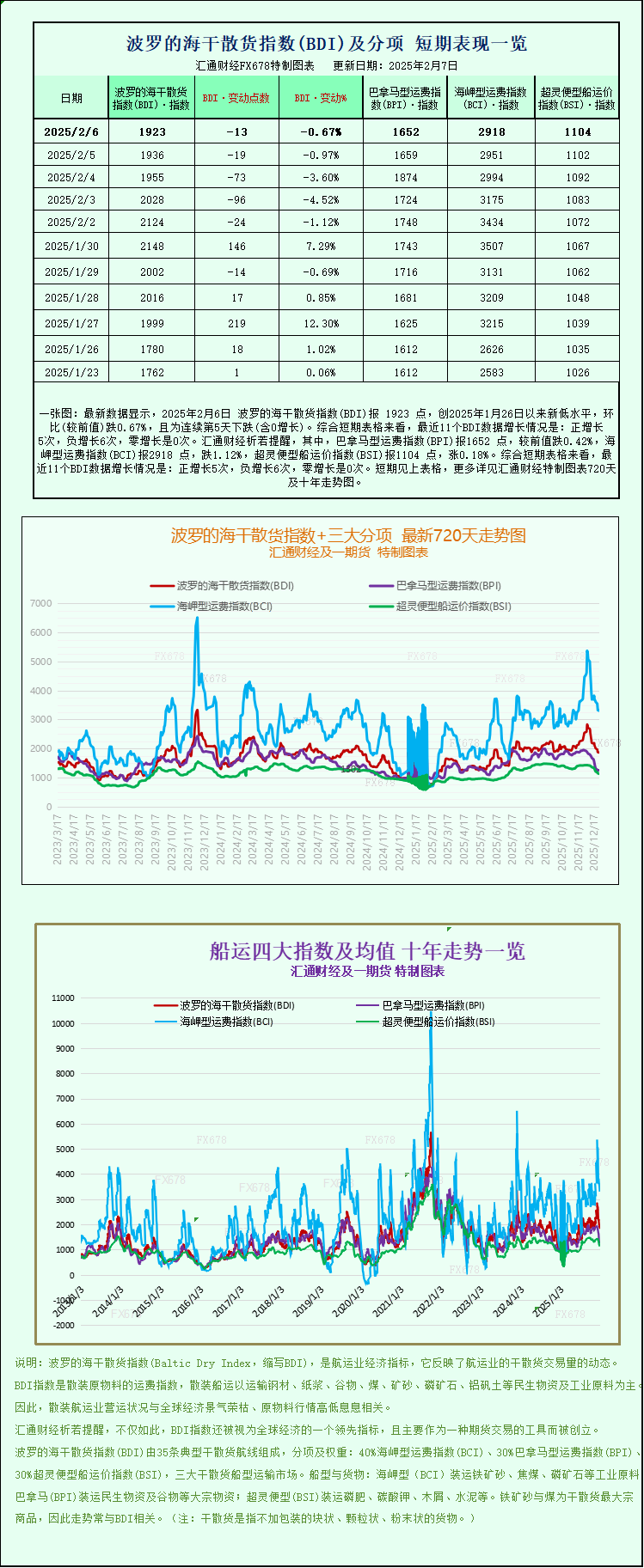

The Baltic Dry Index (BDI) fell 13 points, or 0.7%, to close at 1923. On a weekly basis, the index fell by approximately 10.5% this week, marking one of the largest weekly declines in recent times, highlighting the current weakness in the dry bulk shipping market. The index covers the three main vessel types: Capesize, Panamax, and Supramax. Its overall decline indicates widespread pressure across all segments of the dry bulk shipping market.

The Capesize freight index fell 33 points, a drop of over 1.1%, to close at 2918 points, with a cumulative decline of 16% this week, becoming the main force dragging down the overall index. Capesize vessels are the largest mainstream vessel type in global dry bulk shipping, mainly responsible for transporting bulk commodities such as iron ore and coal across oceans. Their freight rate fluctuations are closely related to global steel industry demand and coal consumption demand.

Capesize vessels saw their average daily earnings fall by $298 to $22,965. These vessels typically have a standard deadweight of around 150,000 tons and primarily transport core commodities such as iron ore (used in steel production) and coal (used in power supply and industrial production). The decline in their average daily earnings directly reflects the shrinking global demand for bulk cargo shipping.

Iron ore futures fell for the second consecutive trading day, impacted by a broad sell-off in commodities triggered by the plunge in Wall Street tech stocks. Singapore iron ore futures prices fell below $100 per ton for the first time since November 2025. As iron ore is a core cargo for Capesize vessels, a price decline typically indicates weakened purchasing demand from global steel companies, leading to reduced demand for iron ore transportation and indirectly dragging down Capesize freight rates.

Wall Street stocks closed sharply lower on Thursday, with the Nasdaq Composite Index falling to its lowest point in more than two months. This followed Alphabet, Google's parent company, announcing it would double its capital spending on artificial intelligence (AI). This move sparked concerns about the profitability and liquidity of tech companies, causing a sharp drop in the share prices of tech giants such as Microsoft and Amazon, dragging down the entire stock market. The weakness in the stock market further spilled over into the commodities market, triggering panic selling by investors, which in turn affected the prices of dry bulk commodities such as iron ore and transportation demand.

The Panamax freight index fell slightly by 7 points, or 0.4%, to close at 1652 points. The cumulative decline for the week was 5.4%, a relatively mild drop, but still dragging down the overall index. Panamax vessels are medium to large-sized vessels in dry bulk shipping, with tonnage between Capesize and Supramax vessels, suitable for most canals and port channels worldwide.

Panamax vessels saw their average daily earnings fall by $66 to $14,865. These vessels typically have a standard deadweight tonnage of 60,000 to 70,000 tons and primarily transport commodities such as coal (for regional power supply) and grain (for food trade). The slight decline in their average daily earnings reflects weak demand in the regional dry bulk shipping market.

Meanwhile, in the small vessel sector, the Supramax freight rate index rose slightly by 2 points, or 0.2%, to close at 1104 points, with a cumulative increase of 3.5% this week, making it the only sub-segment in the dry bulk shipping market to achieve growth this week. Supramax vessels are smaller in tonnage and mainly handle dry bulk cargo transportation in near-sea and coastal areas, transporting small batches of iron ore, coal, grain, and other bulk cargo. The increase in freight rates may be related to a temporary recovery in demand for dispersed cargo transportation within the region, which to some extent alleviated the downward pressure on the composite index, but failed to change the overall weak market trend.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.