A chart shows the Baltic Dry Index falling to a two-week low due to weakening Capesize and Panamax freight rates.

2026-02-09 23:44:56

On Monday, the Baltic Dry Index (BDI), which measures freight rates for vessels transporting dry bulk commodities, fell to its lowest point in two weeks, mainly dragged down by weaker rates for Capesize and Panamax vessels. As a core link in global commodity trade, the fluctuations in the dry bulk shipping index directly reflect the demand for transporting key raw materials such as iron ore, coal, and grains, as well as market sentiment. This decline reflects the current short-term pressure on the global dry bulk market.

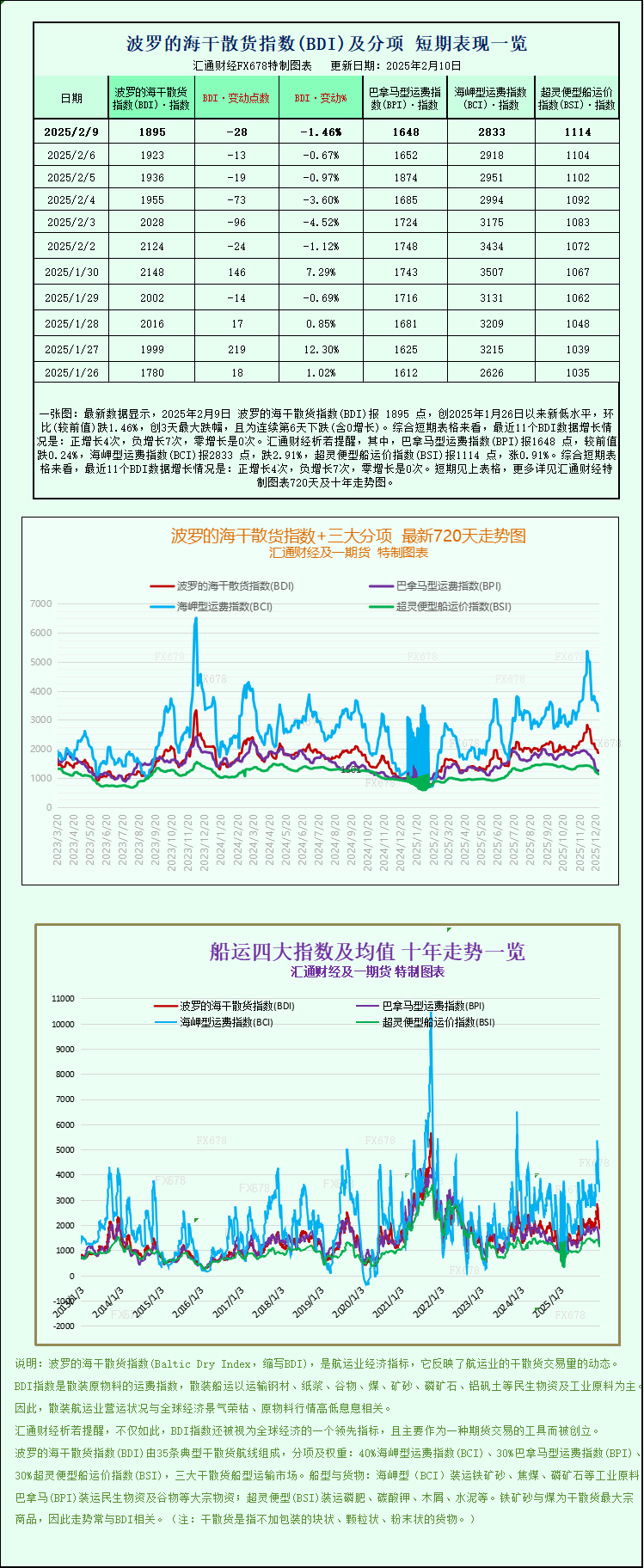

The main index (which monitors freight rates for Capesize, Panamax, and Supramax vessels) fell 28 points, or 1.5%, to close at 1895, its lowest level since January 26. While not a sharp drop, this decline continues the recent downward trend of the index, highlighting the market's cautious expectations for dry bulk shipping demand.

The Capesize freight index fell 85 points, a drop of over 2.9%, to close at 2833 points, also reaching its lowest point in two weeks. Capesize vessels are among the largest tonnage vessels in global dry bulk shipping, primarily responsible for transporting bulk raw materials across oceans. Their freight rate fluctuations have the most significant impact on the overall dry bulk freight index. This time, their decline far exceeded that of the overall index, becoming the main force dragging down the index.

Capesize vessels saw their average daily earnings decline by $776 to $22,189. These vessels, typically with a capacity of 150,000 tons, primarily transport heavy commodities such as iron ore and coal. They are key transport links between major iron ore producing countries like Australia and Brazil and consuming countries like China. The decline in their average daily earnings directly reflects the weakness in global demand for iron ore transportation.

On Monday, Dalian iron ore futures fell slightly for the sixth consecutive trading day, mainly due to rising domestic iron ore inventories in China and persistently weak market demand, both factors suppressing iron ore prices. Furthermore, major Australian iron ore hubs have resumed port operations after cyclone warnings were lifted, and iron ore exports are expected to gradually recover, further pressuring futures prices.

The Panamax freight index fell slightly by 4 points, a drop of only 0.2%, to close at 1648 points. Compared to Capesize vessels, Panamax vessels have a moderate tonnage and relatively flexible capacity, and their freight rates typically fluctuate more gently. This slight decline indicates that although the shipping market for this vessel type is under pressure, the overall situation is relatively stable.

Panamax vessels saw their average daily earnings fall by $36 to $14,829. These vessels typically have a capacity of 60,000 to 70,000 tons and primarily transport commodities such as coal and grain, serving regional and short-to-medium-haul transoceanic shipping routes. The slight decline in their average daily earnings is closely related to the mild fluctuations in global grain and coal trade.

Meanwhile, among smaller dry bulk carriers, the Supramax freight rate index bucked the trend, rising 10 points, or 0.9%, to close at 1114 points. Supramax vessels, due to their smaller tonnage and shallower draft, can call at more small and medium-sized ports and primarily handle dry bulk cargo transportation in near-sea and coastal areas. This rise was the only bright spot in the dry bulk shipping market that day, reflecting relatively strong demand for short-haul transportation within the region, partially offsetting the negative impact of weaker freight rates for larger vessels.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.