A chart shows that Capesize freight rates dragged the Baltic Dry Index down to its lowest point in more than two weeks.

2026-02-10 22:39:26

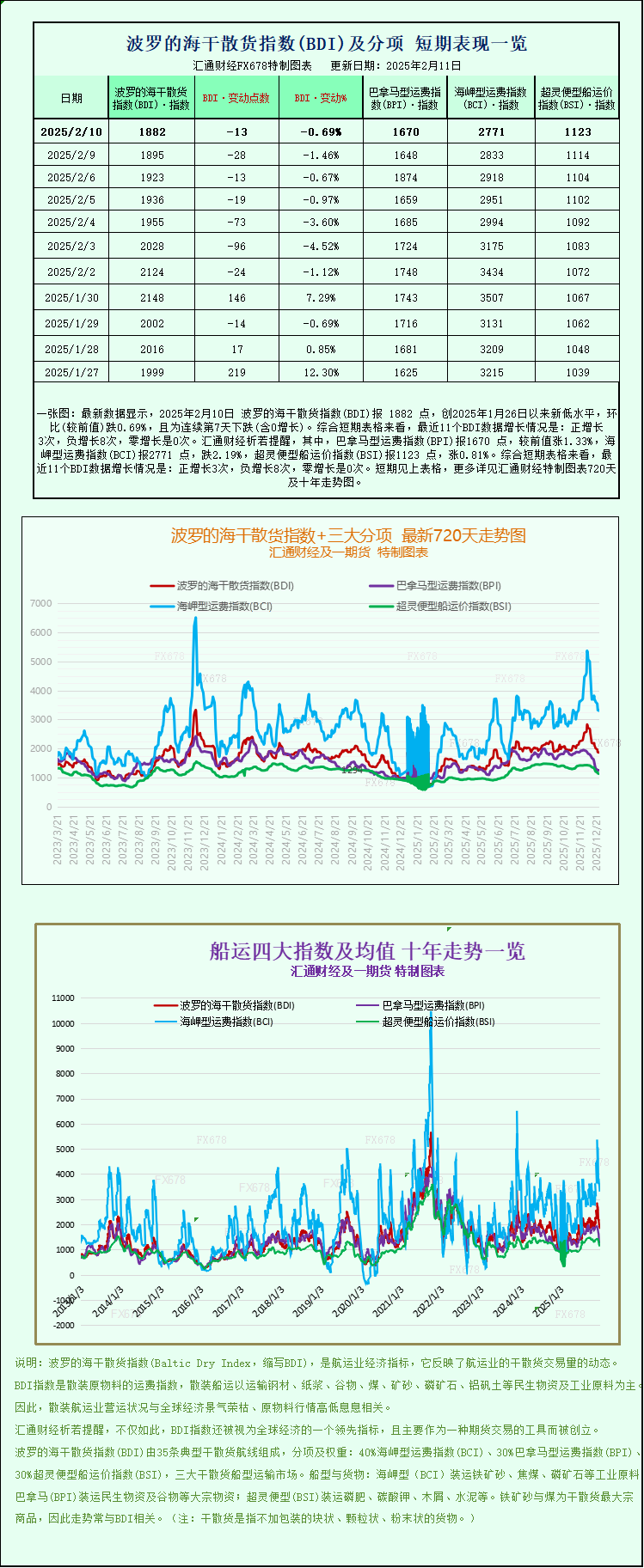

The Baltic Dry Index (BDI), which measures freight rates for dry bulk shipping vessels, fell to its lowest level in more than two weeks on Tuesday, primarily dragged down by weaker Capesize vessel rates. Dry bulk shipping is a core link in global commodity trade, encompassing the transoceanic transport of key industrial and agricultural raw materials such as iron ore, coal, and grains. As a leading indicator of industry health, the BDI's fluctuations directly reflect changes in supply and demand in the global dry bulk shipping market.

The composite freight index, which covers freight rates for three major dry bulk carrier types—Capesize, Panamax, and Supramax—fell 13 points, or 0.7%, to close at 1882 points, the lowest level since January 26, indicating a continued decline in the overall dry bulk market sentiment recently.

The Capesize freight rate index performed the worst, falling 62 points, or 2.2%, to close at 2771 points, also reaching its lowest point in two weeks. Capesize vessels are among the world's largest dry bulk carriers, primarily undertaking long-haul transoceanic transport missions, and their freight rate fluctuations have the most significant impact on the composite index.

The average daily earnings of Capesize vessels also declined, decreasing by $564 to $21,625 on the day. These vessels typically have a deadweight tonnage of around 150,000 tons, and their core cargoes are iron ore and coal. They primarily serve the raw material supply needs of large global steel mills and energy companies, and their earnings are closely linked to global industrial demand.

Meanwhile, Dalian iron ore futures closed flat on Tuesday after falling for six consecutive trading days. Traders are currently weighing multiple factors: on the one hand, low raw material prices and declining ship shipments are supporting futures prices; on the other hand, the pressure of weak market demand persists, and the balance between these two factors has led to the temporary stabilization of futures prices.

The Panamax freight index bucked the trend, rising 22 points, or 1.3%, to close at 1670 points. Panamax vessels are medium-sized dry bulk carriers, suitable for most canals and port channels worldwide, offering high flexibility.

Panamax vessels saw their average daily earnings rise, increasing by $198 to $15,027. These vessels typically have a deadweight tonnage of 60,000 to 70,000 tons and primarily transport coal and grain, covering both near-sea and transoceanic routes. Their freight rates bucked the trend and, to some extent, alleviated the downward pressure on the overall index.

In the small vessel sector, the Supramax freight rate index rose slightly by 9 points, or 0.8%, to close at 1123 points. Supramax vessels have smaller carrying capacities and greater flexibility, primarily serving short-haul dry bulk shipping within the region. The slight increase in their freight rates reflects relatively stable demand in the regional market.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.