The New York Fed's incredible report backfired, and Trump was contradicted by his own people.

2026-02-13 15:55:05

As the average U.S. import tariff jumped dramatically from less than 3% to 13%, the economic burden of the tariffs was not borne by overseas exporters as the government claimed. Instead, it was almost entirely passed on to U.S. businesses and consumers in the form of increased costs.

Regarding the controversy over who should bear the cost of tariffs, the Trump administration has consistently maintained that foreign producers and intermediaries are the main bearers, arguing that economies highly dependent on exports will passively absorb tariffs to avoid losses.

However, research from the Federal Reserve Bank of New York directly refutes this view. Data shows that from January to August 2025, U.S. importers will bear 94% of the tariff costs. Even if the proportion borne by exporters increases slightly by November, U.S. importers will still bear 86% of the tariff expenditure, and U.S. domestic entities will remain the core bearers of tariff costs.

This research finding seems to contradict our own past mistakes.

Research by the Federal Reserve Bank of New York shows that the main tariff costs are borne by the domestic market.

In theory, if foreign exporters bear the burden of tariffs, they should proactively lower their selling prices (export prices) when tariffs increase in order to offset the tariffs and maintain their competitiveness in the US market.

However, overseas exporters have not actually lowered their export prices significantly to absorb tariff costs.

This results in a very high pass-through rate of tariffs to US import prices, leading to price increases for imported goods. In the first eight months of 2025, 94% of tariff costs will be passed on to the US, and even by the end of the year, 86% of tariffs will still be reflected in US prices.

When import prices rise, exporters bear only a small portion of the cost, so the economic burden of tariffs is ultimately borne primarily by American businesses and consumers.

White House supports tariffs: Economic data provides short-term support for the dollar.

The White House defended its tariff policy, arguing that despite tariffs rising nearly sevenfold, U.S. inflation has actually declined and corporate profits have improved. This, coupled with a combination of policies including tax cuts, deregulation, and guaranteed energy supply, has continued to drive economic growth.

The annualized GDP growth rate of the United States reached 4.3% in the third quarter of 2025, a new high in two years. In January, 130,000 new non-farm jobs were added, and the job market remained resilient. The Treasury Department's tariff revenue for the whole year increased by 192% year-on-year to $287 billion.

High Legal Risks: Significant Uncertainty Surrounds the Legality of Tariff Policies

The sustainability of tariff policy faces significant legal challenges.

The U.S. Supreme Court is about to rule on the legality of Trump's tariffs imposed under the Federal Emergency Management Act. If the tariffs are ruled invalid, the U.S. government may face up to $168 billion in corporate tax refund obligations, significantly increasing policy uncertainty.

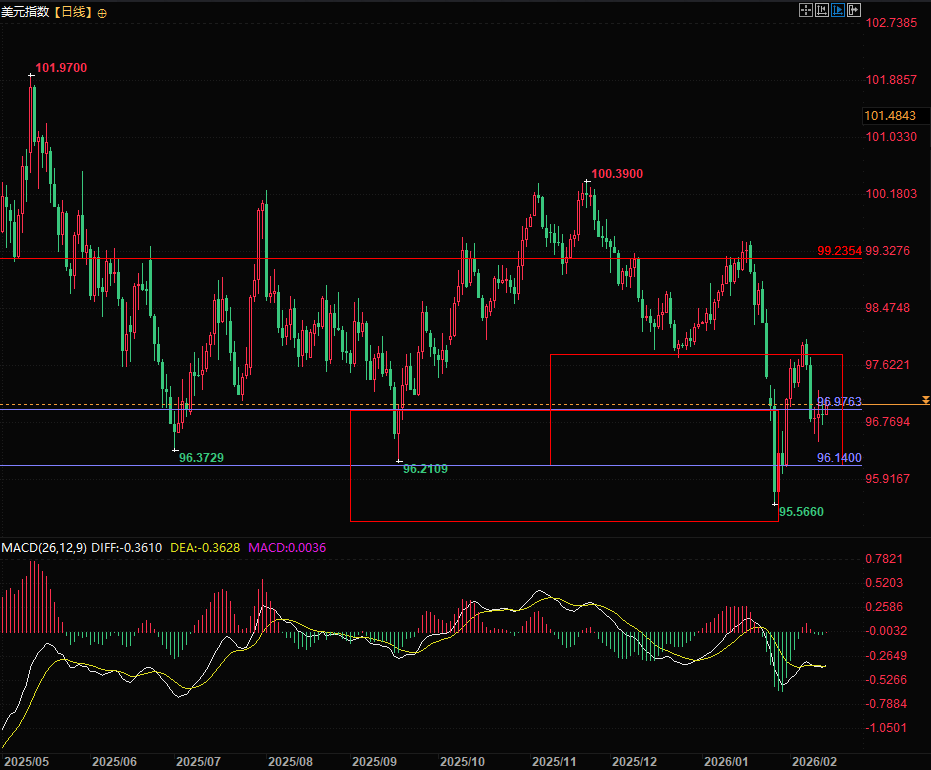

US Dollar Index Trend: Short-term positive, medium- to long-term pressure

From the perspective of the foreign exchange market, this round of tariff policies has a mixed impact on the US dollar index: in the short term, strong US economic and employment data and a significant increase in tariff revenue provide fundamental support for the US dollar;

However, in the medium to long term, the continued shift of tariff costs to the domestic market will suppress corporate profits and consumption potential. The uncertainty surrounding the legality of the policies will exacerbate market concerns about the stability of US policies. Escalating trade frictions will also weaken the global willingness to allocate assets in US dollars, thus exerting long-term downward pressure on the US dollar index.

The future trend of the US dollar index will depend heavily on the judicial rulings on tariff policies and the sustainability of the resilience of the US economy.

(US Dollar Index Daily Chart, Source: FX678)

At 15:52 Beijing time, the US dollar index is currently at 97.062.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.