CPI feinted, short sellers suffered a sharp rebound, and silver entered the battering zone?

2026-02-13 21:52:03

According to the London Bullion Market Association (LBMA) precious metals forecast survey for 2026, the average price of silver for the year is expected to be US$79.57 per ounce.

It should be clarified that $79.57 is the average annual forecast. Analysts generally believe that silver will exhibit a wide range of fluctuations on a weekly and monthly basis in the coming year. This high volatility provides ample opportunities for price arbitrage.

Some institutions have even given a yearly high forecast of $160 per ounce, highlighting its potential trading value.

Why did silver prices pull back?

Besides the correlation with the decline in US stocks, there are several other reasons. First, the recent continuous decline in 5- and 10-year US Treasury yields, coupled with the lack of a rebound in the US dollar index, reveals a lot. The fact that the dollar did not rebound after the release of positive non-farm payroll data indicates that funds are still flowing out of the dollar and being converted into other currencies, offsetting the dollar's potential rebound. Second, the decline in US Treasury yields represents funds flowing into US Treasuries. Therefore, we can conclude that overall funds are flowing out of the US market, while existing funds are flowing into US Treasuries. As a result, it is reasonable that US stocks and precious metals are under pressure due to a lack of funds.

Secondly, the pre-holiday effect of China's long holiday and the pre-holiday effect of the US long weekend. As one of the major trading countries for gold and silver, China's pre-holiday effect is expected to cause domestic precious metals, equity and other investment products to decline. At the same time, the US is also facing a 3-day long weekend, so funds choose to withdraw one day in advance.

Third, the recent US non-farm payroll data was better than expected. However, since it was data released by the BLS (US Department of Labor) and does not represent the January data, and the recent Challenger layoffs and job openings also indicate that the job market is contracting, the market did not pay much attention at first. However, if the US CPI released on Friday shows rising inflation, coupled with the wage increase in non-farm payrolls, it may confirm that the inflation risk has not subsided, which will affect the market's bets on the Federal Reserve to cut interest rates.

Therefore, the market chose to hedge against risk before the release of important CPI data. Before the non-farm payrolls report, the market did not choose to hedge in advance because the preceding employment data was very poor. However, the actual CPI data was lower than expected. The core CPI was 2.5%, which was in line with the expected value of 2.5%, while the CPI including food and energy was 2.4%, which was lower than the expected 2.5%. This also means that the CPI has the greatest impact on ordinary people. The inflation of food and energy, which are the most frequently purchased items, is easing. The hedge funds actually failed to bet. Short sellers began to cover their positions the moment the data was released, and at the same time, the conditions for a US interest rate cut became more favorable.

There is another market speculation that, since the volume of spot silver contracts is not large, but many of the participants are physical business operators who need physical goods, their long positions will not be closed. They will take physical goods from the short positions on the delivery date. At present, standard silver is in very short supply in the London spot market. If the short sellers cannot find enough physical goods by the end of March, they will face default.

Therefore, the short sellers chose to increase their short positions and take advantage of the market panic and decline to find opportunities to close their positions. As we all know, it is difficult for institutions to close their short positions when silver prices rise because there are no counterparties. It is easy to close the silver price at a very high level, which is equivalent to chasing the high.

Strong logical support for a medium- to long-term bullish trend in silver.

The logic of safe-haven substitution and capital rotation: As a "cheap safe-haven alternative" to gold, silver possesses clear safe-haven attributes due to its lower entry barrier. Its price typically moves in tandem with gold, but with a lag – initially, funds flow into gold when safe-haven sentiment rises; however, when gold valuations become too high, some funds shift to the more cost-effective silver. This is the core reason why silver's 147% gain last year significantly outperformed gold's 65%. The current macroeconomic backdrop of escalating geopolitical conflicts and a weakening dollar continues to enhance the overall attractiveness of precious metals, providing fundamental support for silver trading.

Structural drivers of explosive industrial demand: Silver's industrial properties have become a key growth driver. Its conductivity is superior to copper, making it a core raw material for solar panels, technological equipment, electric vehicles, and data centers.

The ongoing energy transition continues to drive demand for silver in the industrial sector. UBS data shows that the increased demand for silver from the new energy and high-tech industries has become one of the core drivers of price increases. From a trading perspective, this structural demand provides solid fundamental support for medium- to long-term bullish strategies.

The supply-demand gap and the scarcity logic reinforced by policies: Limited supply is a long-term pain point for silver - silver is mostly a by-product of copper, gold, lead and zinc mines, with limited independent production capacity, and the supply-demand gap has lasted for more than six years.

On the policy front, the US added silver to its list of critical minerals last November, further tightening supply expectations. Coupled with the extreme liquidity volatility that occurred in 2025, current silver leasing rates are still significantly higher than gold rates, and a liquidity crisis may erupt again in 2026, becoming a potential catalyst for a price surge.

Institutional Forecasts and Trading References: Price Range Guidance Amidst Bullish/Bearish Divergence

(I) Bullish Camp: Aggressive Targets and Trading Opportunities

Bruce Ikemi of the Japan Gold and Silver Market Association (JBMA) gave the most aggressive target: the price of silver in 2026 could reach a high of $160 per ounce and a low of $65, with an average price of $120 for the year.

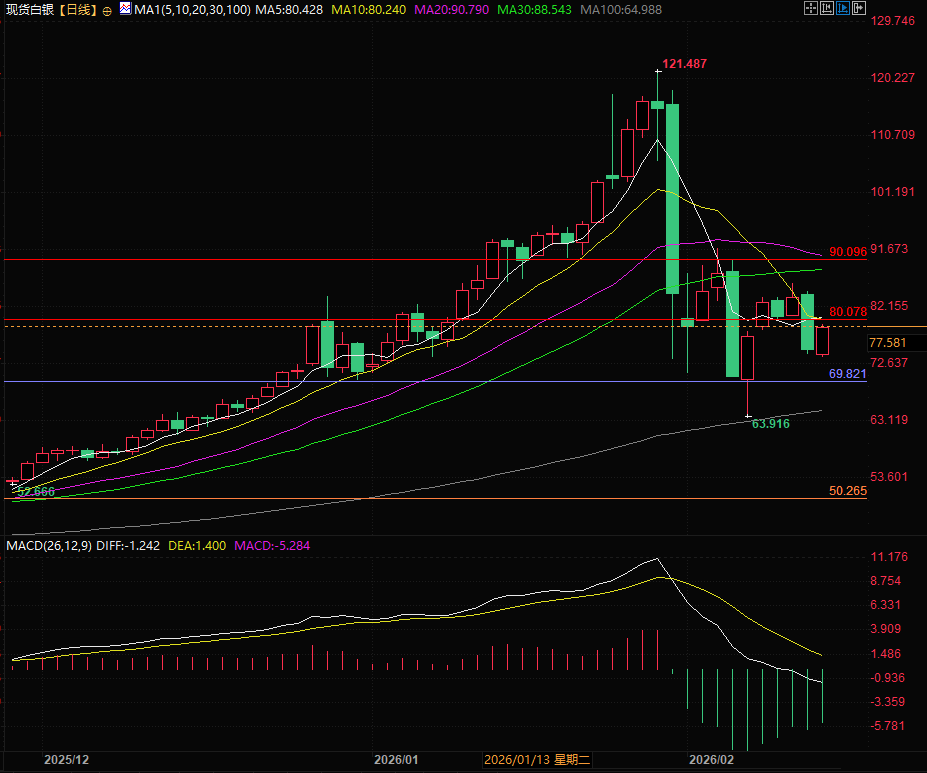

From a trading perspective, after silver prices hit a record high of $121 on January 29, they fell to $67 during last week's sell-off, which was close to the predicted low. The current price range of around $77 provides trend traders with an opportunity to buy on dips.

The core logic is that, in addition to the common support for gold, the supply-demand imbalance and liquidity gap unique to silver will continue to push up prices.

Julia Du of ICBC predicts: a high of $150/ounce, a low of $62/ounce, and an average price of $125 for the year.

Du emphasized the characteristics of sharp price fluctuations, reminding traders to pay attention to position management—a phased pullback caused by profit-taking can be regarded as an entry window for short-term trading, while the judgment that the long-term trend remains unchanged supports the swing trading strategy.

Silver is expected to continue its bull market trend in 2026, with the core drivers being the same as those for gold (geopolitical tensions, safe-haven demand, and Fed rate cuts).

More importantly, the silver market is smaller and has relatively limited liquidity. Coupled with lower entry costs, its volatility is significantly higher than that of gold (currently, gold's implied volatility is 21%, while silver's volatility is even higher), making it extremely attractive to traders seeking highly volatile assets.

Structural supply shortages coupled with increased demand for jewelry and investment will further amplify price volatility. Supply chain restructuring triggered by potential US tariffs may fuel speculative price increases.

(II) Pessimistic Outlook: Risk Warning and Stop-Loss Reference <br/> Caroline Bain & Company holds a relatively pessimistic view: the high point of silver prices in 2026 will be $85/oz, the low point will be $45/oz, and the average price for the year will be $63.50.

The core logic is that gold prices are expected to correct in the second half of the year, and silver, as a high-beta commodity, may experience a larger percentage decline.

This forecast provides traders with an important stop-loss reference – if the price falls below the key support level of $60, be wary of the risk of further decline.

However, Bain also acknowledged that silver prices have stronger independent support: strong industrial demand in sectors such as electronics and renewable energy, coupled with China's export restrictions, structural market shortages, and low physical inventories, limit downside potential and provide fundamental support for traders to set stop-loss levels.

Summary and Technical Analysis:

Overall, the core of silver trading in 2026 lies in "seizing trend opportunities amidst volatility." The supply-demand gap in the fundamentals and policy support constitute the long-term bullish logic, while the high volatility provides flexibility for short-term trading. Traders need to find a balance between trend judgment and risk control.

From a technical perspective, spot silver is trading around round number levels, currently between 70 and 80. As mentioned in previous articles, the price center of silver is around round number levels like 60, 70, and 80, so there are trading opportunities when the price approaches these round number levels.

(Spot silver daily chart, source: EasyForex)

At 21:48 Beijing time, spot silver is currently trading at $78.37 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.