A chart shows that the Baltic Dry Index fell slightly on Friday, with significant divergence in performance across different vessel types.

2026-02-13 23:11:34

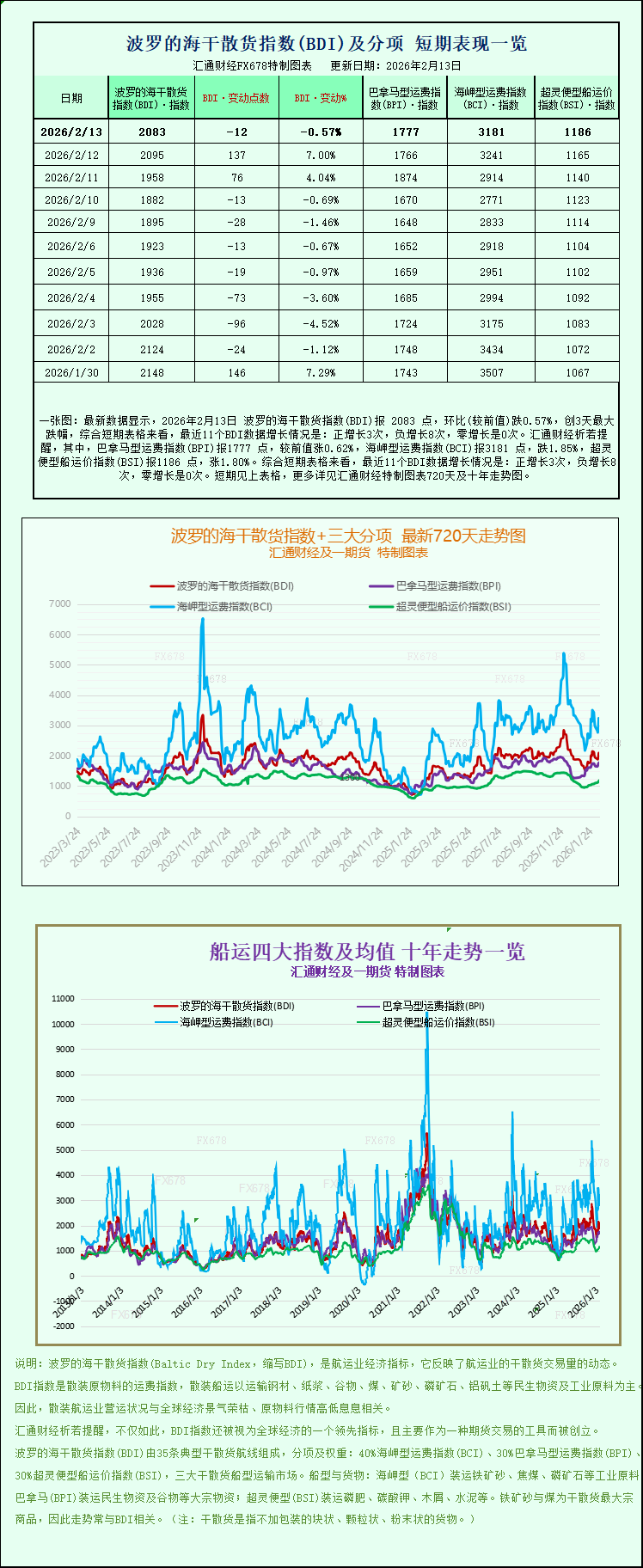

As a core indicator of freight rates in the global dry bulk shipping market, the Baltic Dry Index (BDI-related system) published by the London Baltic Exchange saw a slight downward adjustment on Friday. Specifically, freight rates for different vessel types showed a significant divergence. The marked decline in freight rates for Capesize vessels completely offset the upward momentum in freight rates for Panamax and Supramax vessels, ultimately resulting in a slight overall decline in the index, reflecting the still fragile supply-demand balance in the current dry bulk market.

The core monitoring indicator—the Baltic Dry Index—was under pressure on the day, specifically falling 12 points, a drop of 0.6%, to close at 2083 points. The index primarily tracks freight rates for the three major dry bulk carriers: Capesize, Panamax, and Supramax. It is a key indicator reflecting the overall health of the global dry bulk shipping market, and its fluctuations directly reflect the relative changes in global seaborne demand and supply of commodities such as iron ore, coal, and grains. It is worth noting that the index had just climbed to a one-week high on Thursday, and this slight pullback highlights the market's short-term volatility but does not change the recent overall pattern of consolidation.

Among the various vessel types, Capesize vessels (also known as Harborsize vessels) were the main drag on the overall index that day, with their corresponding index showing weakness, falling sharply by 60 points, a drop of 1.9%, to close at 3181 points. Capesize vessels, as the "juggernauts" of the dry bulk shipping market, are too large to pass through the Suez Canal and must detour around the Cape of Good Hope or Cape Horn. They primarily undertake the transoceanic transport of large global commodities, and their freight rates are highly correlated with the global demand for seaborne industrial raw materials such as iron ore and coal. This index decline directly reflects the short-term weakening of seaborne demand for these commodities.

In line with the decline in the Capesize vessel index, the average daily charter income for Capesize vessels also decreased. Data shows that the average daily income for this type of vessel decreased by $547, ultimately falling to $25,346. It is understood that a single Capesize vessel typically has a capacity of around 150,000 tons and is mainly used to transport large quantities of basic industrial raw materials such as iron ore and coal. They are crucial transport carriers in the global supply chains of industries such as steel and electricity, and fluctuations in their charter income directly affect the operating efficiency of shipowners. This decline further confirms the short-term downturn in this segment of the market.

From the demand side, the decline in Capesize vessel freight rates and charter rates is closely related to the performance of the upstream commodity futures market. On Friday, iron ore futures prices fell significantly, primarily due to the approaching Spring Festival holiday, with major domestic and global traders closing out their positions to mitigate the risks of market volatility during the holiday. Simultaneously, the market generally expects a temporary slowdown in global industrial production during the Spring Festival holiday, especially in China, the world's largest iron ore importer, where import demand is expected to decrease sharply. This will then be transmitted to the shipping market, putting pressure on Capesize vessel demand and pushing down freight rates and charter rates. Looking at recent iron ore futures market trends, since early February, the main iron ore futures contract price has been trending downwards, further exacerbating market concerns about seaborne iron ore demand.

In stark contrast to the sluggish performance of Capesize vessels, Panamax vessels shone brightly, with their corresponding index rising slightly by 11 points, or 0.6%, to close at 1777. As a mainstay in the dry bulk shipping market, Panamax vessels have a capacity between Capesize and Supramax, suitable for most ports and shipping routes worldwide. Their freight rates are primarily influenced by the demand for seaborne transport of agricultural products such as coal and grains, as well as industrial raw materials. This index increase reflects the relatively strong demand for these commodities.

As the Panamax vessel index rose, its average daily charter revenue also increased. Data shows that the average daily revenue for Panamax vessels rose by $92, eventually reaching $15,989. These vessels typically have a single-ship capacity between 60,000 and 70,000 tons, and a wide range of transport capabilities, handling both transoceanic transport of bulk commodities such as coal and grain, as well as short-haul regional transport. The increase in charter revenue reflects the current relative balance between supply and demand in this segment of the market, and also benefits from the temporary increase in demand for grain and coal transport in some regions, consistent with the recent strong resilience of the overall small vessel market.

Among smaller dry bulk carriers, Supramax vessels performed exceptionally well, with their corresponding index rising 21 points, or 1.8%, to close at 1186 points. As a small, mainstay vessel type in the dry bulk shipping market, Supramax vessels offer advantages such as high flexibility and port adaptability, primarily undertaking regional dry bulk shipping tasks and being relatively less affected by fluctuations in global macroeconomic demand. Recent market performance shows regional differentiation in the Supramax market. The Atlantic market saw charter rates rise driven by strong demand in the US Gulf Coast, while the Pacific market benefited from capacity constraints caused by port congestion in Indonesia, resulting in stable charter rates. These factors combined to support the rise in the Supramax vessel index and became a significant force driving overall dry bulk market sentiment that day.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.