Gold's $5,000 Do-or-Die Situation: Wall Street Debates Bull and Bear Markets

2026-02-16 14:25:45

This week, global markets will be affected by multiple holidays: the US will be closed on Monday for Presidents' Day and Canada for Family Day, and the world's largest gold market will be closed for the Chinese New Year. In this environment of thin trading, even small capital flows may cause large fluctuations in gold prices, and market volatility may be further amplified.

Gold prices rose initially last week but then fell, with a flash crash drawing attention.

Gold prices consolidated last week, with spot gold rising 1.06% cumulatively, reaching a high of 2.5% on Friday.

However, the flash crash that occurred on Thursday evening was remarkable – gold prices plummeted by nearly 4% in less than an hour, hitting a low of around $4,900, before gradually rebounding and eventually forming a short-term trading range between $4,880 and $5,120.

Regarding this sudden fluctuation, various speculations circulated in the market, including CPI data leaks, panic in the artificial intelligence sector, and profit warnings, but none of them have been confirmed. Adam Barton, head of foreign exchange strategy, pointed out that this trend is more likely due to forced liquidation by large institutions. He speculated that a European fund sold off its holdings to make up for margin calls, and this irrational liquidity shock was further amplified in the thin market conditions.

Capital flows into US Treasuries as a safe haven, lowering nominal interest rates and benefiting gold.

A key recent market characteristic is the decline in US Treasury yields without a rise in the US dollar index. This suggests that, with no increase in domestic funds in the US, US Treasuries have drawn liquidity away from US stocks, putting pressure on them. In other words, the decline in US stocks has led to safe-haven funds flowing into US Treasuries.

Meanwhile, the buying of US Treasuries boosted their prices and lowered their yields, leading to a downward shift in the market interest rate center. This reduced the opportunity cost of holding gold, which was one of the key reasons for gold's rebound last week.

If the rebound in government bond yields is not significant at present, it will continue to benefit the rebound of gold.

(Daily chart of 10-year US Treasury yield)

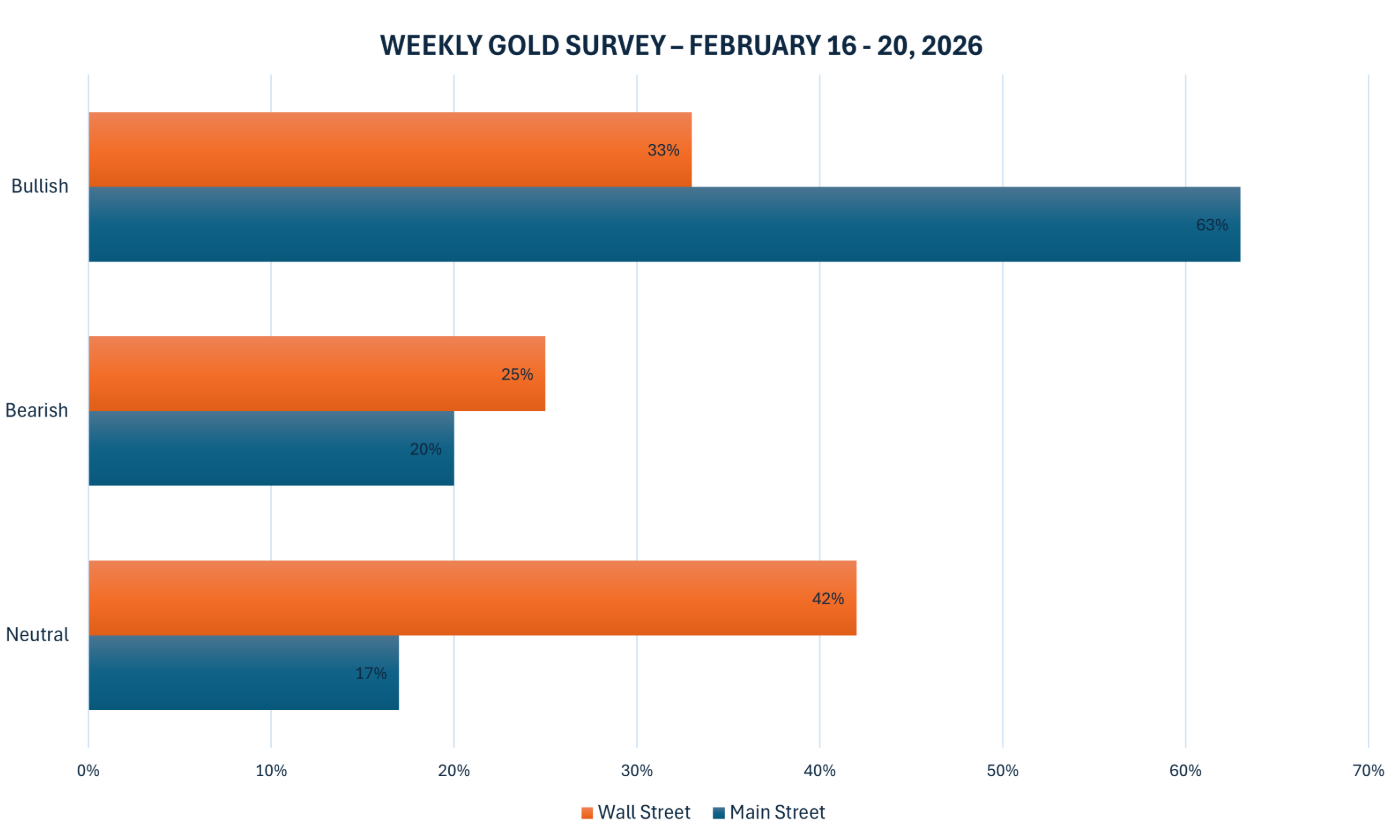

There is a clear divergence between bulls and bears, and institutional opinions are divided.

There is a clear divergence between technical and institutional opinions. Mark Chandler, Managing Director of Bannockburn Global Forex, believes that although gold has been consolidating recently, the probability of a long-term upward breakout still exists. If it can hold above the $5,000 mark and reduce volatility, it is expected to attract investors back into the market.

Senior market analyst Alex Kupzikovich, however, holds a pessimistic view. He points out that the correlation between silver hitting local lows for three consecutive weeks and platinum weakening in tandem suggests that the precious metals market may be turning into a bear market. He expects gold prices to fall back to the $4,600-$4,700 range, and if it breaks through this support level, it could trigger a rapid retreat of bullish investors.

Senior analyst Jim Wyckoff provides key price levels from a technical perspective: bulls need to break through the strong resistance at $5,250 to open up upward potential, while bears could trigger a further pullback if they push the price below $4,670. In the short term, the key levels to watch are the resistance at $5,100 and the support at $4,800.

(Gold Wall Street bullish/bearish comparison chart)

Key data and risk events next week will influence gold price movements.

On the data front, key economic data such as the preliminary value of US fourth-quarter GDP (including the core PCE index), manufacturing PMI, and consumer confidence index will be released successively. As an important indicator for the Federal Reserve to monitor inflation, the performance of the core PCE index may affect expectations for monetary policy.

The minutes of the Federal Reserve's January meeting will also reveal policymakers' discussions on the path of interest rates, providing clues for the direction of future policies.

Regarding risk events, the US Supreme Court's ruling on the president's tariff powers may be finalized next week. If this triggers uncertainty in trade policy, it could provide safe-haven support for gold. Meanwhile, progress in negotiations with Iran and developments related to Federal Reserve Chairman candidate Warsh are also seen by the market as potential sources of volatility.

Trading Strategy: In quiet market conditions, caution is paramount; strictly control risk.

For gold traders, extra caution is needed in the quiet market conditions during the holiday season. Adam Barton cautions that the current high volatility environment makes asset valuation more difficult, dampening investor confidence. With expectations of seasonal weakness after the Lunar New Year, there is a lack of clear catalysts for short-term gains, and a neutral stance is recommended while waiting for a clearer direction.

Michael Moore, founder of Moore Analytics, offered specific trading advice: In the short term, attention should be paid to the key support level of 50,806 points and the resistance level of 48,570 points. If gold prices fail to return above these key levels, the downside risk will increase significantly. Against the backdrop of a dense mix of data and events, controlling position size and setting strict stop-loss orders will be key strategies for managing market uncertainty.

Technical Analysis:

Technical analysis shows that spot gold has been oscillating around a central level near 4944 recently. This central level is the 0.618 Fibonacci retracement of the recent gold price increase. Gold prices tested this support level last week after a sharp drop, and then returned to the upward channel above it.

(Spot gold daily chart, source: FX678)

At 14:20 Beijing time, spot gold was trading at 4666.53.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.