US Dollar Index Analysis: Long-term bearish trend remains unchanged.

2026-02-16 19:26:18

I. Fundamental Analysis

Past macroeconomic data and market reactions confirm a lack of confidence: Market performance in recent weeks shows that even with some improvement in the US macroeconomic situation, it has not been enough to push the dollar back to early January levels. The wave of "selling off US assets" in mid-January brought a sustained negative impact on the dollar, a trend quite similar to the market conditions in the summer of 2025. The market reaction after last week's non-farm payroll data release further confirms that market confidence has not yet been restored—even with strong economic data and the market repricing hawkish expectations from the Federal Reserve, the dollar only experienced a brief and mild rebound, failing to generate sustained upward momentum.

Several US economic data releases are scheduled for this week, with their overall impact showing a "divergent" characteristic. Among them, the core data will play a crucial guiding role in the dollar's trajectory. On one hand, the ADP employment data to be released tomorrow is noteworthy; this data, which has previously been weak, will provide an initial reflection of the recent state of the US job market. On the other hand, the December core PCE price index and fourth-quarter GDP data released this Friday are of paramount importance—core PCE, as the Fed's most valued inflation indicator, is expected to see its month-on-month growth rate rebound to 0.3%, which could reverse the dovish sentiment in the market after last week's CPI slightly missed expectations. Strong economic growth data could further reinforce the market's repricing of Fed policy.

The market's current focus is heavily on the FOMC meeting minutes to be released on Wednesday. Investors will use these minutes to assess the Federal Reserve's willingness to ease monetary policy, which is one of the core variables determining the short-term trend of the US dollar. If the minutes release a hawkish signal, weakening expectations of further easing, it could drive a dollar rebound; conversely, if they maintain a dovish stance, it could further suppress the dollar.

It's crucial to note that stock market performance will likely continue to outweigh the impact of macroeconomic data on the US dollar. Technology stocks are currently at a critical juncture – Nvidia will release its earnings report on February 25th, a report that could be a game-changer. Whether the report falls short or exceeds expectations could trigger another period of significant stock market volatility, which will have a substantial ripple effect on the foreign exchange market. Furthermore, while the US dollar's safe-haven appeal has weakened considerably, unlike in the summer of 2025, the dollar currently exhibits a negative correlation with US stocks. This linkage will further influence the dollar's short-term price movements.

II. Market Sentiment

Current market sentiment has shifted from "widespread panic" to "cautious optimism," a change that directly impacts the dollar's trajectory. While investors' expectations for the Federal Reserve's easing policies remain unchanged, they have entered a "wait-and-see" phase, with no large-scale sell-offs of the dollar yet. Simultaneously, this cautious sentiment has led some safe-haven funds to buy during the Asian and European trading sessions, providing short-term support for the dollar and driving a slight rebound. It's important to clarify that this short-term support is merely a sentiment-driven, temporary phenomenon and does not alter the market's long-term expectations for the dollar.

III. Future Outlook

The upside risks for the US dollar have increased this week, primarily driven by a rebound in core PCE data, strong GDP figures, and the possibility of a hawkish FOMC meeting minutes. However, it should be emphasized that this upward movement is only a short-term correction and unlikely to form a substantial rebound – after all, the market's long-term expectations for Fed easing remain unchanged, and the long-term bearish technical outlook for the dollar and the lingering effects of "selling off US assets" are still unfolding.

Today is a US holiday, and market trading volume is expected to remain low. The US dollar is unlikely to fluctuate significantly and will mainly consolidate within a narrow range. The "approaching turning point" mentioned in the technical analysis mainly refers to the release of core data (PCE, GDP) and the FOMC meeting minutes this week, which are unlikely to trigger a turning point in the short term.

In the current fragile market risk environment, we are more concerned about the performance of high-risk currencies such as the Australian dollar than the US dollar, as their volatility may be more significantly affected by the stock market and risk sentiment.

IV. Technical Analysis

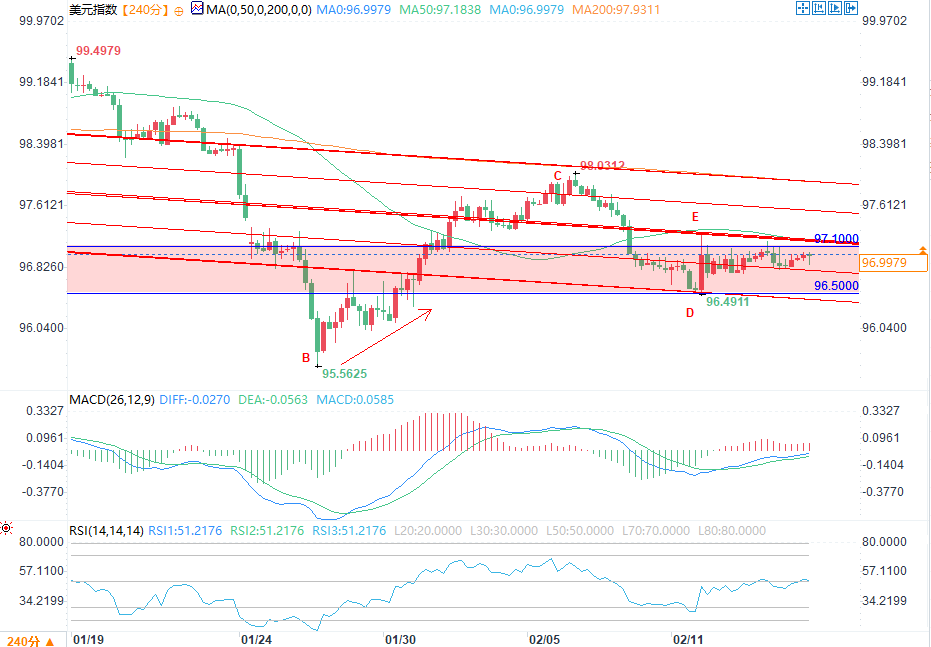

(US Dollar Index 4-hour chart source: FX678)

The US dollar index is currently consolidating around 96.98, at the end of a converging symmetrical triangle, and is being suppressed by the downtrend line since the January high. The price is oscillating narrowly around 96.82 (the 0.382 Fibonacci retracement level), with candlesticks showing mostly small bodies and overlapping bodies, indicating significant divergence between bulls and bears, and a potential turning point is approaching (a turning point is highly likely to be triggered after the release of key data and meeting minutes this week). Short-term resistance is at the 50-day moving average of 97.20, with key strong resistance at the 200-day moving average of 97.60. Support levels are at 96.34 (0.236 Fibonacci retracement), 96.01, and 95.55.

From a structural and momentum perspective, the exchange rate is near a long-term support zone formed by two support rebounds in the second half of 2025, and downward momentum has weakened. The previous false break below this support zone, followed by a rebound to the previous resistance point C, indicates that short-term bearish pressure has subsided. Furthermore, points C, D, and E correspond to the 50%–61.8% Fibonacci retracement ranges of their respective price movements, showing short-term stabilization characteristics in the volatility structure. It should be clarified that this short-term stabilization is merely a phase correction within a downward trend. The original support zone has evolved into a relatively balanced oscillation range between bulls and bears, and the downward channel pattern remains valid. The stabilization and rebound that started from point B only indicates that the bears are unlikely to continue their previous strong dominance; it has not changed the long-term bearish outlook.

In terms of trading strategy, based on the core logic of "long-term bearish bias and short-term correction," a two-way trading approach is proposed: If the price stabilizes above 97.60, the US dollar is expected to rise rapidly to 97.98 (a short-term rebound), in which case a long position can be taken with a stop-loss set below 96.80; if the price falls below 96.34, it will accelerate its decline towards 96.00 and 95.55 (in line with the long-term bearish trend), in which case a short position can be taken with a stop-loss set above 96.80.

From a technical perspective, the long-term bearish trend of the US dollar index remains unchanged. The current slight rise in the dollar is more like a second correction within a broader correction and does not alter the long-term trend. The short-term rebound mainly relies on a temporary inflow of safe-haven funds and a short-term boost from core economic data, lacking sustained momentum.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.