The stock market hits new highs, gold reaches 4200, but crude oil remains stuck in its downward trend! Are three major Q4 risks holding rebound opportunities?

2025-10-16 20:43:57

Global Macro Background

The World Bank's latest Global Economic Prospects (June 2025) outlines a complex environment for the fourth quarter. After repeated shocks to the global economy from 2020 to 2024, new headwinds are now emerging: rising trade barriers and heightened policy uncertainty. Global economic growth is projected to be just 2.3% in 2025, the lowest level since 2008, excluding recessions.

The core driver of this economic slowdown is a significant increase in tariffs (currently, effective US tariff levels have reached a nearly 100-year high), coupled with geopolitical frictions disrupting trade and investment. Business and consumer confidence remains fragile: the latest data shows that the US Consumer Confidence Index fell to 55.40 in September 2025, down from 58.20 in August.

But even in this context, driven by strong buying in the technology and artificial intelligence sectors, U.S. stock indexes continued to hit record highs, while gold prices hit a record high of $4,200.

This abnormal situation of stock market frenzy and risk aversion highlights the deep-seated uncertainty in the market. It may be a feast for the capital market, but the slowdown in economic growth does restrict the potential for crude oil to achieve a sustained rebound from the low of around $55 in 2025.

OPEC+ supply easing dynamics

In April 2025, OPEC+ announced a supply resumption amidst an uncertain demand outlook, triggering a sharp drop in oil prices. The first tranche of 2.2 million barrels per day (bpd) has already been released, pushing prices down to around $55 per barrel. The second tranche of approximately 1.6 million bpd will be released at a slower pace, averaging approximately 137,000 bpd per month.

OPEC has stated that it may suspend or even reverse this supply easing strategy if demand and economic growth deteriorate. Nevertheless, the organization's determination to regain market share is evident, significantly increasing uncertainty about the supply and demand balance in the fourth quarter.

Monetary Policy and Inflation Patterns

Despite slowing economic growth, inflation remains above pre-pandemic averages, and has even rebounded in some developed economies. By August 2025, the US Consumer Price Index (CPI) will have increased by approximately 2.9% year-on-year. This situation presents central banks with a dilemma: controlling inflation while supporting economic growth.

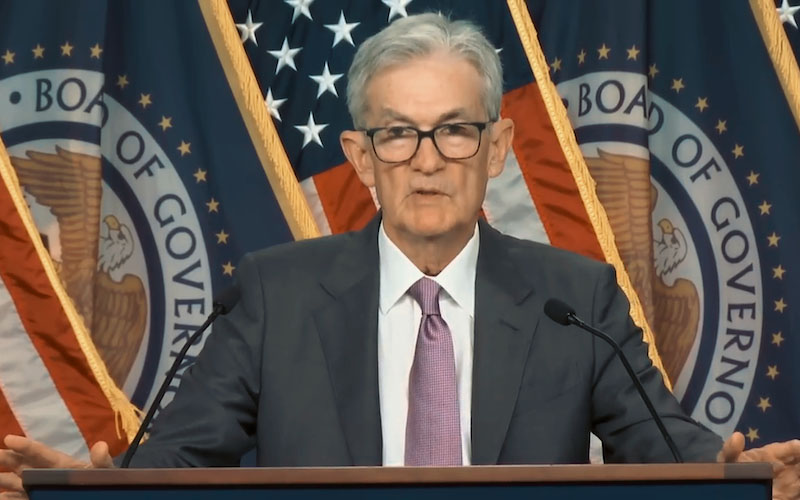

In the US, the market has already priced in a cumulative 75 basis points of interest rate cuts by the Federal Reserve through 2025. However, Fed Chairman Powell recently emphasized that sticky inflation and a weak labor market may limit the Fed's aggressive rate cuts—especially as tariff fluctuations add another layer of uncertainty. Currently, according to the CME FedWatch Tool, the market expects another 50 basis points of room for rate cuts before the end of the year, which would bring the federal funds rate down to around 3.75%.

Geopolitical risk pressure

Geopolitical risks remain a constant factor influencing the market and crude oil prices. The Russia-Ukraine conflict continues to weigh on Eurozone economic growth, while also exacerbating the risk of supply disruptions through sanctions and potential attacks. Furthermore, trade dynamics between the US, China, and India are also attracting significant attention; any policy adjustments or shifts in relations could significantly impact global crude oil demand.

Winter heating demand typically rises seasonally, and if supply risks persist, this increase in demand could provide additional support for oil prices. These factors combined could create conditions for a stronger rebound in oil prices, supporting OPEC members by boosting revenues and regaining market share.

This fragile global backdrop sets the tone for crude oil prices in the fourth quarter, with supply risks, geopolitical uncertainty, and shifting demand expectations continuing to dominate oil price fluctuations. Technically, crude oil has been constrained by a three-year downward trend since its 2022 high, entering a narrow consolidation range since June 2025. This has limited breakout potential and exacerbated market wait-and-see sentiment.

Technical analysis and focus

The November futures contract of U.S. crude oil is currently supported at the intersection of the 50% percentile of the lower box and the previous important support. At present, the oil price is likely to fluctuate within the lower box range. Referring to the previous blue circle, if it holds 58.70, the probability of upward fluctuation is relatively high. 58.70 is also the watershed between bulls and bears in the near future.

(Daily chart of the November crude oil futures contract, source: Yihuitong)

At the same time, oil prices may rebound near the downward trend line in the next few days, but this trend line is not very important. The main thing is to rely on the box to oscillate in the range and then choose the direction.

The fourth quarter has arrived, and traders need to focus on whether OPEC's supply easing measures can successfully help member countries regain market share and boost revenue?

Whether the Federal Reserve's monetary policy can strike a balance between controlling inflation and stabilizing labor market growth is a question for the global economy.

Will geopolitical tensions ease, or will the risk of supply disruptions escalate further? These are the general logics that stimulate oil prices. The so-called risks come from rising prices, and value comes from falling prices. Pay attention to these opportunities for future oil prices to reverse.

At 20:41 Beijing time, U.S. crude oil is currently trading at $58.57 per barrel.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.