Safe-haven buying is returning, and the price of gold has regained its footing at 4100. Will the CPI data upset this balance?

2025-10-23 18:11:54

Market background: Risk aversion dominates, gold fluctuates and stabilizes at a high level

Gold recently came under short-term pressure after hitting an all-time high of $4,381.21, entering a technical correction. This week, gold prices found renewed support amid heightened geopolitical uncertainty and rising US policy risks. The US government's consideration of new export controls on certain technology products, coupled with President Trump's announcement of new sanctions against Russian energy companies, have heightened market concerns about the outlook for global trade and supply chain security.

Against this backdrop, the appeal of safe-haven assets has significantly increased. Besides gold, silver rose by over 1.5% and platinum by 2.3%, indicating a resurgence of buying interest in precious metals. Analysts point out that after a healthy correction, gold is attempting to regain its mid-term upward momentum, while the market's tolerance for high volatility has significantly increased.

Renowned analyst Han Tan pointed out that gold prices are "looking for support again" after a technical correction, and that "stubborn geopolitical risks will continue to maintain safe-haven buying." However, he also emphasized that compared with the past, the market's reaction to breaking news has become more rational and no longer fluctuates violently.

Fundamental analysis: Policy and data resonate, focus on the Fed's interest rate cut expectations

Gold has risen approximately 57% this year, primarily due to continued buying by global central banks, expectations of lower interest rates, and a confluence of macro and geopolitical risks. Since mid-October, diverging US economic data has refocused the market on inflation indicators. The CPI data, delayed due to the government shutdown, will be released on Friday, and investors generally believe it will provide key insights for the Federal Reserve's interest rate meeting next week.

The market has almost fully digested the expectation that the Federal Reserve will cut interest rates by 25 basis points at its meeting next week. Considering the recent slowdown in US growth momentum and rising fiscal risks, the low interest rate environment may be maintained for a longer period of time, which will continue to support gold, a non-yielding asset.

Furthermore, recent US tariff rhetoric has reignited concerns about the global trade outlook. Analysts believe that a new round of US export restrictions could disrupt global supply chains, intensifying demand for safe-haven assets. Meanwhile, US sanctions on Russian energy companies have increased uncertainty in commodity price fluctuations. Overall, these factors have contributed to the high volatility of gold prices.

UBS Chief Investment Officer Mark Haefele pointed out in the report that gold remains an "effective portfolio diversification tool" and believes that if the macro or political situation deteriorates further, the gold price still has the opportunity to challenge the $4,700 area.

Technical analysis: short-term rebound repair, medium-term support remains solid

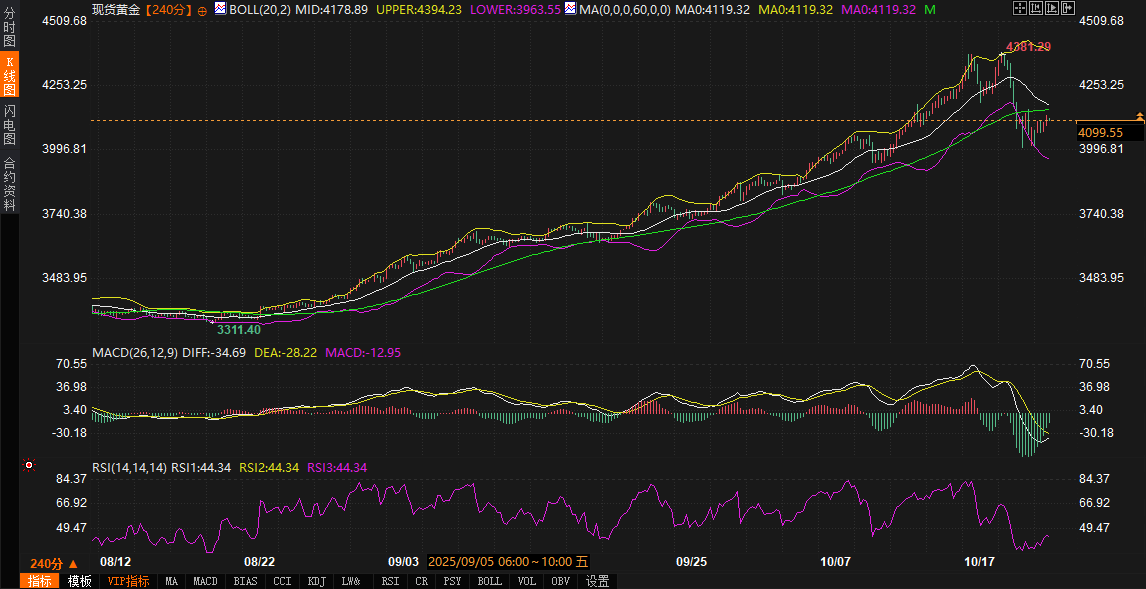

From a technical perspective, the 240-minute gold chart shows that prices have stabilized and rebounded below the middle Bollinger Band. Currently, the three Bollinger Bands are at 4184.77, 4399.99, and 3969.55, respectively, indicating a wide short-term range. Gold prices are fluctuating below the middle band, strengthening short-term rebound momentum, but technical resistance remains in the 4200-4180 range.

Regarding the MACD indicators, the DIFF and DEA readings are -37.03 and -26.65, respectively. The histogram is at -20.79. While still below the zero axis, the green bars are gradually shrinking, reflecting weakening bearish momentum. The RSI indicator is at 44.72, slightly below neutral territory, suggesting that gold prices are still in the final stages of a correction. A break above the middle Bollinger band could signal a resumption of the medium-term upward trend.

From a broader perspective, gold has found solid support near $4,000 since retreating from its mid-October high, a level that has marked the starting point of several rallies this year. If it can hold steady between $3,960 and $4,000, the market structure will remain volatile, with the potential for a short-term rebound extending to $4,180-4,200.

Future Outlook: Data determines the rhythm, and the main line of risk aversion remains unchanged

Looking ahead, market focus will shift to Friday's US CPI data. If the data falls short of expectations, it will further reinforce expectations of a rate cut, providing additional upward momentum for gold prices. Conversely, if inflation remains resilient, it could temporarily dampen gold's upward momentum. However, from the overall macroeconomic perspective, the Federal Reserve's shift toward easing monetary policy is largely confirmed, while factors such as geopolitical tensions, trade frictions, and political uncertainty persist.

Precious metals analysts generally believe that gold's short-term volatility may intensify, but its medium- to long-term upward trend remains unchanged. Supported by both safe-haven demand and capital allocation needs, gold prices may continue to fluctuate above $4,000.

In summary, Thursday's resumption of gold's upward trend is unsurprising. Global risk premiums remain elevated, and the Federal Reserve's upcoming policy meeting may be a key turning point for the next phase of the market. As long as the market remains cautious about the economic outlook, gold's safe-haven properties will continue to be favored, and its long-term bullish trend remains intact.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.