One chart: The Baltic Dry Index rises, boosted by stronger Capesize freight rates.

2025-10-30 00:32:23

The Baltic Dry Index (which monitors freight rates for ships transporting dry bulk commodities) ended a five-day losing streak on Wednesday, thanks to a rise in freight rates for Capesize vessels.

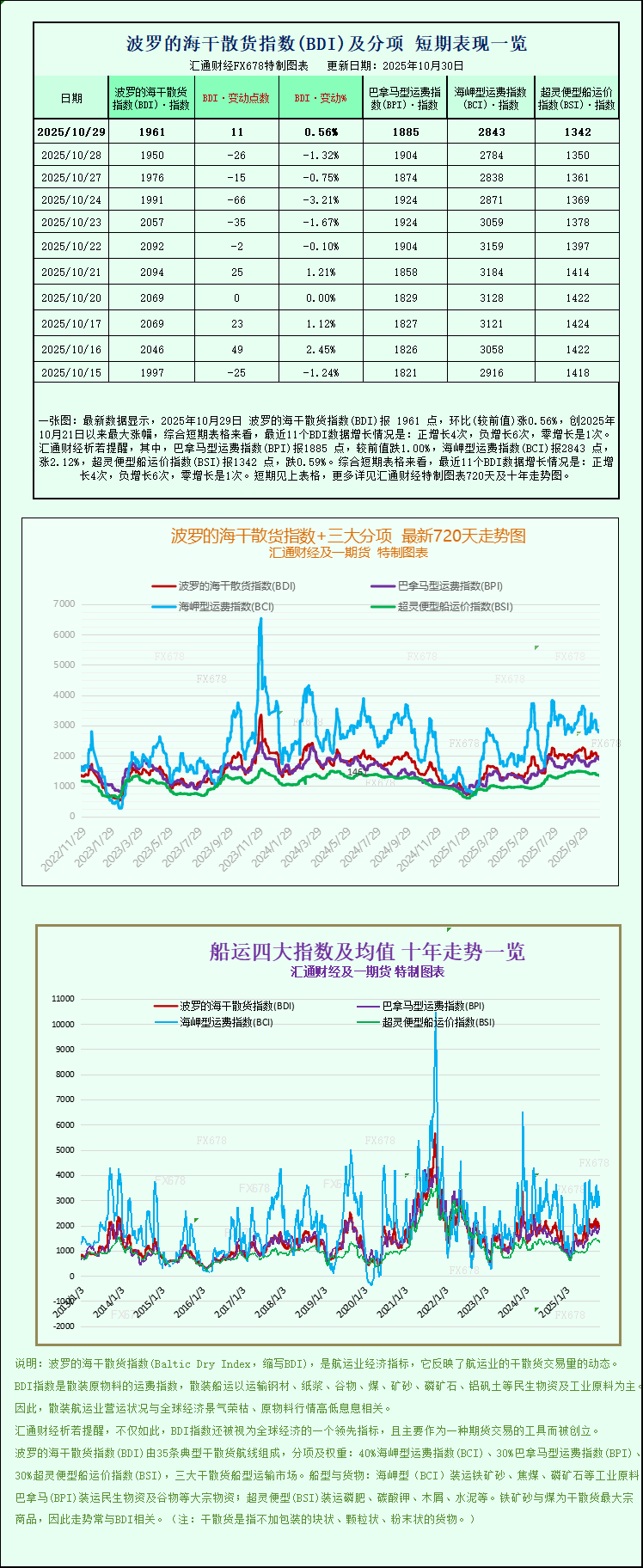

The main index, the Baltic Dry Index, which takes into account freight rates for Capesize, Panamax, and Supramax vessels, rose 11 points, or 0.6%, to 1,961.

The Capesize index rose 59 points, or 2.1%, to 2,843.

The average daily earnings of Capesize vessels transporting 150,000 tons of cargo, such as iron ore and coal, increased by $491 to $23,580.

Iron ore futures prices rose for the third straight session on Wednesday, hitting a two-week high, buoyed by optimism surrounding a potential U.S.-China trade deal.

On Wednesday, Donald Trump and South Korean President Lee Jae-myung finalized details of their contentious trade deal at a summit in South Korea, with the US president also expressing optimism about an upcoming summit with Chinese President Xi Jinping.

Meanwhile, the Panamax index fell for the third consecutive trading day, dropping 19 points, or 1%, to 1,885, its lowest level since October 21.

The average daily earnings of Panamax vessels (typically carrying 60,000-70,000 tons of coal or grain) fell by $176 to $16,962.

Among smaller vessels, the Very Large Vessels Index fell 8 points to 1,342.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.