Hawkish comments from the Federal Reserve and expectations of easing trade tensions are putting pressure on gold prices, which are expected to remain volatile in the short term.

2025-10-30 10:53:46

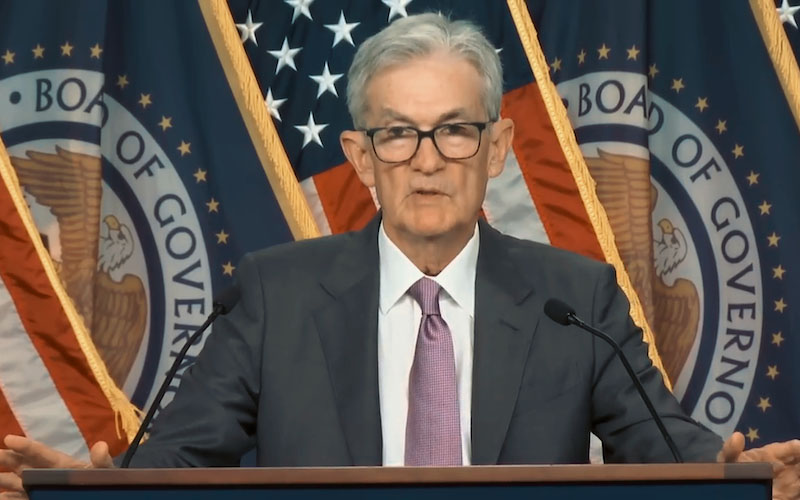

Amid differing stances among Federal Reserve officials and a lack of macroeconomic data, market opinions on the future direction of monetary policy have once again diverged. The Federal Reserve announced a slight interest rate cut of 25 basis points on Wednesday, lowering the benchmark interest rate range to 3.75%–4.00%.

Despite widespread market expectations for this move, Chairman Powell emphasized after the meeting that "a December rate cut is far from a certainty," suggesting that policy will remain flexible.

It is worth noting that this meeting marked the third consecutive time that a dissenting vote had appeared, the first time since 2019 that such a divergent situation had occurred consecutively.

"This internal division of opinion makes it more difficult for the market to grasp the policy path and weakens investors' confidence in further easing." — Sebastian Mullins, Head of Multi-Assets at Schroders. The US government shutdown since early October has delayed the release of key economic data, leaving investors without crucial decision-making references.

Higher interest rates typically put pressure on non-yielding assets such as gold, while a slight pullback in the US dollar index (down 0.1%) provided some support for gold prices.

Looking at fund flows, the five consecutive days of outflows from gold ETFs reflect a more cautious sentiment among institutional investors. Statistics show that global gold ETF holdings have now entered their longest period of consecutive decline since May.

Despite this, gold prices have still risen by nearly 50% year-to-date, supported by global central bank gold purchases and concerns about currency devaluation. Some institutions believe that the recent pullback is a normal technical correction, and that the long-term fundamentals of the gold market remain solid.

Overall, the short-term rebound in gold prices was mainly driven by uncertainty surrounding Federal Reserve policy and a pullback in the US dollar, rather than a strong inflow of safe-haven funds. Future price movements will depend on changes in expectations of Fed rate cuts, the outcome of trade negotiations, and global investors' reassessment of inflation and fiscal deficits.

From a daily chart perspective, gold stabilized and rebounded above $3900 after four consecutive days of decline, forming a clear short-term support level. The MACD indicator shows initial bullish divergence, and the RSI has rebounded from oversold territory to around 42, suggesting potential for a short-term rebound.

The key resistance level to watch is the $3,990-$4,020 range. A break above this level would reignite bullish momentum and could potentially challenge $4,080. The key support level is at $3,920. A break below this level would reconfirm the mid-term correction pattern.

Overall technical analysis suggests that gold prices are trending slightly higher in the short term, while the medium-term trend still needs further confirmation from fundamental factors.

Editor's Note:

The gold market is currently at a critical juncture in the battle between bulls and bears. Although internal disagreements within the Federal Reserve have provided an opportunity for a market rebound, Powell's "cautious rate cut" statement suggests that the scope for monetary easing is limited, and the short-term rebound in gold prices is more of a technical correction than a trend reversal.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.