Expectations of another interest rate hike by the Bank of Japan are rising, causing the dollar to rise against the yen before falling back.

2025-11-04 13:24:55

Furthermore, market speculation that Japanese authorities might intervene in the foreign exchange market to curb excessive yen depreciation provided temporary support for the exchange rate. However, analysts believe that any significant yen appreciation is unlikely to be sustained.

The reason is that Japan's new prime minister, Sanae Takaichi, may implement a more aggressive fiscal stimulus policy after taking office, which will weaken the tightening effect of interest rate hikes; at the same time, the cooling of safe-haven demand has also caused the yen to lose some support.

In stark contrast, the US Federal Reserve recently reiterated its stance of maintaining high interest rates, pushing the dollar to new highs since August and further consolidating the dollar's strength against the yen.

JPMorgan foreign exchange strategist Kenji Sakurai noted: "While the market is concerned that the Bank of Japan may adjust its policy before the end of the year, the upside potential for the yen remains limited against the backdrop of expectations for fiscal stimulus."

Tokyo's core CPI has been above the 2% inflation target for three and a half years, providing a reason for the Bank of Japan to gradually exit its ultra-loose monetary policy.

Kazuo Ueda stated last week, "The current economic and price trends are in line with the central bank's forecasts, and the possibility of policy normalization is increasing." However, the Bank of Japan remains cautious about further interest rate hikes.

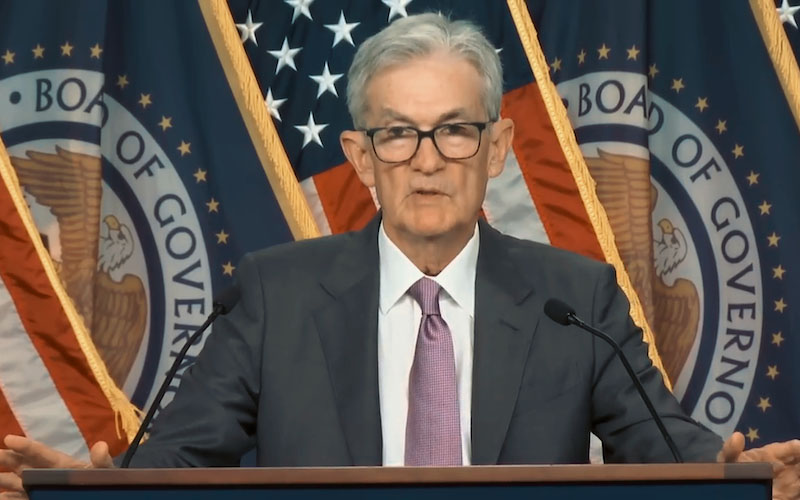

Meanwhile, hawkish signals from the US have become even stronger. Federal Reserve Chairman Powell last week explicitly refuted market expectations of a December rate cut, driving the US dollar index (DXY) to a three-month high.

The strong performance of the US dollar continues to put pressure on the Japanese yen. Furthermore, potential intervention by the Japanese government in the foreign exchange market has become a focus of market attention. If the yen approaches the 155 level again, the Ministry of Finance may intervene in the market to curb the depreciation.

Analysts believe that this intervention is more of a psychological deterrent, but it is enough to make short sellers more cautious.

From a technical chart perspective, the USD/JPY pair rose further above 154.00 after breaking through the key resistance level of 53.25 last week. Currently, the daily chart oscillators remain in positive territory and do not show signs of being overbought, indicating that the bulls still have the upper hand.

If the exchange rate breaks through 154.80, it is expected to test the psychological level of 155.00. Support levels are located in the 154.00-153.65 range, followed by the 153.30-153.00 area. A break below 152.00 would destroy the short-term bullish structure, and the price may fall back to the key support level of 151.00.

Editor's Note:

While expectations of a Bank of Japan interest rate hike have reinforced market signals of a policy shift, the reality of fiscal stimulus and global capital flows to the US dollar makes it difficult for the yen to continue to strengthen.

Technically, the USD/JPY pair remains in an upward trend in the short term. Barring government intervention or unforeseen risk events, the exchange rate is expected to continue its upward-trending movement within the 154-155 range. In the long term, if the Bank of Japan takes action before the end of the year, market sentiment may see a brief reversal, but given the continued policy divergence, the dollar's strong position remains unshaken.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.