One chart: Capesize freight rates surge, Baltic Dry Index hits near two-year high.

2025-12-03 00:17:02

The Baltic Dry Index (BDI), which tracks dry bulk shipping rates, climbed to its highest level in nearly two years on Tuesday, primarily driven by strong gains in the Capesize shipping sector. As a key indicator of the global dry bulk shipping market, this change in the BDI directly reflects the structural shifts in current international commodity shipping demand, with the transportation activity of basic industrial raw materials such as iron ore and coal being a key driving factor.

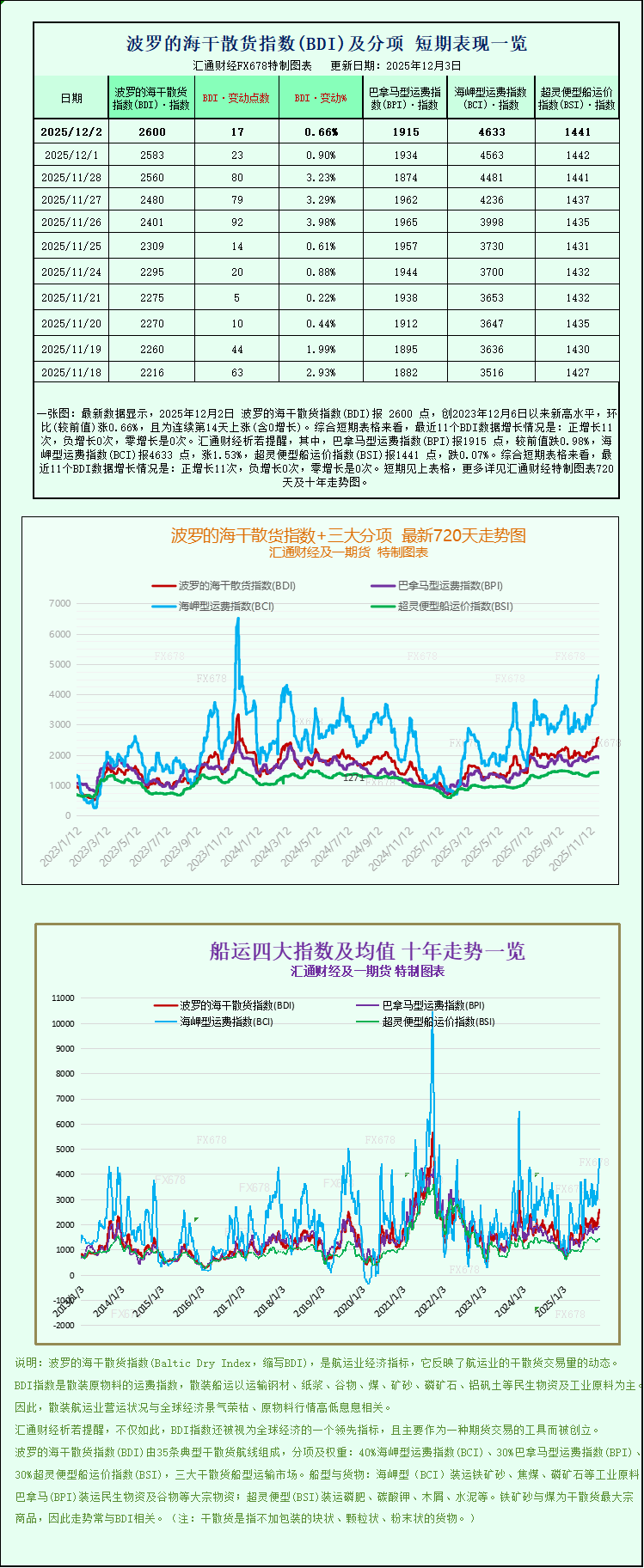

The composite index, which covers Capesize, Panamax, and Supramax freight rates, rose 17 points, or 0.7%, to close at 2,600 points. This figure not only continues the recent upward trend but also marks the highest level since December 2023, indicating that the dry bulk shipping market has gradually recovered from its previous period of adjustment.

Among the sub-sectors, the Capesize freight rate index performed particularly well, rising 70 points in a single day, an increase of approximately 1.5%, to close at 4633 points, also setting a new peak since December 2023. Capesize vessels, as the "juggernauts" of global dry bulk shipping, primarily handle the transoceanic transport of bulk industrial raw materials such as iron ore and coal. Their significant freight rate increase is closely related to the recovery of the global steel industry chain and fluctuations in energy demand.

In terms of shipping company revenue, the average daily charter rate for Capesize vessels increased by $587 to $38,427. This increase in charter rates for these large vessels, which typically carry 150,000 tons of cargo, will directly boost the profit margins of related shipping companies, especially those focused on deep-sea dry bulk shipping.

From the perspective of upstream cargo demand, although some recent economic data released by China showed slight weakness, stable demand in the infrastructure construction sector and the steady operation of the steel consumption market jointly offset the negative impact of the data, driving a rebound in iron ore futures prices. As one of the most important cargoes transported by Capesize vessels, the correlation between iron ore prices and transportation demand further boosted the activity of the shipping market, and relevant trading data also confirmed this linkage effect.

In contrast to the strong performance of Capesize vessels, the Panamax freight index saw a slight decline, falling 19 points, or 1%, to close at 1915 points. Panamax vessels mainly transport cargoes such as coal and grain in the 60,000 to 70,000 tonne range, and their freight rate fluctuations are more influenced by regional energy allocation and the pace of grain trade. This short-term adjustment may be related to a period of consolidation following the concentrated release of cargo on some routes.

The average daily charter rate for Panamax vessels subsequently decreased by $168 to $17,237. Despite the short-term correction, the charter rate for this vessel type remains in the upper-middle range of the past year, reflecting the overall resilience of the regional dry bulk shipping market.

In the small vessel sector, the Supramax freight rate index fell slightly by 1 point to close at 1441, remaining basically stable. Supramax vessels, with their flexibility, primarily serve near-sea and coastal routes, transporting various small-volume dry bulk cargoes. Their stable freight rates reflect the balanced regional trade demand, unaffected by significant fluctuations in the deep-sea market.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.