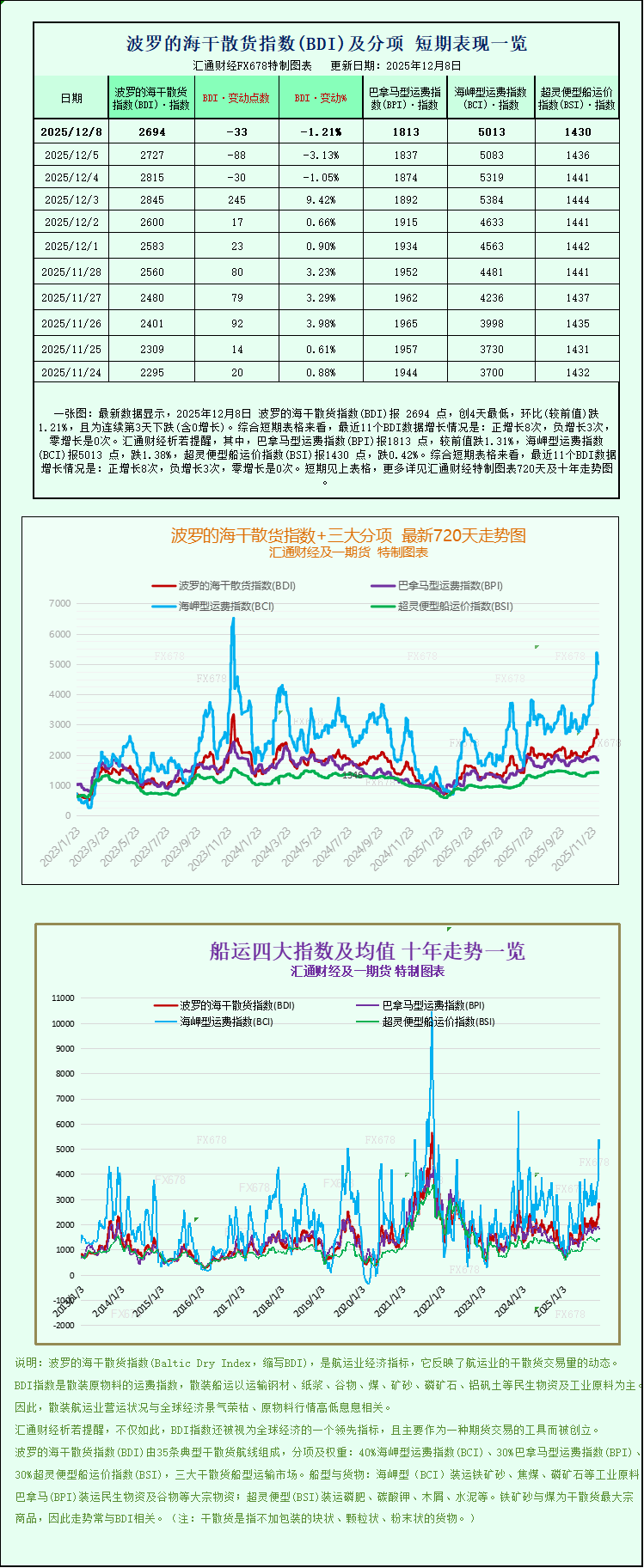

A chart shows that the Baltic Dry Index continued its decline, hitting a near three-week low, with freight rates weakening across all vessel types.

2025-12-11 23:39:19

On December 11, the Baltic Dry Index (BDI) fell further on Thursday, hitting a near three-week low. The main driver of this decline was the collective weakening of freight rates across all vessel types.

As a core indicator reflecting the health of the dry bulk shipping market, the Baltic Dry Index (BDI) has declined for the sixth consecutive trading day, falling 136 points, or 5.6%, to close at 2294 points, its lowest level since November 21. The index covers freight rate changes for the three main vessel types: Capesize, Panamax, and Supramax. Its continued decline directly reflects the overall weakness of the current dry bulk shipping market.

Looking at different vessel types, the Capesize index led the market decline, plunging 357 points, or about 8.3%, to close at 3927 points, its lowest level in over two weeks. Capesize vessels primarily handle the long-distance transport of bulk commodities such as iron ore and coal, with a single vessel carrying up to 150,000 tons of cargo. Their corresponding daily profit margins also declined, decreasing by $2958 to $32569. Notably, the weakening of Capesize freight rates was linked to the decline in iron ore futures prices. On that day, steel demand in China, the world's largest iron ore consumer, was weak, and market concerns about downstream demand intensified. This negative factor outweighed market expectations for policy support from high-level meetings, ultimately suppressing iron ore futures prices and further weakening the demand for Capesize vessels.

The Panamax market also came under pressure, with the Panamax index falling 40 points, or 2.3%, to close at 1724, its lowest level since October 8. This type of vessel has a carrying capacity of 60,000 to 70,000 tons and primarily transports coal and grain. Its average daily profit decreased by $359 to $15,519, reflecting a contraction in demand for medium-volume bulk cargo transportation in the commodity trade.

In the small-tonnage vessel sector, the Supramax index was also affected, falling 18 points in a single day to close at 1387 points, continuing the overall downward trend in the dry bulk market.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.