Gold Trading Alert: Gold prices surge towards the $4,300 mark, while silver retreats after hitting a record high. With the non-farm payrolls data coming soon, how long can the bulls continue their rally?

2025-12-15 07:36:23

Despite the Federal Reserve's indication of caution regarding further rate cuts before more data is available, investors still anticipate two rate cuts next year, providing strong support for gold. As a traditional safe-haven asset, gold continues to attract inflows amid heightened global uncertainty. On Monday (December 15th) in early Asian trading, spot gold traded in a narrow range, currently hovering around $4306.17 per ounce.

Silver prices hit a record high before profit-taking increased, putting pressure on a short-term pullback.

In stark contrast to gold, silver performed poorly. Spot silver surged to a record high of $64.64 per ounce, but subsequently faced massive profit-taking, falling nearly 3% on Friday to close near $61.7.

Silver prices rose nearly 5% last week, and have surged a staggering 112% year-to-date. Key factors driving the rally include continued tightening of inventories, strong industrial demand, particularly from applications in solar energy, electric vehicles, and data centers, and silver's inclusion on the U.S. list of critical minerals. These fundamental factors maintain a positive long-term outlook for silver, but analysts point out that the price increase has been somewhat excessive and caution is advised in the short term.

The CMZ report emphasizes that industrial demand is expected to increase in the long term, but current high levels could trigger further selling pressure.

Internal divisions within the Federal Reserve have emerged, with hawkish voices putting pressure on the market.

The Federal Reserve's decision to cut interest rates last week was not unanimous, with several officials expressing opposition. Kansas City Fed President Schmid stated that inflation was "overheating" and opposed the rate cut, arguing that monetary policy should remain moderately tight. Chicago Fed President Goolsby also opposed a recent rate cut, calling for more inflation and employment data to be released. Cleveland Fed President Hammark favored tightening policy, while Philadelphia Fed President Paulson focused more on the state of the job market. Only San Francisco Fed President Daly supported the rate cut, believing it would help balance inflation control and employment support.

These hawkish comments led to a rise in US Treasury yields and a stabilization of the dollar index, which rebounded to 98.44 points. Although the dollar continued its third consecutive week of decline, this put short-term pressure on gold and silver. Meanwhile, US stocks closed lower on Friday, with the S&P 500 falling 1.07% and the Nasdaq plunging 1.69%, as investors' concerns about an artificial intelligence bubble and inflation intensified, leading them to shift towards defensive sectors.

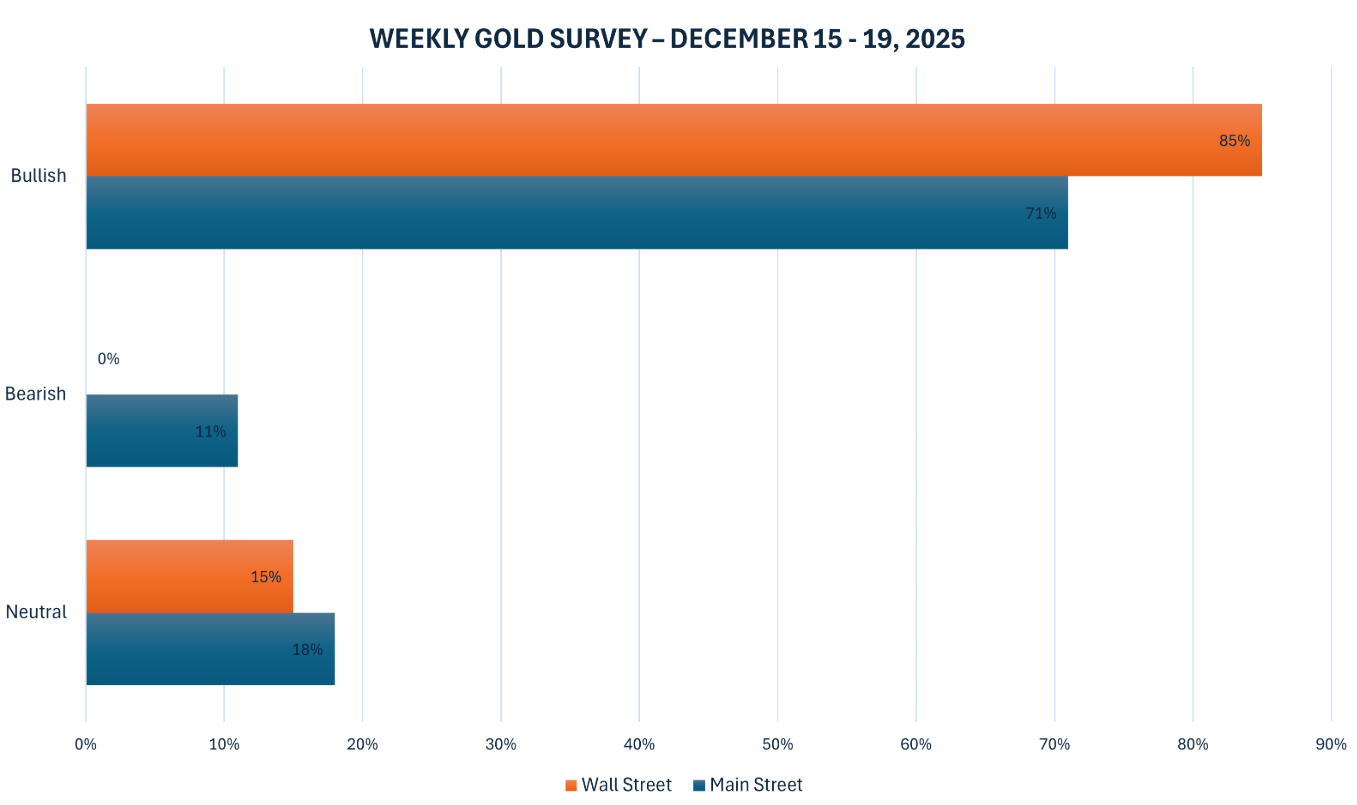

Kitco surveys indicate a generally bullish outlook on Wall Street and high enthusiasm among retail investors.

The latest Kitco News weekly gold survey results are encouraging, with 85% of Wall Street analysts predicting a rise in gold prices in the coming week, no one bearish, and only 15% expecting sideways movement. Experts such as Adrian Day point out that the Federal Reserve's large-scale purchases of Treasury bonds (though not called quantitative easing) are beneficial to gold. Among retail investors, 71% are bullish on gold, indicating strong sentiment on the main street.

Sean Lusk, director of Walsh Trading, emphasized that gold is currently the mainstream trend in the market, with central banks, pension funds, and investment funds continuing to buy. Short-term profit-taking will not change the upward trend in the technical picture.

This week is packed with important data releases, with the non-farm payrolls report taking center stage.

Investors are closely watching key economic data releases this week, particularly the U.S. nonfarm payrolls report, due on December 16. This report, which covers data delayed due to the government shutdown in October and November, may provide clearer signals about the health of the economy.

In addition, Monday will see a manufacturing survey, Tuesday will bring retail sales and preliminary PMI figures, Thursday will feature US CPI data, weekly jobless claims, and the Philadelphia Fed manufacturing survey, and Friday will see the Bank of Japan's interest rate decision and US existing home sales data. These data will directly impact market expectations regarding the Fed's rate cut path next year. Weak non-farm payroll data could further strengthen expectations of rate cuts, pushing gold prices to new highs; conversely, strong data could lead to hawkish pressure and a short-term pullback.

Trading Reminder: Bulls are in control, but be wary of pullback risks.

Overall, gold is currently in a strong uptrend, with both fundamentals and technicals supporting further gains, targeting the $4350-$4400 range. However, profit-taking in silver and the hawkish divisions within the Federal Reserve remind us that short-term volatility will increase. Ahead of this week's non-farm payroll data, it is recommended to maintain long positions in gold. Those with lighter positions can consider buying on dips around $4250-$4280, with a stop-loss below $4200. Simultaneously, pay attention to the dollar's performance and US Treasury yields; if the dollar continues to weaken, the upside potential for gold will further expand. Risk-takers should monitor geopolitical events, such as progress on the US-Ukraine peace plan, which could trigger increased safe-haven demand. In short, after the data vacuum period ends, gold trading opportunities will become clearer. It is recommended to closely monitor real-time developments, operate rationally, and avoid chasing highs.

(Spot gold daily chart, source: FX678)

At 07:34 Beijing time, spot gold was trading at $4306.29 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.