A chart: The Baltic Dry Index falls to its lowest point in more than five months.

2026-01-05 22:52:32

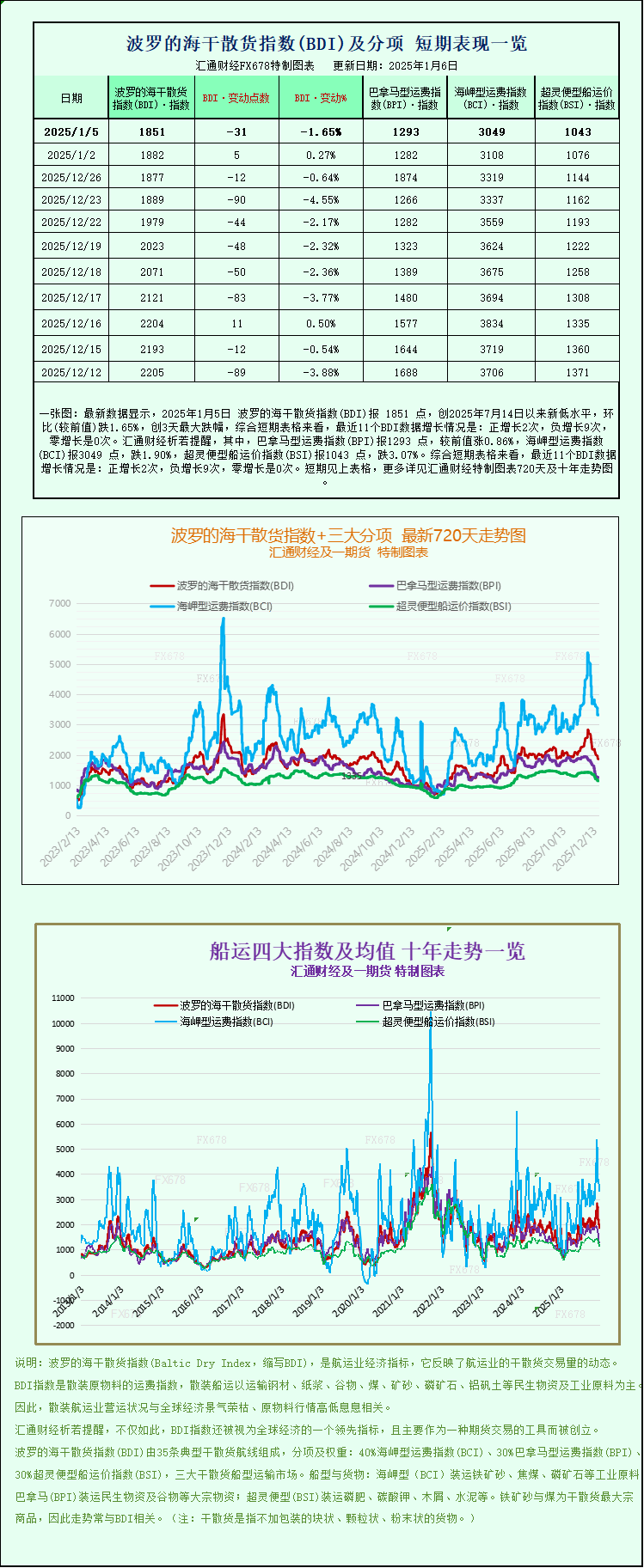

Latest data shows that the Baltic Dry Index (BDI) was 1851 points on January 5, 2025, a new low since July 14, 2025, down 1.65% month-on-month, the largest drop in three days. Looking at the short-term charts, the BDI has seen positive growth twice, negative growth nine times, and zero growth in the last 11 BDI readings. Specifically, the Panamax Freight Index (BPI) was 1293 points, up 0.86% from the previous value; the Capesize Freight Index (BCI) was 3049 points, down 1.90%; and the Supramax Freight Index (BSI) was 1043 points, down 3.07%. For detailed 720-day and 10-year trend charts of the Baltic Dry Index and its three main sub-indices, please refer to the specially designed charts.

The Baltic Dry Index, which tracks global dry bulk shipping rates, fell slightly on Monday, hitting its lowest level in more than five months. Specifically, the continued decline in freight rates for Capesize and Supramax vessels completely offset the positive effects of rising Panamax freight rates, ultimately leading to a lower overall index.

Specifically, data shows that the main index covering freight rates for three core vessel types—Capesize, Panamax, and Supramax—fell by 31 points to close at 1851 points, the lowest level since July 2025, indicating the recent weakness in the dry bulk shipping market. Among them, the Capesize vessel index fell 59 points, a drop of 1.9%, to close at 3049 points. Capesize vessels, mainly used for transporting bulk commodities such as iron ore and coal, with a single vessel capacity of up to 150,000 tons, also saw a corresponding decrease in average daily revenue, a reduction of $538 to $24,149 per day, facing significant pressure on operating profits.

However, it is worth noting that in stark contrast to the sluggish dry bulk shipping market, China's iron ore futures market saw prices rise against the trend on Monday, the first trading day of the new year, supported by both strong market demand and persistent supply constraints.

In the small and medium-sized vessel segment, the Very Large Vessel Index also showed a downward trend, falling 33 points to close at 1043. Conversely, the Panamax Vessel Index bucked the trend, rising 11 points, or 0.9%, to close at 1293. These Panamax vessels, typically carrying 60,000 to 70,000 tons of cargo such as coal or grain, saw their average daily earnings increase by $104 to $11,640 per day, becoming one of the few bright spots in the dry bulk shipping market that day.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.