The USD/JPY pair remains in a weak, high-level consolidation pattern; caution is advised regarding the 160 intervention level.

2026-01-15 18:59:04

The yen remains weak overall. Although it has fallen from last year's high, the core factors leading to the yen's structural weakness have not yet shown significant improvement.

Fundamental analysis

United States

Regarding the US dollar, the core logic is that the Federal Reserve will not rush to cut interest rates. The latest Beige Book from the Federal Reserve shows that economic activity was stable or growing in 8 of the 12 districts, and there were no signs of deterioration in the labor market. The market has postponed its expectations for a rate cut this year to after June, and may even have eliminated expectations for a second rate cut, which is beneficial to the US dollar.

Geopolitically, the Trump administration's retreat from military action against Iran in early 2026 led to a 5% drop in Brent crude oil prices. Investors were reluctant to chase related themes due to concerns about a potential reversal in US policy, which was a key reason why the dollar did not sell off after Powell faced legal investigation. Furthermore, strong demand for emerging market assets (iShares Core MSCI EM saw its highest inflows since 2021 last week) and investors diversifying their portfolios to US tech stocks suppressed the dollar's strength.

In the short term, attention should be paid to the US November TIC data to be released tonight, and changes in official US Treasury holdings should be noted (China has reduced its holdings in 4 out of the last 6 months), as this survey may exacerbate the trend of de-dollarization.

The weekly unemployment claims data to be released today (expected at 215,000) and speeches by Federal Reserve officials are expected to have a limited impact on policy direction. The US dollar index may rise slightly in the 98-100 range in the short term. The current 10-year USD/JPY interest rate differential of approximately 285 basis points continues to support USD/JPY's high-level fluctuations.

From the perspective of interest rate differentials, the current 10-year USD/JPY interest rate differential is about 285 basis points, which is still at a medium-high level since 2020. It remains attractive for yen carry trades, and funds continue to flow out of Japan, supporting the USD/JPY exchange rate to fluctuate at high levels.

Japan

The yen is primarily pressured by political and fiscal expectations: Prime Minister Sanae Takashi enjoys high approval ratings, and the ruling coalition plans to dissolve the House of Representatives in late January and hold a snap election in early to mid-February, aiming to consolidate its majority and advance large-scale fiscal expansion. Japan's public debt has reached 260% of GDP, and these fiscal expansion expectations directly weigh on the yen.

The divergence in monetary policies between the US and Japan has exacerbated pressure on the yen: Although the Bank of Japan has raised interest rates to 0.75% (a 30-year high), its economic recovery is weak (2025 Q4 GDP growth of 0.1% quarter-on-quarter), and subsequent rate hikes will be slow and limited in magnitude (may not exceed 50 basis points for the whole year); meanwhile, expectations of a Fed rate cut have narrowed, the dollar is strong, and the interest rate differential advantage continues to lead to capital outflows from Japan, further depressing the yen.

The USD/JPY pair is currently trading in the 158.4-158.8 range, only 1-2 yen away from the 160 intervention threshold. Japanese authorities are highly vigilant against unilateral depreciation, with the Finance Minister repeatedly issuing statements and communicating with the US Treasury Secretary. If the exchange rate rapidly approaches/breaks through 160, intervention is highly probable next week (especially during the US holiday period). However, historical experience shows that intervention can only bring short-term, impulsive rebounds and is unlikely to change the fundamentally driven depreciation trend.

Japan's CPI may fall to around 2% in 2026 due to the high base effect (core CPI 1.8%), which is lower than the central bank's inflation target. This will provide room for fiscal expansion, reduce the urgency for the Bank of Japan to accelerate tightening, and strengthen expectations of monetary easing.

In the long run, if Japan's policy normalization remains undisturbed, the yen may moderately rebound to 145-150 in the second half of 2026-2027, but the market is currently focused on short-term negative factors.

The short-term fundamentals for the Japanese yen are bearish, and the exchange rate is likely to test the 158.8-160 range. Above 160, there is an intervention "firewall." Caution is advised in trading. Consider intervention opportunities on rallies, but long positions should only be considered after a substantial shift in fundamentals (such as a US rate cut, accelerated rate hikes by the Bank of Japan, and a cooling of expectations for Japanese fiscal expansion).

Technical Analysis

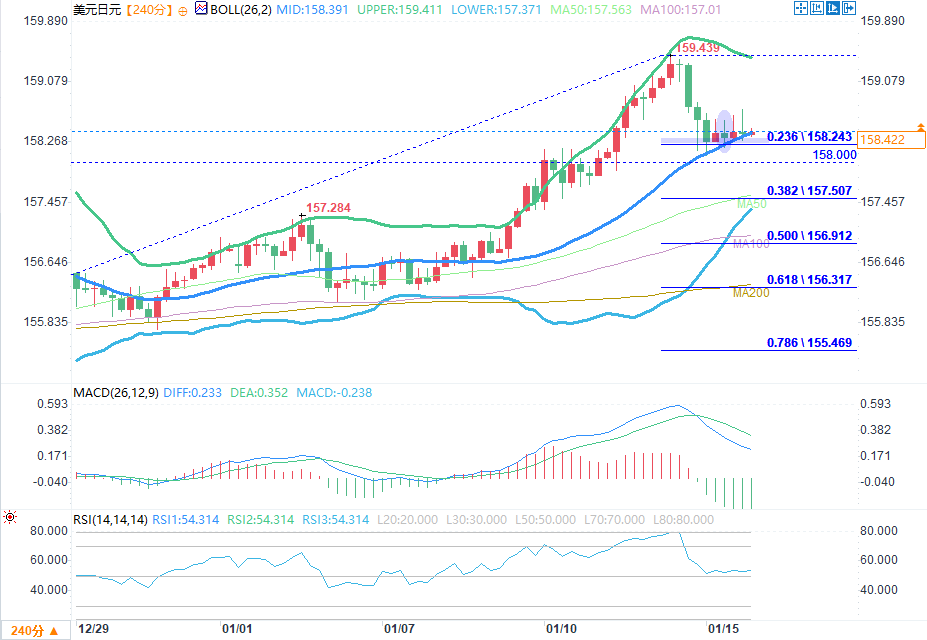

(USD/JPY daily chart source: EasyForex)

From a technical perspective, USD/JPY is bullish, with key support at 158.24 (the 23.6% Fibonacci retracement level of the December-January rally). A break below this level on the daily closing price would invalidate the bullish logic. It's important to note that intervention could disrupt the technical trend, but if the support holds and the fundamentals remain unchanged, the bullish trend may continue.

On the 4-hour chart, the exchange rate formed an inverted hammer reversal pattern at the lower Bollinger Band, fluctuating around 158.45, and is likely to start a new round of upward movement with a target of 160.00. The potential trend is to first pull back to test the support at 158.00, and then resume the upward trend. If 158.00 fails, we need to pay attention to the defense at 158.24.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.